US Dollar (DXY) Consolidates, Monthly US Retail Sales Miss Expectations

US Dollar (DXY) Price, Chart, and Analysis

- US retail sales miss forecasts.

- Fed speakers are out in force today.

Recommended by Nick Cawley

Get Your Free USD Forecast

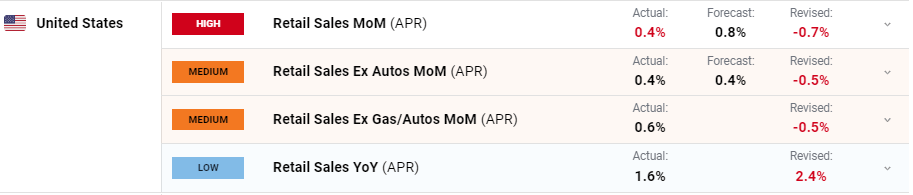

US retail sales (April) missed market expectations, data showed today, with all of March’s numbers also revised lower. Retail sales m-o-m grew by 0.4% compared to estimates of 0.8%, while y-o-y sales grew by 1.6% against a revised lower prior reading of 2.4%.

For all market-moving data releases and economic events see the real-time DailyFX calendar

Staying with the American high street, Home Depot (HD), the largest home improvement retailer in the US, released a disappointing set of Q1 results earlier and cut its full year guidance on lower demand. HD shares are around 2.5% lower in pre-market trade.

During today’s session, a handful of high-profile Federal Reserve members are scheduled to give us their latest thoughts on the state of the US economy. There is an ongoing battle between the market and the Fed about the path ahead for US interest rates. According to market pricing, the Fed looks set to hold rates at the current level before starting a rate cutting cycle at the September FOMC meeting. CME Fed Fund futures are currently predicting three 25 basis point cuts this year with additional cuts next year taking Fed Funds down to 275-300bps by November next year from a current level of 500-525bps. This is in contrast to recent Fed rhetoric of potentially higher rates this year before rates are lowered next year. Today’s Fed speakers include Loretta Mester, Raphael Bostic, Michael Barr, John Williams, and Lorie Logan.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

US debt ceiling talks continue with President Joe Biden expected to meet Republican Speaker of the House Kevin McCarthy later today. Treasury Secretary Janet Yellen recently warned that the US could run out of money by June 1st, leaving the US government staring at a potential default on its outstanding debts. One-month US Treasury Bills currently offer 5.60% having hit a multi-year high yield of 5.89% yesterday, as investors demand more yield over the potential default date.

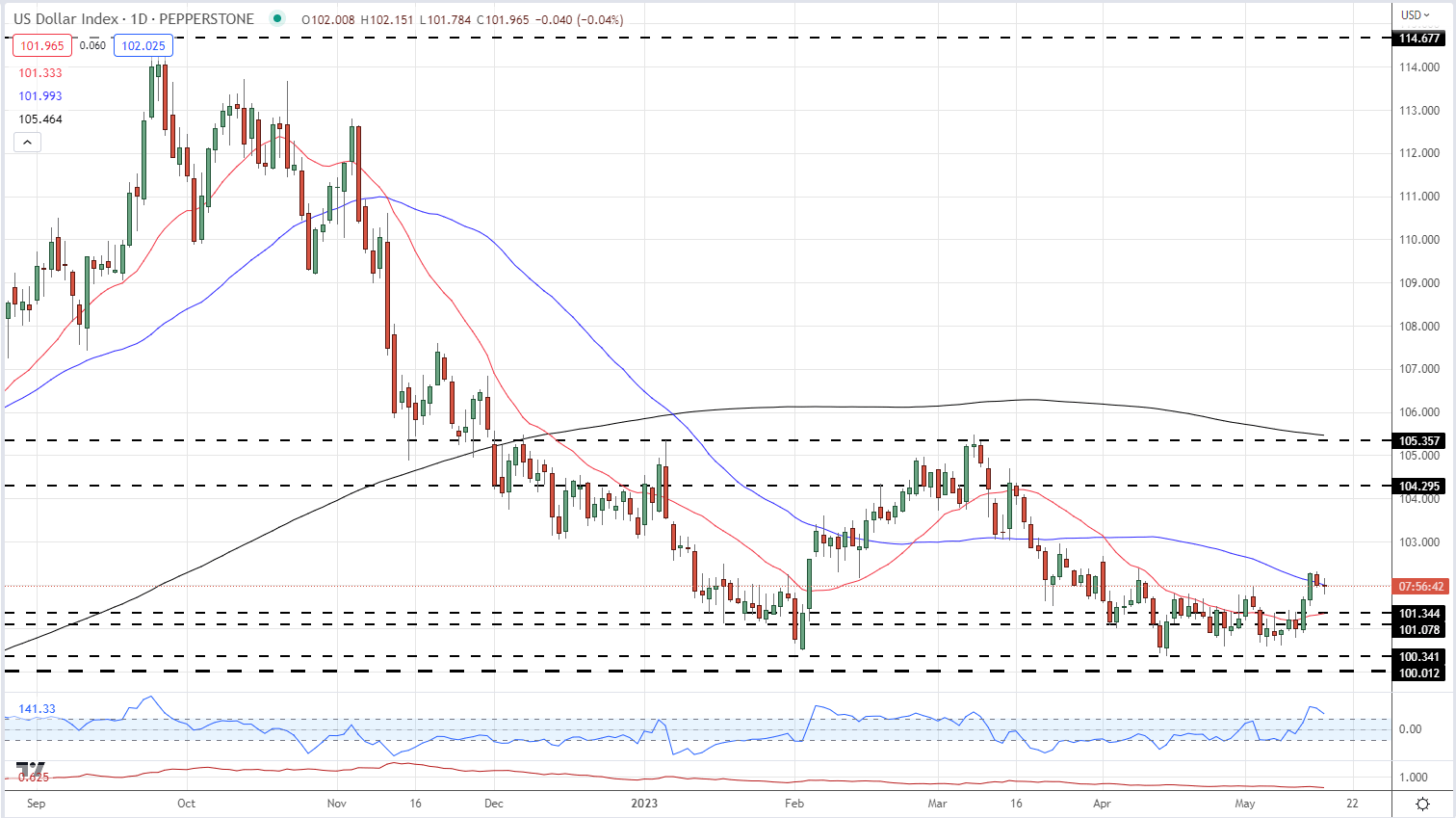

The US dollar is currently consolidating its recent gains although moves either way are limited. Last Friday the greenback broke out of a multi-week range to trade at a fresh one-month high of 102.29 before edging marginally lower this week. The US dollar is likely to remain around these levels ahead of a speech by Fed chair Jerome Powell on Friday.

US Dollar (DXY) Daily Price Chart – May 16, 2023

Chart via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.