USD/CAD Fails to Sustain Breakout after Bank of Canada Decision. What’s Next?

BANK OF CANADA DECISION:

- Bank of Canada holds rates steady at 5.00% for the second month in a row, in line with expectations

- The bank says that inflationary risks have increased and that it is prepared to raise borrowing costs further if needed

- USD/CAD rises after BoC’s decision, but fails to break out decisively

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: EUR/USD Forecast – Euro Sinks After Fakeout ahead of ECB Decision. What Now?

The Bank of Canada today concluded its October monetary policy meeting. The institution led by Tiff Macklem voted to keep its benchmark interest rate unchanged at 5.0% for the second month in a row, but left the door open to further tightening. The decision to stand pat was broadly anticipated.

In its statement, the BoC said that past rate increases are dampening activity and slowing inflation, underscoring that consumption and business investment are weakening. Policymakers also recognized that supply and demand forces in the economy are coming into better balance, which signifies the imminent closure of the output gap. Theoretically, this should help mitigate future price pressures, though the process may take some time.

On forward guidance, the central bank retained a hawkish position, making it clear that the Governing Council stands ready to raise borrowing costs further if necessary, especially given the slow progress toward price stability and upside risks to inflation.

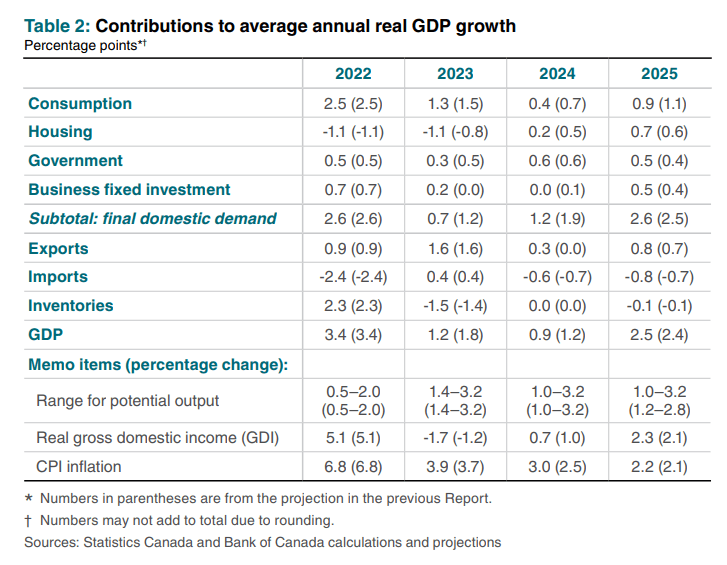

Despite the communique’s tone, traders remain skeptical of additional monetary tightening on the horizon, arguing that policymakers will prioritize growth over the inflation fight in the future. The significant reduction in GDP forecasts for 2023 and 2024 appears to have further solidified this perspective, increasing the likelihood of a more cautious approach.

Interested in learning how retail positioning can shape the short-term trajectory of the Canadian Dollar? Our sentiment guide has the information you need—download it now!

| Change in | Longs | Shorts | OI |

| Daily | -9% | 19% | 10% |

| Weekly | -9% | 30% | 17% |

The table below shows new macroeconomic projections by the BoC.

Source: Bank of Canada

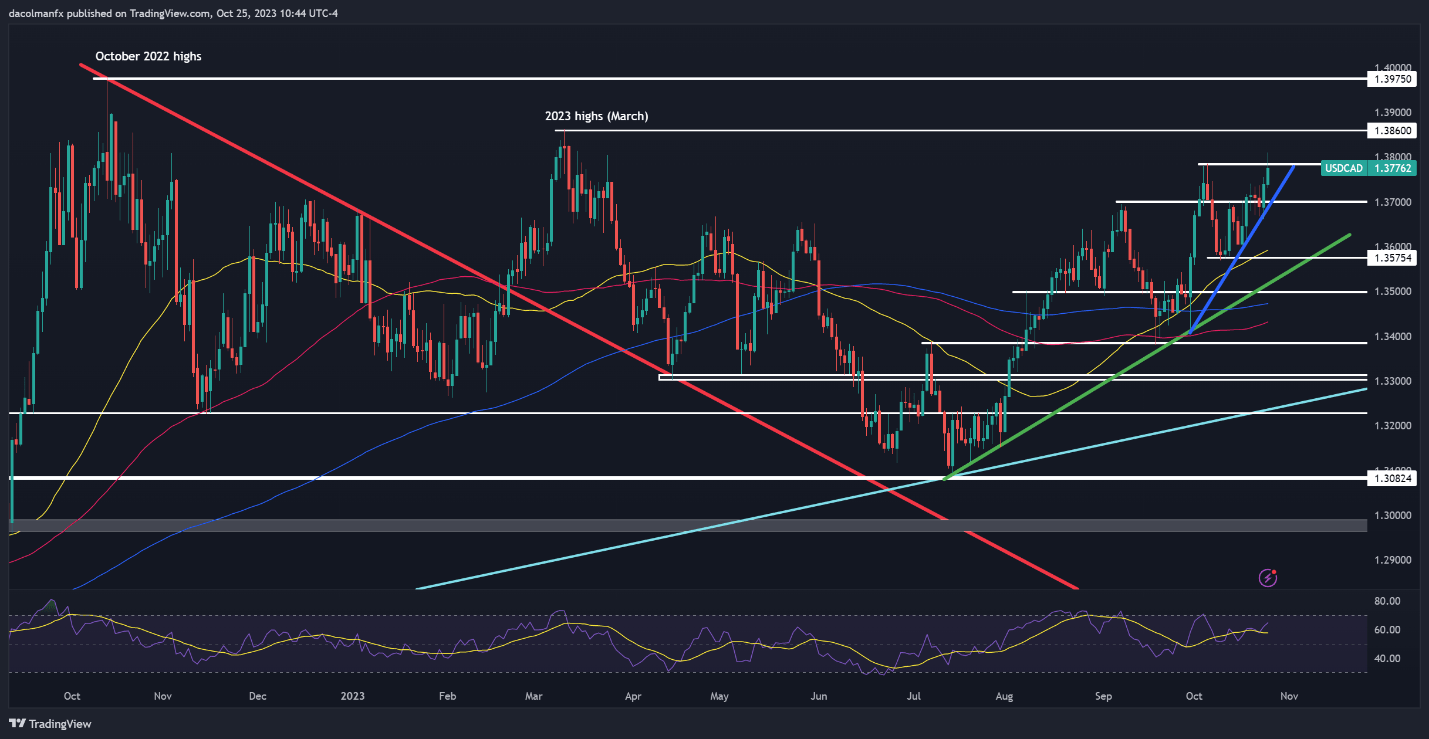

USD/CAD TECHNICAL ANALYSIS

USD/CAD briefly set a fresh multi-month high after the Bank of Canada’s announcement, but pulled back quickly, failing to clear resistance at 1.3785 decisively. Traders should watch this area carefully in the coming days, bearing in mind that a sustained breakout could pave the way for a retest of this year’s peak.

On the flip side, if the bears resurface and trigger a retracement, initial support is located around the 1.3700 level. Successfully breaching this floor could rekindle downward impetus, setting the stage for a pullback toward the 50-day moving average, nestled around 1.3575.

If you are discouraged by trading losses, why not take a proactively positive step towards improvement? Download our guide, “Traits of Successful Traders,” and access invaluable insights to assist you in avoiding common trading errors.

Recommended by Diego Colman

Traits of Successful Traders

USD/CAD TECHNICAL CHART

USD/CAD Chart Creating Using TradingView

Comments are closed.