US Dollar May Keep Weighing on the Chinese Yuan if Exports Soften

US Dollar, Chinese Yuan, USD/CNH – Q2 Top Trade Opportunity

- US Dollar may continue pressuring the Yuan in Q2

- A Chinese export decline seems to be a key factor

- Keep a close eye on USD/CNH between 7.08 – 7.52

Recommended by Daniel Dubrovsky

Get Your Free Top Trading Opportunities Forecast

US Dollar May Continue Pressuring the Chinese Yuan in the Second Quarter

This is a continuation of my ongoing outlook on USD/CNH based on a multiple linear regression model. I have made a couple of changes from the first quarter 2023 outlook. The first is we are now looking at USD/CNH instead of CNH/USD. The second is that the model was simplified, removing variables no longer statistically significant.

The first variable used to gauge the impact on the exchange rate is Chinese exports (year-over-year). Increasing global appetite for Chinese goods should translate into higher demand for the local currency and vice versa. The second variable is G20 real GDP (also y/y). China’s economy is closely tied to the global business cycle, making capturing worldwide growth a key component of this equation.

Finally, the spread between 10-year Treasury yields and equivalent Chinese bonds was factored. This is trying to capture the difference between United States and Chinese monetary policy expectations.

This model confirms that Chinese exports and G20 real GDP tend to have an inverse relationship with USD/CNH. In other words, the Yuan persistently appreciates when the world consumes more Chinese goods and when global growth rises. Meanwhile, when bond yields rise in the US relative to China, the Yuan tends to weaken and vice versa.

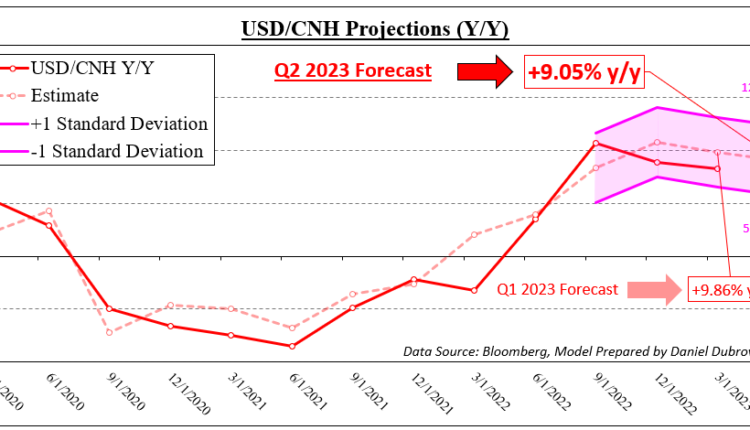

After making this model, Bloomberg second-quarter economic forecasts for the three variables are noted. Using the latter, I can then estimate how USD/CNH might behave in Q2 with an error zone. In the chart below, the model estimates USD/CNH rising about +9% y/y in Q2 versus +9.9% y/y in Q1. At the time of writing, USD/CNH was well within the margin of error prescribed by the Q1 forecast.

For the second quarter, this outlook translates into a 7.52 – 7.08 exchange rate zone, up from 6.77 – 7.19 prior. In other words, we could be looking at cautious US Dollar strength. This is highly influenced by an anticipated -6.0% y/y contraction in Chinese exports.

This zone could come in handy if prices move outside of this range. For example, a drop below 7.08 could speak to the US Dollar being oversold and vice versa. Needless to say, we might see performance outside of the error range should conditions warrant.

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.