US Dollar Up but Bearish Risks Grow, Setups on EUR/USD, GBP/USD Before Powell

US DOLLAR FORECAST – EUR/USD, GBP/USD

- The U.S. dollar extends its recovery as U.S. yields push higher

- Powell’s speech on Friday will take center stage

- This article looks at key tech levels to watch on EUR/USD and GBP/USD

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Consumer Spending Eases but the US Dollar Index (DXY) Continues to Advance

The U.S. dollar, as measured by the DXY index, extended its recovery on Thursday, boosted by a bounce in U.S. Treasury yields following remarks from San Francisco Federal Reserve President Mary Daly indicating that the FOMC is not yet considering slashing borrowing costs.

Daly's forceful position, which clashes with the more cautious posture embraced by other colleagues, highlights a widening chasm between the doves and the hawks.

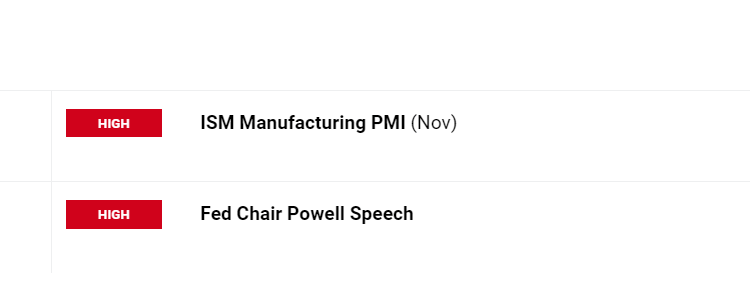

UPCOMING MARKET EVENTS

Source: DailyFX Economic Calendar

Unsure about the U.S. dollar's trend? Gain clarity with our Q4 forecast. Request your complimentary guide today!

To address uncertainties regarding the broader central bank’s stance, traders should closely monitor Fed Chair Powell’s speech at Spelman College on Friday. This event might serve as a platform for the FOMC chief to provide clarification on the monetary policy outlook.

Hawkish comments endorsing higher interest rates for longer are likely to exert upward pressure on U.S. yields, creating the right conditions for the U.S. dollar to prolong its nascent rebound. On the flip side, a lack of pushback on dovish market pricing ( many rate cuts for 2024 already discounted) could drag yields, weighing on the greenback.

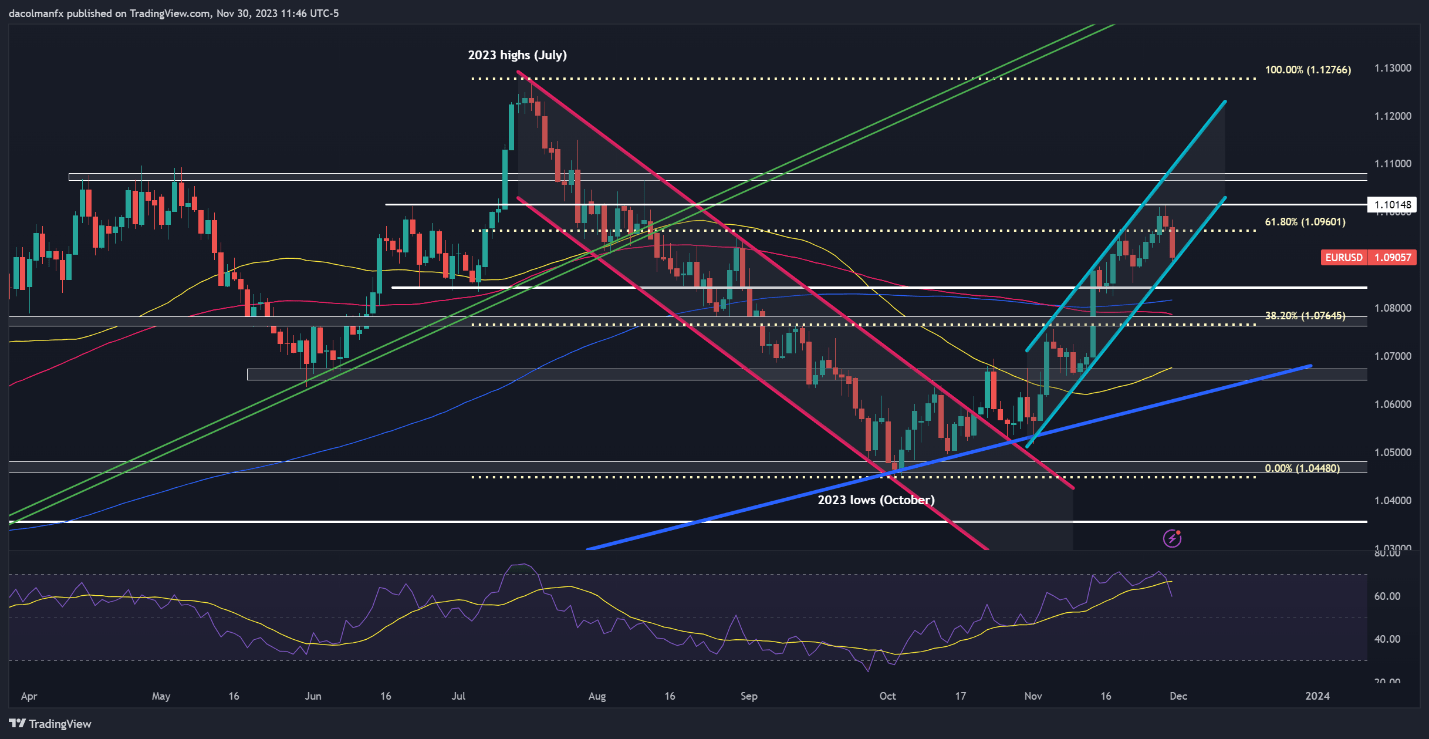

EUR/USD TECHNICAL ANALYSIS

The EUR/USD fell for a second consecutive day on Thursday, with losses accelerating after the release of weaker-than-expected Eurozone inflation data for November. If the pullback gathers steam in the coming trading sessions, the lower boundary of a short-term ascending channel at 1.0890 may act as support, but the prospect of a drop towards 1.0840 cannot be ruled out if a breakdown unfolds.

Conversely, if bulls regain control of the market and the exchange rate resumes its recent advance, the first ceiling to watch is positioned at 1.0960, which corresponds to the 61.8% Fib retracement of the July/October slump. On further strength, a revisit to November’s peak is probable, followed by a potential rally towards horizontal resistance at 1.1080.

For a comprehensive assessment of the euro’s medium-term technical and fundamental outlook, request a free copy of our latest forecast!

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

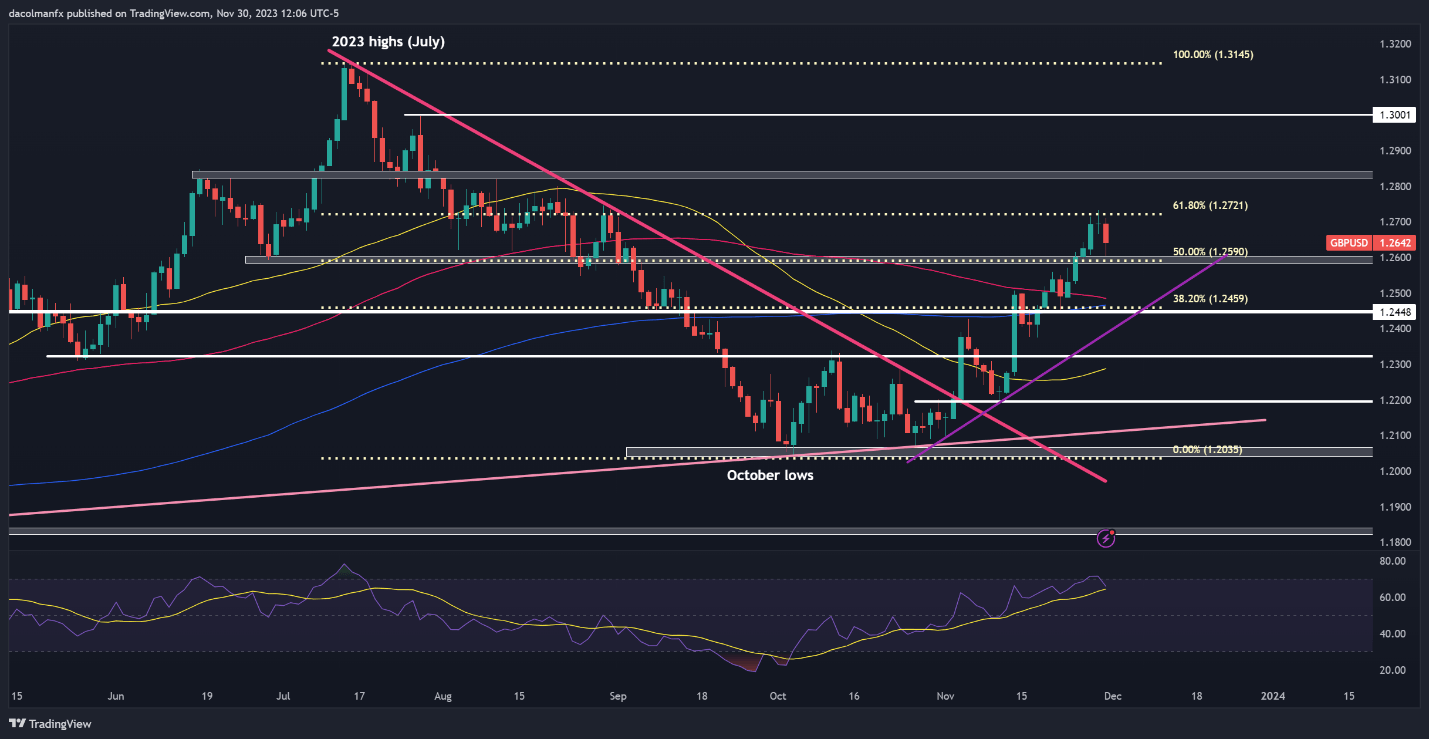

GBP/USD TECHNICAL ANALYSIS

GBP/USD also retreated on Thursday, but managed to remain above technical support in the 1.2590 region. This moderate pullback is unlikely to signal a shift towards a negative outlook; rather, it may represent a brief pause in the near-term uptrend.

Upholding cable’s bullish outlook requires the pair to stay above 1.2590. If this floor holds, GBP/USD may soon resume its upward trek following a brief consolidation period, paving the way for a move towards 1.2720, the 61.8% Fib retracement of the July/October slide. Continued strength might direct attention to the 1.2800 handle.

On the flip side, if losses intensify and sellers manage to drive prices below 1.2590, we might observe a drop toward both the 100-day simple moving average and 1.2460 in the case of sustained weakness.

Interested in understanding how retail positioning may shape GBP/USD’s trajectory? Our sentiment guide examines crowd psychology in FX markets. Download your free guide now!

| Change in | Longs | Shorts | OI |

| Daily | -4% | 1% | -1% |

| Weekly | -2% | 1% | 0% |

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Using TradingView

Comments are closed.