UK Unemployment and Upside Wage Pressures Dominate Jobs Report

POUND STERLING ANALYSIS & TALKING POINTS

- UK wage data creates concerns around inflation battle.

- 4.2% unemployment level reiterates robust jobs market.

- GBP/USD trading above 50-day MA.

Elevate your trading skills and gain a competitive edge. Get your hands on the British Pound Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

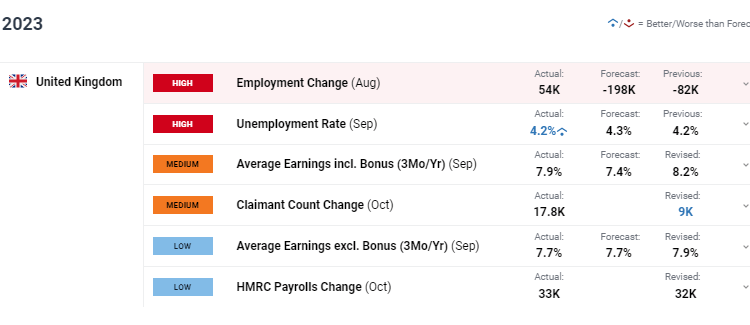

The British pound found support after UK labor data (see economic calendar below) showed signs of resilience in the face of a tight monetary policy environment. Unemployment missed estimates while average earnings including bonuses beat forecasts; possibly contributing to upside inflation concerns. Headline employment change supplemented a tight labor market narrative by moving back into positive territory for the first time since April this year.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

It is important to remember the exclusions for this particular report (refer to graphic below) may dampen its validity in terms of monetary policy decisions. What is disappointing from an investor point of view is this jobs release will be the last before the Bank of England (BoE) December interest rate announcement. Without the complete picture, more significance will likely be placed on the upcoming UK CPI report later this week.

Source: Office for National Statistics

TECHNICAL ANALYSIS

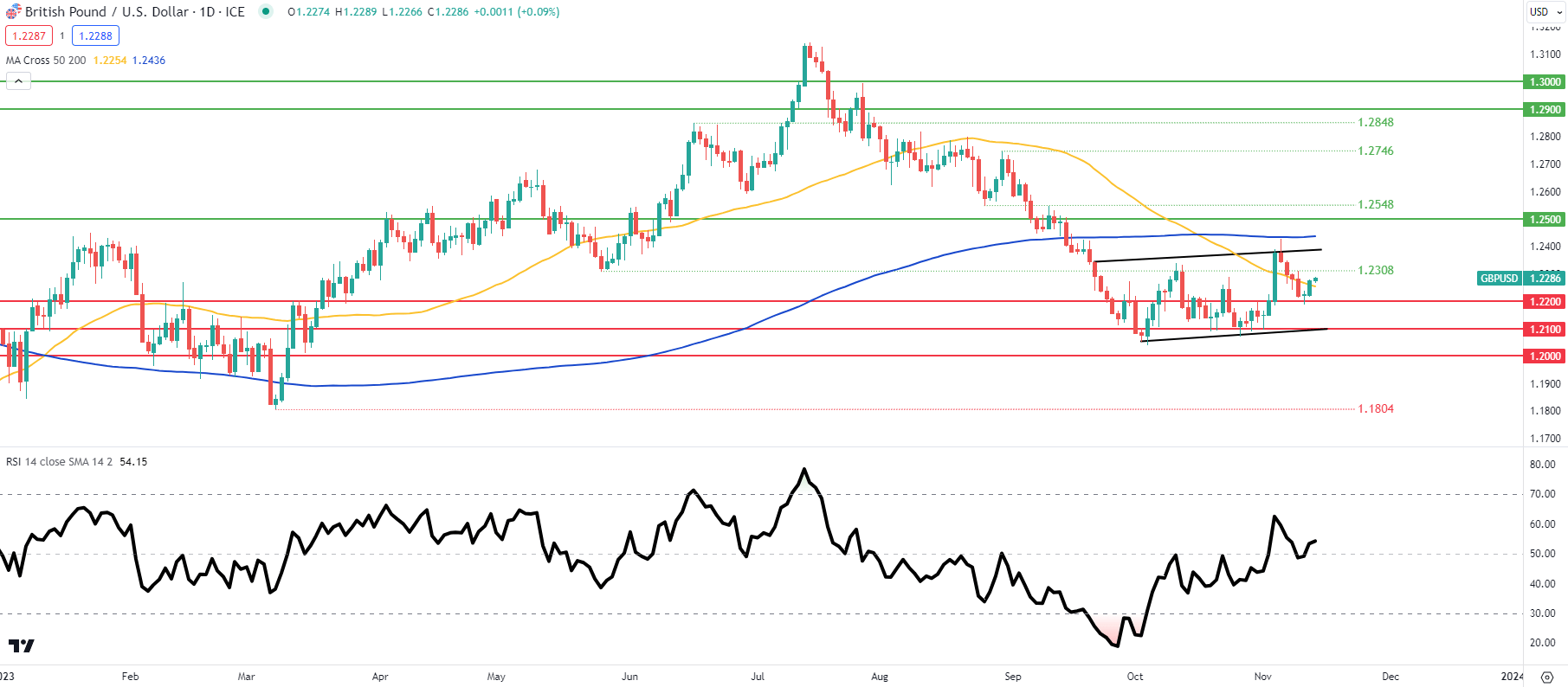

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action gained upside impetus post-release but remains cautious ahead of US CPI later today.

Key resistance levels:

Key support levels:

- 50-day MA (yellow)

- 1.2100/Flag support

- 1.2000

- 1.1804

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 67% of traders holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.