USD/CAD in Consolidation Triangle Ahead of Fed Decision

USD/CAD FORECAST

- USD/CAD gains ahead of Fed rate announcement, but has been on a downward path in recent months

- The FOMC’s policy outlook will guide the pair’s trajectory in the near term

- This article looks at key technical levels to watch in the coming days

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: EUR/USD and EUR/JPY Trend Hinges on Fed, ECB and BoJ Outlook; Volatility Ahead

USD/CAD rose modestly on Tuesday, up about 0.15% to 1.3185 amid market caution ahead of a high-profile event on Wednesday: the Federal Reserve's interest rate announcement. Despite this advance, the exchange rate has been on a downward trajectory for the past two months, down around 2.8% since early June.

For clues on the pair’s potential path and trading bias, market participants should closely follow the Fed's monetary policy decision for its July meeting, including its forward guidance.

In terms of consensus estimates, the FOMC is seen raising borrowing costs by 25 basis points to 5.25%-5.50% as part of its ongoing fight against inflation. With this move fully discounted, the focus should be on the outlook and whether policymakers intend to deliver additional tightening later this year.

If the central bank signals more work is needed to restore price stability, U.S. Treasury yields could march higher as interest rate expectations shift in a more hawkish direction. This could initially boost the U.S. dollar, exerting downward pressure on the “Loonie”.

Related: What is Crude Oil? A Trader’s Primer to Oil Trading

Recommended by Diego Colman

Get Your Free USD Forecast

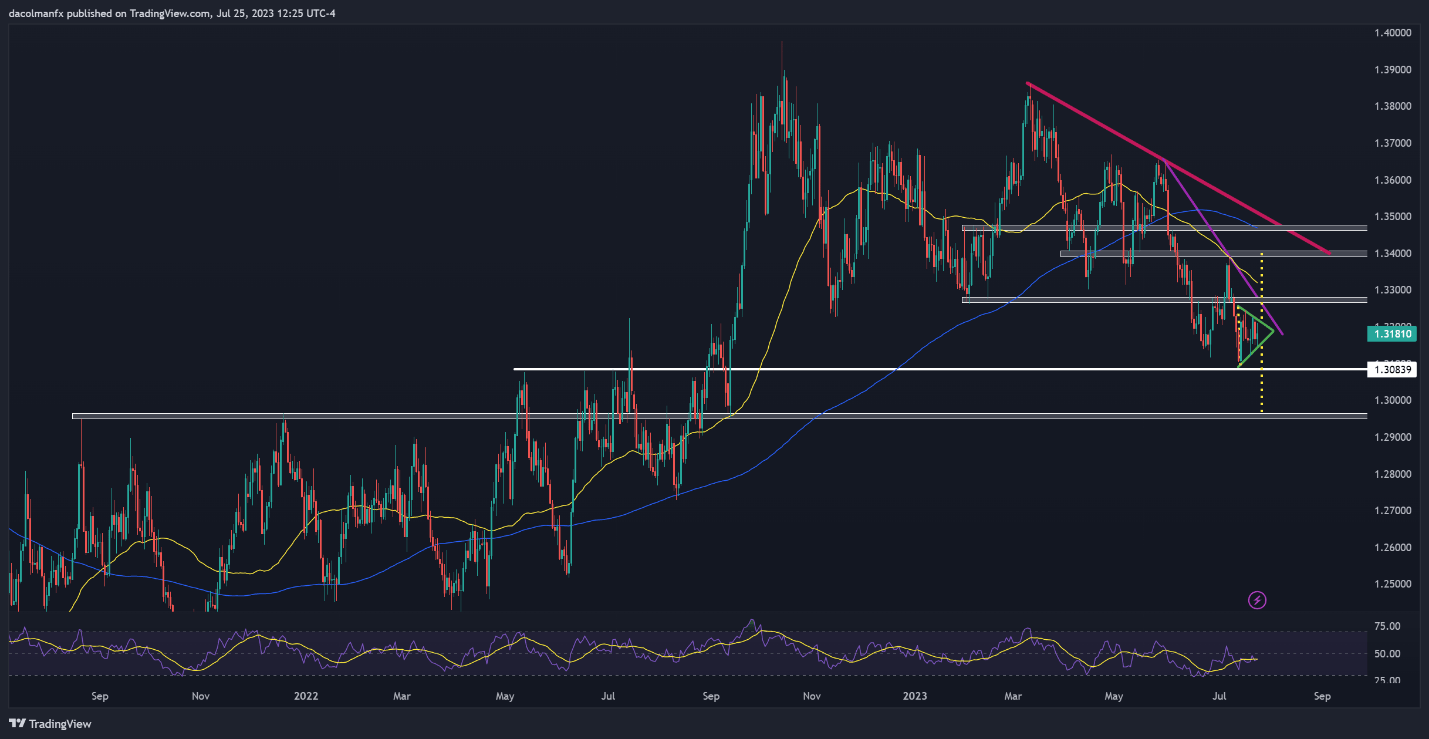

Over a longer-term horizon, however, there is scope for the Canadian dollar to strengthen against the greenback, driven by the strong recovery in oil prices and stabilizing global economic conditions. This means that the path of least resistance could be lower for USD/CAD over the coming months.

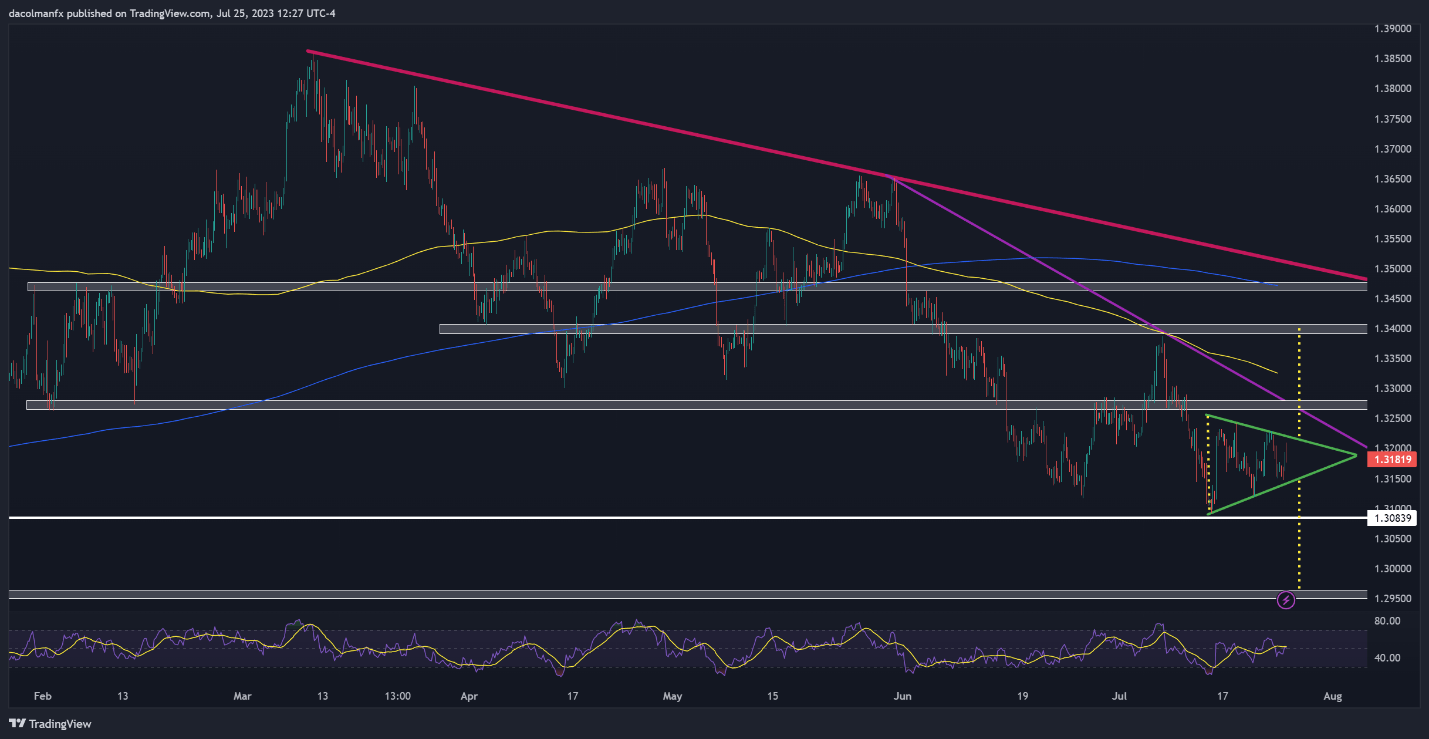

In terms of technical analysis, USD/CAD appears to be coiling inside a symmetrical triangle, a technical formation composed of two converging trend lines, an ascending one connecting a sequence of higher highs and a descending one linking a series of lower lows.

In general, the symmetrical triangle tends to be a continuation pattern, but it can also indicate a possible reversal if it resolves against the prevailing trend. For this reason, it is imperative to watch how prices evolve over the next few trading sessions. That said, there are two cases to consider.

Case 1: USD/CAD breaks topside of triangle at 1.3220

If this scenario plays out, we could see a move towards 1.3275. On further strength, the focus would shift to the psychological 1.3400 level.

Case 2: USD/CAD breaks triangle support at 1.3140

If this scenario unfolds, the bears could become emboldened to launch an attack on 1.3085. If this floor is taken out, USD/CAD may head towards 1.2960.

| Change in | Longs | Shorts | OI |

| Daily | -1% | 0% | 0% |

| Weekly | 4% | 16% | 8% |

USD/CAD TECHNICAL CHART

Daily Chart

Four-hour Chart

USD/CAD Charts Prepared Using TradingView

Comments are closed.