US Dollar Slides as Fed’s Favorite Inflation Gauge Comes Below Expectations

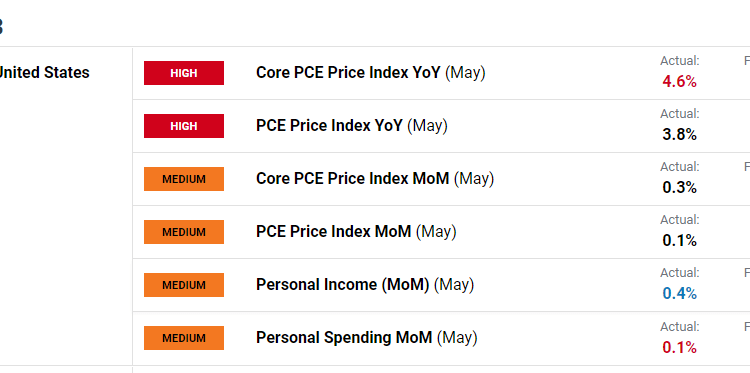

PCE REPORT KEY POINTS:

- May U.S. consumer spending rises 0.1% m-o-m, one-tenth of a percent below expectations

- Core PCE climbs 0.3% monthly, bringing the annual rate to 4.6% from 4.7%, also below estimates

- U.S. dollar extends losses following weaker-than-forecast spending and core inflation data

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Gold Prices Teeter on Brink of Breakdown as US Yields Fly High Following US Data

The U.S. Department of Commerce released this morning income and outlays data from last month. According to the agency, personal consumption expenditures, which make up more than two-thirds of the country’s gross domestic product, grew 0.1% m-o-m in May versus a forecast of 0.2%, a sign that the American consumer is losing some staying power, but not yet faltering.

Meanwhile, personal income ticked up by 0.4% following a 0.3% gain in April, slightly above consensus estimates. Although no major conclusions should be drawn from one single report, the solid increase in earnings can help households sustain spending heading into the second half of the year, creating a more constructive backdrop for the economy and preventing a hard landing.

Focusing on price indexes, headline PCE rose 0.1% m-o-m and 3.8% y-o-y. Meanwhile, core PCE, the Federal Reserve's favorite inflation indicator, which reflects the overall price trend in the economy, climbed 0.3 % m-o-m, bringing the annual rate to 3.6% from 3.7%, one-tenth of a percent below market projections.

US PERSONAL INCOME AND PCE DATA

Source: DailyFX Calendar

Softer household spending, coupled with weaker inflationary pressures, may give the Fed the cover it needs to adopt a less aggressive stance. While policymakers may still be inclined to raise borrowing costs by 25 basis points in July, given the recent resilience of the U.S. economy, a September hike may be less likely, preventing interest rate expectations from shifting in a more hawkish direction. This situation may cap Treasury yields going forward, creating the right conditions for a U.S. dollar pullback.

Immediately following this morning's report, the U.S. dollar, as measured by the DXY index, took a turn to the downside, falling as much as 0.3%, while bond yields retreated across the curve, erasing some of their advances from the previous session. That said, if incoming data continues to cooperate, today's moves in the FX and fixed-income markets could have legs.

Recommended by Diego Colman

Introduction to Forex News Trading

US DOLLAR (DXY) AND YIELDS CHART

Source: TradingView

Comments are closed.