Uneventful ISM Services Beat Heightens FOMC Expectancy

U.S. DOLLAR ANALYSIS & TALKING POINTS

- ISM data largely in line with expectations.

- FOMC announcement in focus later today.

Recommended by Warren Venketas

Get Your Free USD Forecast

DOLLAR FUNDAMENTAL BACKDROP

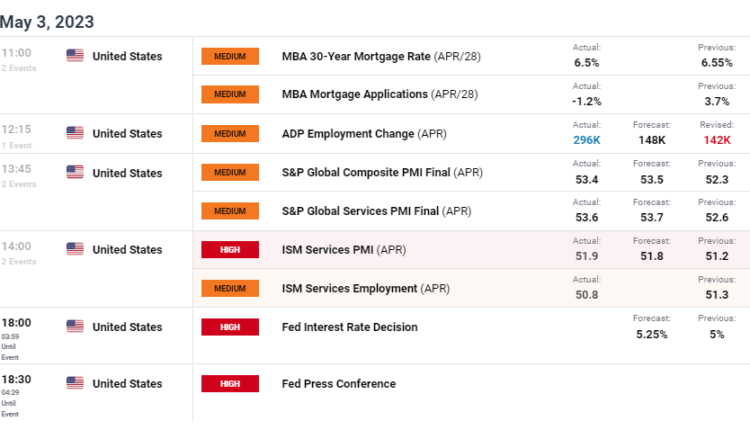

US ISM services PMI data beat (refer to economic calendar) indicates the services industry remaining in expansionary territory but a few metrics fell short of expectations including:

- The Business Activity Index: -3.4%

- Employment: -0.5%

- Inventory Sentiment: -9.0%

Services grew primarily via an increase in new orders and the easing of supply chain dynamics. That being said, most respondents were optimistic of economic conditions but cited concerns as recessionary discussions gain traction.

The build-up to the PMI print saw the ADP employment change figure surprising markets with yet another robust print. This is in contrast to the JOLTs openings and services employment indicating areas of the labour market are diverging. The weaker employment figure in the ISM report seemed to be the highlight of the release, potentially unwinding the persistent tight US labor market conditions – initial reaction on the Dollar Index (DXY) chart showed a marginal sell-off.

This sets up the upcoming FOMC announcement to be packed with anticipation as the Fed have multiple moving parts to contend with in the midst of a banking crisis and the looming decision around the US debt ceiling.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Overall, a healthy release for the US economy which leads me to believe the Fed will remain in line with money market pricing and 25bps interest rate hike.

US ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

U.S. DOLLAR INDEX DAILY CHART

Chart prepared by Warren Venketas, IG

The daily DXY chart above remains within the developing symmetrical triangle pattern that is ripe for a breakout depending on the FOMC announcement later today.

Resistance levels:

- 103.42

- 50-day MA (yellow)

- 102.81

- Triangle resistance

Support levels:

- 101.42

- Triangle support

- 101.00

- 100.79

— Written byWarren Venketasfor DailyFX.com

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.