US Mega-Cap Tech Build on Gains; Singapore Avoids Technical Recession

Discover what kind of forex trader you are

Following a downside surprise in the recent US consumer price index (CPI) data, the release of US June producer prices overnight further reinforces the narrative of abating inflation risks, paving the way for Wall Street to add to recent gains (DJIA +0.13%; S&P 500 +0.61%; Nasdaq +1.58%). Strength was largely concentrated in the growth sectors however, with performance heavy-lifted by megacap tech stocks once more (NVDA +4.7%, GOOG +4.4%, AMZN +2.7%, TSLA +2.2%).

The US headline producer price index (PPI) for June came in at a 0.1% growth from a year ago, way below the 0.4% forecast. The core aspect revealed promising progress from tighter policies as well, heading lower to 2.4% versus the 2.6% consensus. Month-on-month, core PPI came in at 0.1% (consensus 0.2%).

With that, market rate expectations found further conviction for a rate pause from the Federal Reserve (Fed) after July, along with more leeway for rate cuts into 2024. Treasury yields headed lower, with the US 10-year down for the fourth straight day while the two-year yields widen its gap further below the key 5% level.

Looking ahead, the US consumer sentiment data for July will be in focus, with expectations for an uptick in the reading to 65.5 from the 64.4 in June, which will be the third straight month of increase. Further recovery in US consumer sentiments may likely provide some support for soft landing hopes, considering that past recessions since 1968 have always been marked by a decline in the US consumer sentiment data.

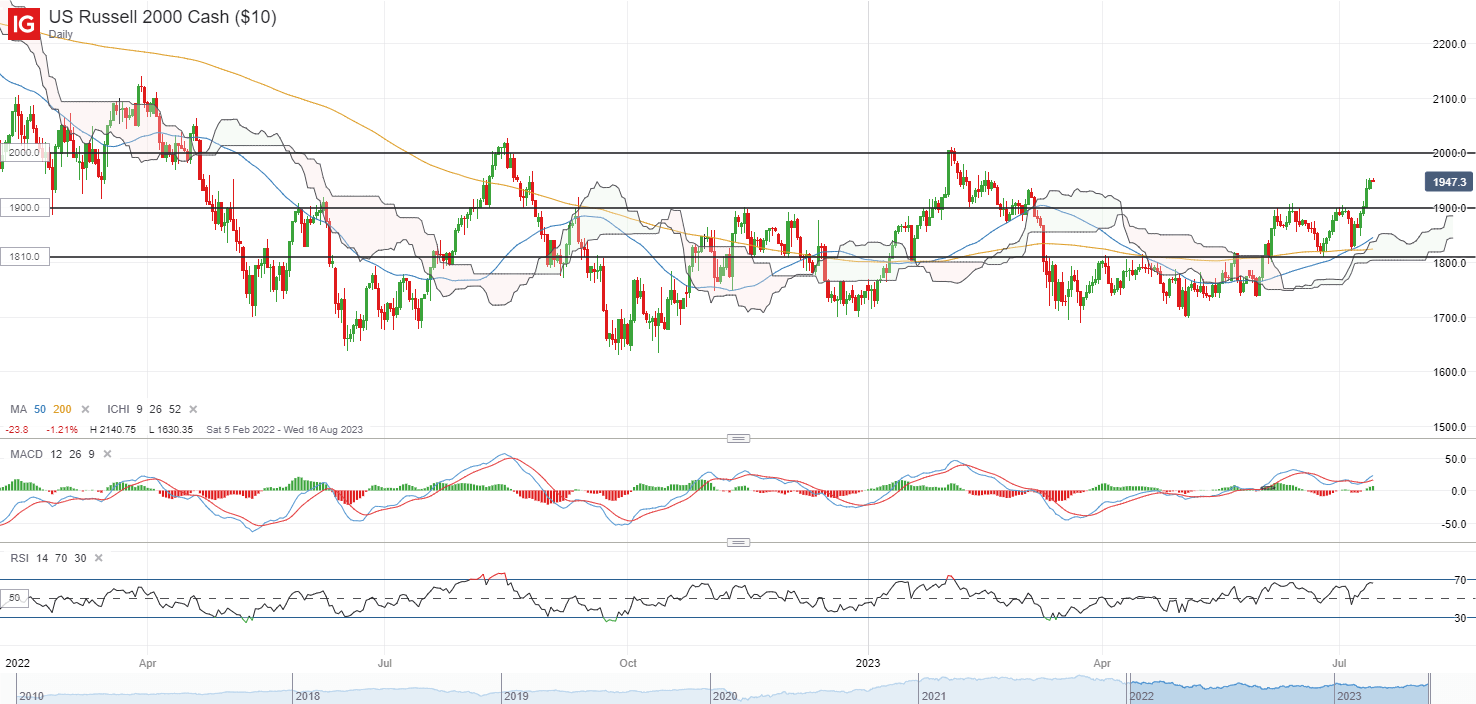

The Russell 2000 has managed to break out of its previous consolidation zone to deliver a new four-month high. Its Relative Strength Index (RSI) has retained above its key 50 level thus far, as an indication of buyers in control, along with a firm bounce off its 50-day and 200-day moving average (MA) at the start of the month. Further upside may leave the key psychological 2,000 level on watch for a retest, while the 1,900 level will now serve as a resistance-turned-support.

Source: IG charts

Asia Open

Asian stocks look set for a positive open, with Nikkei +0.14%, ASX +0.49% and KOSPI +0.68% at the time of writing. The economic calendar this morning saw some resilience in Singapore’s advance Q2 gross domestic product (GDP) growth rate, with the economy narrowly avoiding a technical recession with a tepid expansion. Quarter-on-quarter read was largely in line with expectations at 0.3%, while year-on-year read came in at 0.7%, which slightly outperformed the 0.6% consensus.

While we have a less-bad-than-feared outcome, economic challenges are still presented with a still-weak showing in the manufacturing sector (-7.5% YoY versus -6% in 1Q), having to lean on strength in the services industries for some cushioning. Heading into the second half of this year, much may hinge on China’s recovery story and economic conditions in the US and other trading partners holding up to build on current resilience.

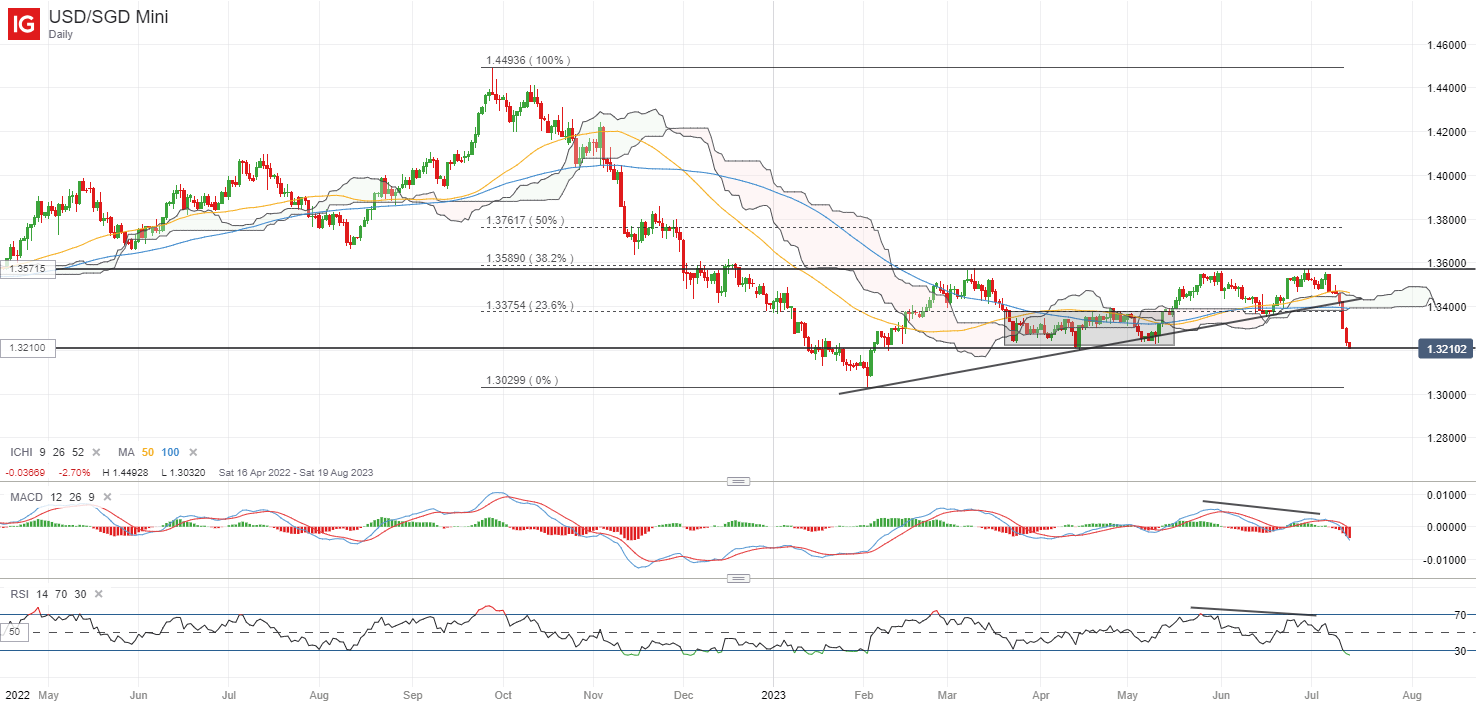

Following the data release, the USD/SGD headed further to the downside, having already been weighed by the sell-off in the US dollar over the past few days. The breakdown of the ascending triangle pattern has brought about a current retest of the 1.321 level. While an oversold RSI read may drive an attempt for a near-term bounce, the overall trend continues to lean on the downside. Its moving average convergence/divergence (MACD) has crossed below the zero level and the 1.340 level of support confluence has given way, where its Ichimoku cloud stands alongside its 100-day MA. Further breakdown of the 1.321 level may pave the way to retest its year-to-date low at the 1.303 level.

Source: IG charts

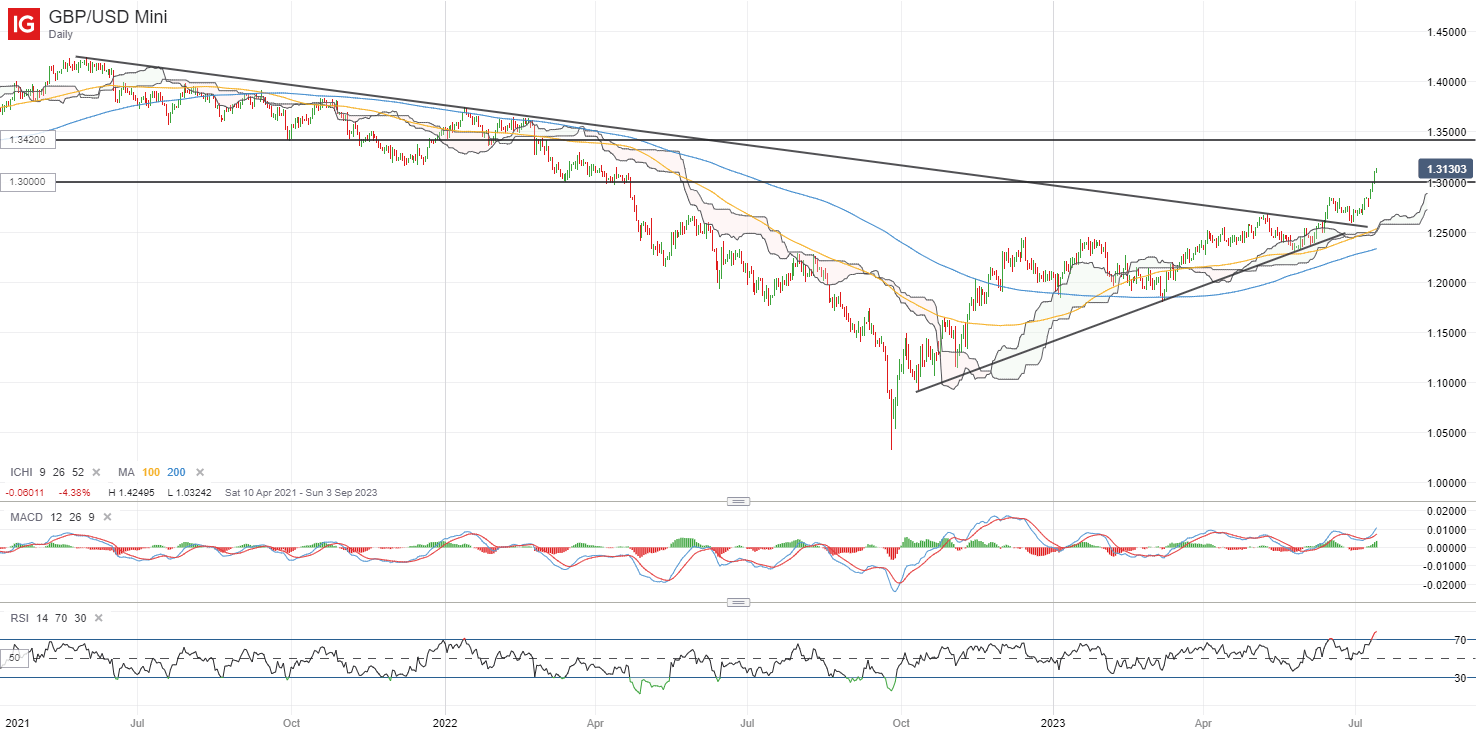

On the watchlist: GBP/USD broke to new high since April 2022

Further weakness in the US dollar and a better-than-expected read in the UK GDP figure for May have propelled the GBP/USD above the key 1.300 level of resistance yesterday. The three-month year-on-year GDP came in flat (0%), but a less-bad-than-feared scenario provided some solace with estimates looking for a worse outcome of a 0.1% contraction.

The formation of a new higher high and the RSI retaining above the key 50 level reinforce the overall upward trend in place. Further upside may place the 1.342 level on watch as the next level of resistance for a retest. The IG client sentiment data shows that 73% of traders are net-short in the GBP/USD, with further net-short positioning building from last week. A typical contrarian view to crowd sentiment may point towards a stronger bullish trading bias for the GBP/USD.

Source: IG charts

Thursday: DJIA +0.13%; S&P 500 +0.61%; Nasdaq +1.58%, DAX +0.74%, FTSE +0.33%

Comments are closed.