US Dollar Sluggish as Poor Manufacturing PMI Strengthens Case for Fed Pause

ISM MANUFACTURING KEY POINTS:

- Manufacturing activity edges down to 46.9 in May from 47.1 previously, slightly below expectations

- New orders sink, whereas the employment and production indices offset weakness in other components of the ISM PMI survey

- U.S. dollar extends losses as disappointing economic data reinforces the case for the Fed to hold rates steady at its meeting this month

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: US Dollar Dithers After Debt Deal Passes House of Reps. Will the Fed Now Drive USD?

A gauge of U.S. factory activity worsened and extended its contraction for the sixth consecutive month in May, a sign that the economy continues to struggle to stabilize in response to weakening demand conditions amid stubbornly high inflation and rapidly rising interest rates.

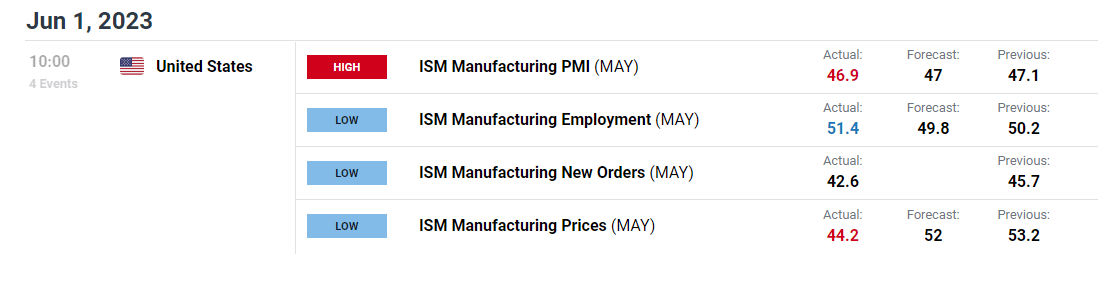

According to the Institute for Supply Management (ISM), May manufacturing PMI fell to 46.9 from 47.1 previously versus 47.00 expected, hitting its lowest since March. For context, any figure above 50 indicates growth, while readings below that threshold denote a contraction in output.

Looking under the hood, the goods-producing sector of the economy was hindered by a pronounced drop in the new orders indicator, which plunged to 42.6 from 45.7. Meanwhile, the employment and production indices offset weakness elsewhere, with the former rising to 51.4 and the latter climbing to 51.1.

Finally, the prices paid index moderated sharply after a brief rebound in April, plummeting to 44.2 from 53.2, a welcome development for the Fed. Softening cost burdens for manufacturers, if sustained, could help ease inflationary pressures, paving the way for a less aggressive central bank stance.

ISM DATA AT A GLANCE

Source: DailyFX Economic Calendar

Recommended by Diego Colman

Forex for Beginners

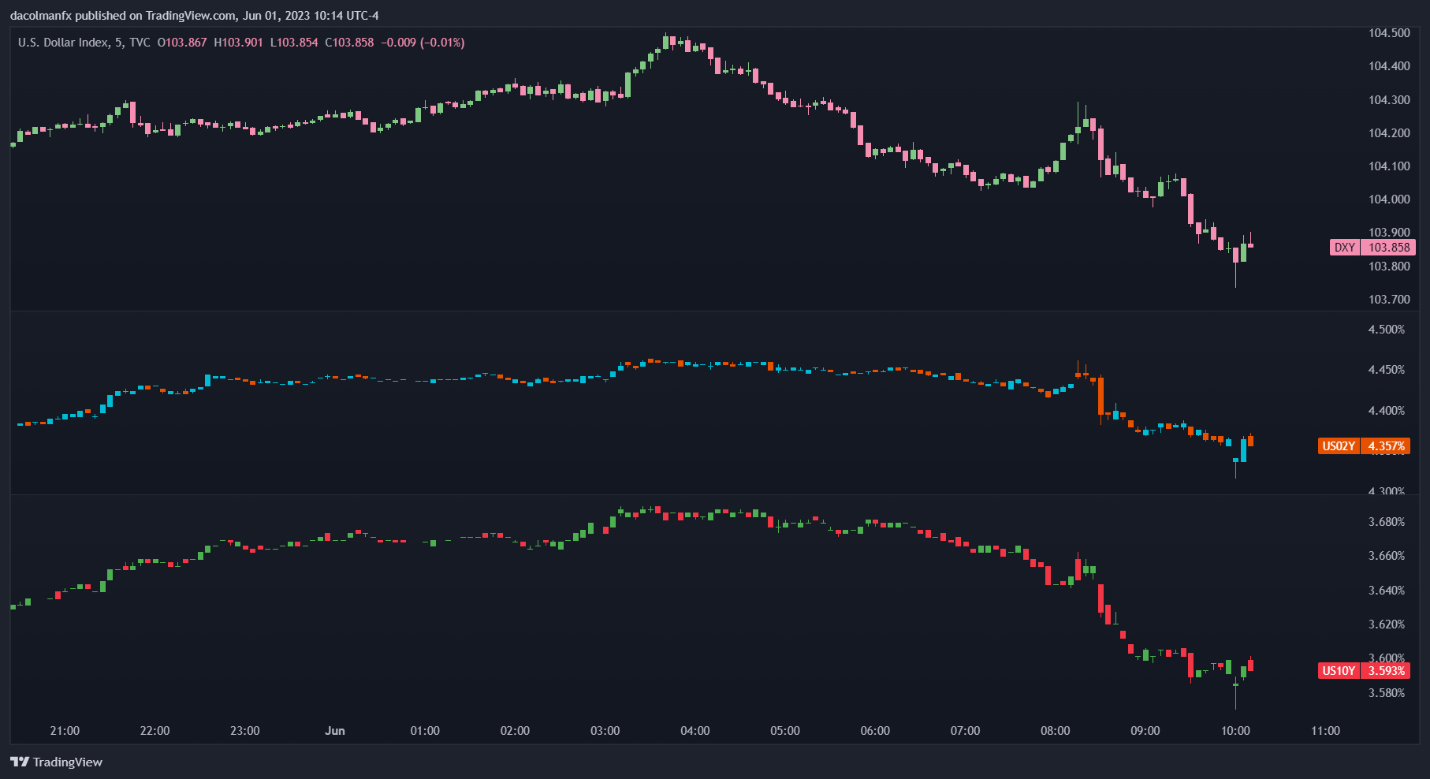

Disappointing manufacturing activity results are likely to reinforce the case for the Federal Reserve to hold interest rates steady at its June meeting to assess the lagged effects of cumulative tightening and other economic risks before deciding on the next move.

The increased likelihood of the Fed hitting the pause button should undermine the U.S. dollar in the near term by weighing on Treasury yields. Traders may see a “hold” as the first step toward a dovish pivot, even if policymakers signal that it is a “skip” rather than a prolonged pause or the end of the hiking campaign.

Immediately after the ISM results were released, the U.S. dollar extended session losses as yields retreated further, but then trimmed the decline as the knee-jerk response began to fade. Despite this reaction, the U.S. dollar could head lower in the coming days as markets attempt to front-run the Fed’s incoming action.

US DOLLAR (DXY) 5-MINUTE CHART

US Dollar Chart Prepared Using TradingView

Comments are closed.