US Dollar Dip Pauses as Markets Reassess Fed Moves and China Concerns. Lower USD?

US Dollar, DXY Index, USD, Fed, GDP, China PMI, USD/JPY, Euro CPI – Talking Points

- The US Dollar was undermined by weak data that gave hope to equity bulls

- China saw good PMI numbers, but the property sector continues to weigh

- Markets appear to be data-focused for now. Will sluggish numbers push the USD lower?

Recommended by Daniel McCarthy

Introduction to Forex News Trading

The US Dollar has steadied the ship going into Thursday after disappointing data overnight that may indicate rough waters ahead for the US economy.

Annualised GDP for the second quarter was revised down to 2.1% from 2.4% and the ADP employment report missed estimates. It showed that 177k jobs were added in August rather than the 195k anticipated.

In a classic case of bad news is good news, this led to speculation that the Federal Reserve might not need to be as aggressive in its monetary policy settings as previously thought.

Equities appear to like that angle with Wall Street recovering from early losses in the cash session to finish the day with modest gains. The Nasdaq was the best performer, eking out a 0.54% uplift. Futures are pointing to a quiet start to the cash session ahead.

APAC stock markets have had a mixed day with Australian and Japanese indices slightly in the green, while the bourses on mainland China and Hong Kong edged into the red.

Country Garden, one of China’s largest property players, revealed further problems and signalled that a debt default could happen after reporting a record loss of US$ 7 billion for the first half of this year.

Official Chinese manufacturing PMI for August beat estimates of 49.2 to print at 49.7, but it wasn’t enough to overcome lingering concerns around the property sector.

Japanese industrial production figures month-on-month to the end of July came in at -2.0% instead of the anticipated -1.4%. USD/JPY dipped toward 145.75 in the aftermath before recovering back above 146.

Crude oil has held on to recent gains with the WTI futures contract above US$ 81.50 bbl while the Brent contract is near US$ 86 bbl. Likewise, spot gold is holding above US$ 1,940.

Looking ahead, Euro-wide CPI data will be released ahead of US jobless claims.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade USD/JPY

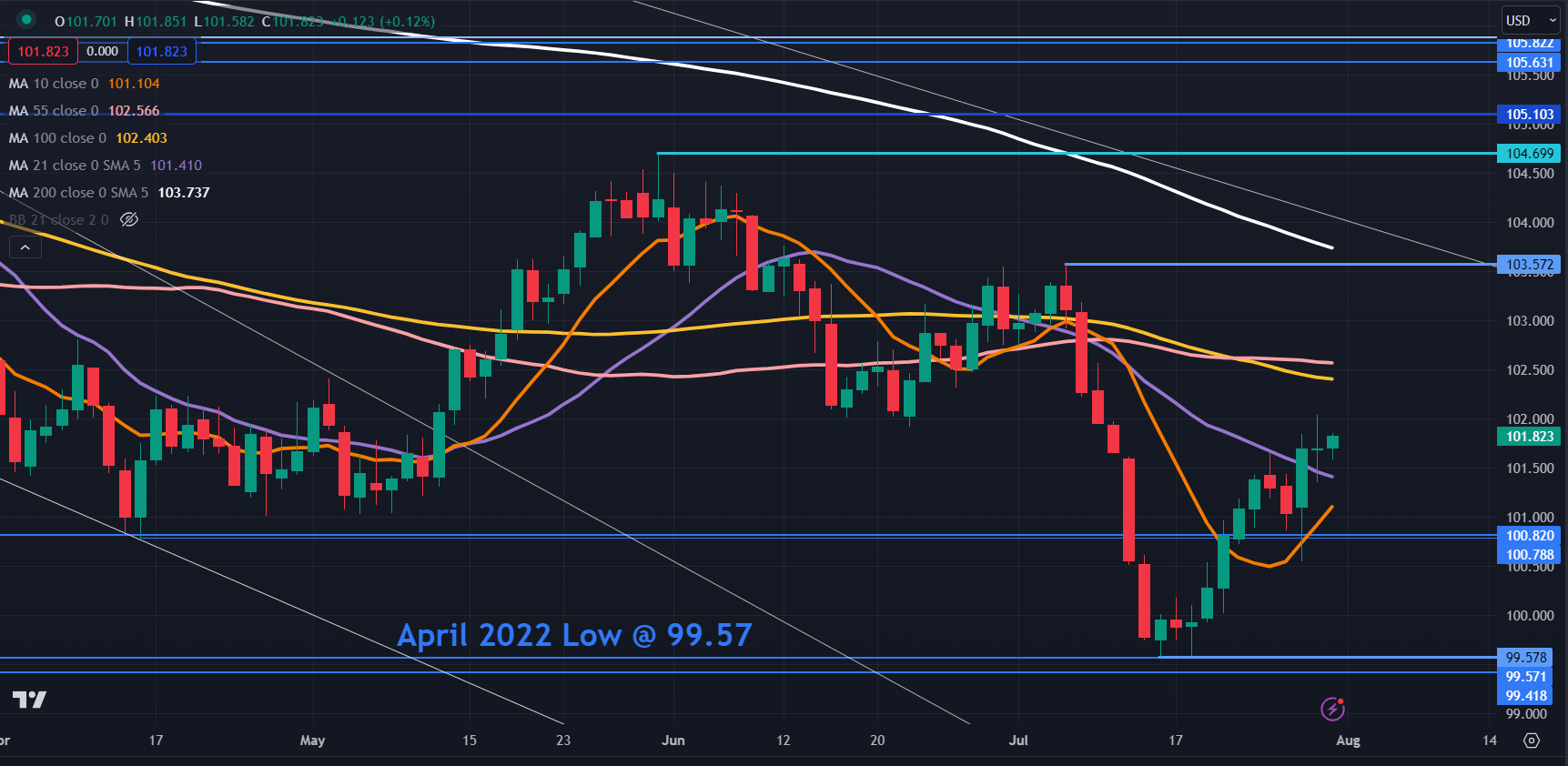

DXY (USD) INDEX TECHNICAL ANALYSIS

The DXY (USD) index steadied today after notching up 3-days of losses and crashing below an ascending trendline.

Support could be at 102.58 which is the 38.2% Fibonacci Retracement level of the move from 99.58 up to 104.45. The 50% retracement of the same move may also provide support near 102.00.

Between those levels, the 55- and 100-day simple moving averages (SMA) might provide support, currently in the 102.35 – 102.50 area.

On the topside, nearby resistance could be at the 10-day SMA which is near a historical breakpoint at 103.57. Further up, the prior peak at 104.45 and 104.70 may offer resistance.

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.