US Dollar Gains as Yields in JGB and Treasury Markets Rise. Where to for USD?

US Dollar, DXY Index, USD, China PMI, Fed, AUD, NZD, Japan YCC, BoJ, HSI – Talking Points

- The US Dollar resumed strengthening again today as yields go north

- The Fed’s Kashkari hit the wires warning of potential labour market strains

- The Bank of Japan is allowing bond yields to go higher. Will that impact USD?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

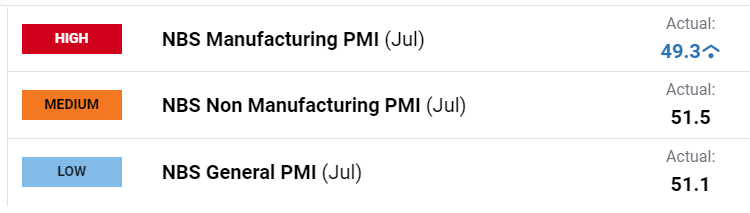

The US Dollar has found strength to start the week against most major currency pairs except for the Aussie and Kiwi Dollars after some firm Chinese PMI data.

The market tends to place more emphasis on manufacturing PMI due to the wider implications for economic activity. Some economists had been anticipating a print below 49.0.

A rosier outlook for China led to some growth-linked parts of the region getting a boost. Korea’s KOSDAQ and the Hang Seng China Enterprise indices led the way, adding over 2% today. The broader Hang Seng Index (HSI) made a 3-month high.

Gold dipped lower toward US$ 1,950 on the stronger USD and crude oil also eased. The WTI futures contract is a touch above US$ 80 bbl while the Brent contract is near US$ 84.40 bbl at the time of going to print.

On Sunday, Minneapolis Federal Reserve President Neel Kashkari appeared on US television and seemed to slightly step back from his previously strongly hawkish perspective.

He said that inflation was heading in the right direction but that the labour market might have to pay the cost of bringing price pressures down. Treasury yields are up a couple of basis points across most of the curve.

The 10-year Japanese Government Bond (JGB) traded at its highest yield since 2014 above 0.60%.

The move comes hot on the heels of Friday’s Bank of Japan adjustment to yield curve control (YCC). The Bank announced an unscheduled bond-buying program today of 300 billion Yen in the 5-to-10-year part of the yield curve.

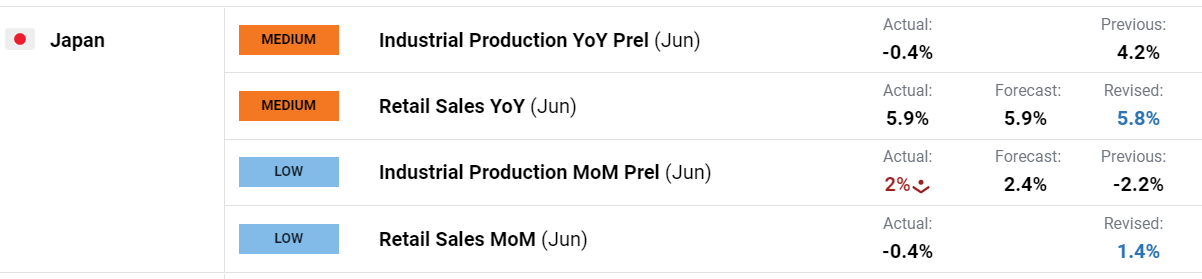

The Japanese Yen has been the biggest underperformer today with USD/JPY once again heading toward 142.00. There was mixed data out of Japan with retails sales beating forecasts while industrial production was underwhelming.

Euro-wide GDP and CPI data will be released today. Tomorrow will see the Reserve Bank of Australia (RBA) make a decision on monetary policy ahead of the Bank of England on Thursday.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade FX with Your Stock Trading Strategy

DXY (USD) INDEX TECHNICAL ANALYSIS

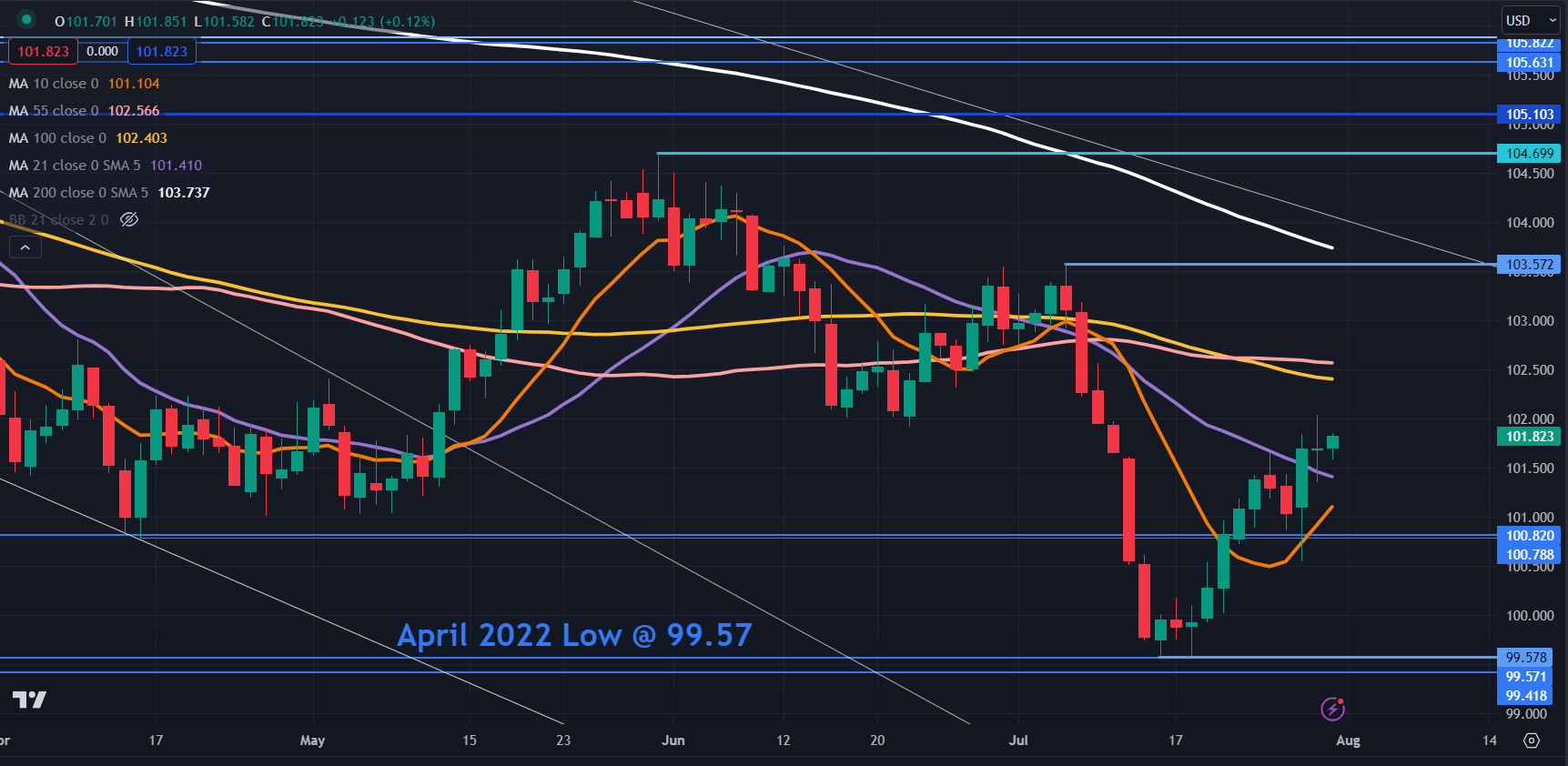

The DXY (USD) index steadied again today after making a 2-week high last Friday.

It remains above the 10- and 21-day simple moving averages (SMA) and that may indicate short-term bullish momentum could further evolve.

The next level of resistance might be at the 55- and 100-day SMAs in the 102.40 – 102.60 area. The 103.60 – 103.70 zone may also offer resistance with a prior peak and the 200-day SMA in that area.

Support could be at the breakpoint zone near 100.80 or below at the 15-month low of 99.58 which was just above the April 2022 low of 99.57.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.