UK House Price Index Rises for 2nd Consecutive Month

POUND STERLING ANALYSIS & TALKING POINTS

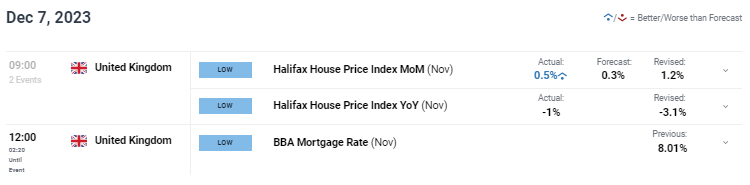

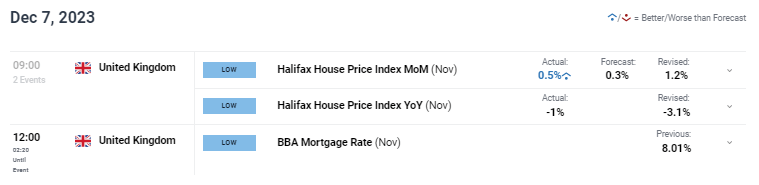

- UK housing prices provide support for struggling pound.

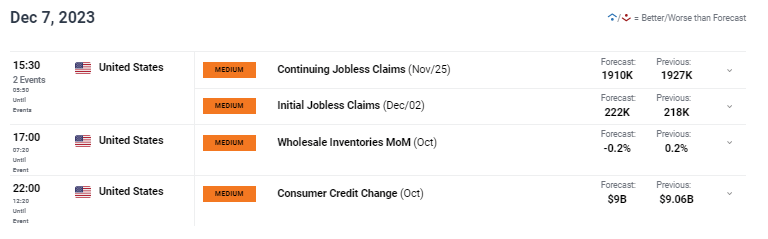

- US jobless claims to lay foundation ahead of tomorrow’s NFP report.

- GBP/USD hesitant ahead of key US data.

Elevate your trading skills and gain a competitive edge. Get your hands on the BRITISH POUND Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound remains depressed but is attempting to find support this morning after housing prices surprised to the upside MoM (see economic calendar below). FX markets are relatively muted with little high impact economic data scheduled ahead of tomorrow’s Non-Farm Payroll (NFP) report. After yesterday’s weak UK construction PMI figures and minimal impact from Bank of England (BoE) Governor Andrew Bailey, focus now shifts to the US for guidance.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Later today, jobless claims data will be closely watched with particular emphasis on initial jobless claims as this statistic shows any new/emerging unemployment. ADP employment change missed forecasts yesterday but taking into account its recent disconnect with NFP numbers, markets will largely dismiss its predictive capability.

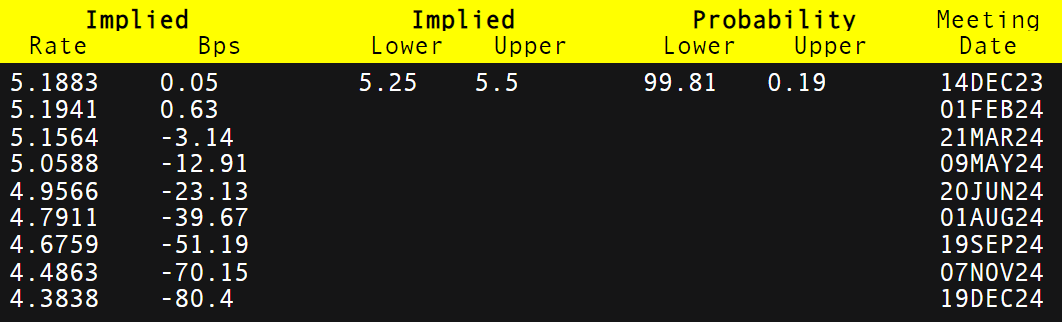

Money market pricing for the BoE (shown below) has been ‘dovishly’ repriced and with only UK GDP and UK jobs reports to come before the next rate announcement, these two data points will carry significant weight as to pricing moving forward.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

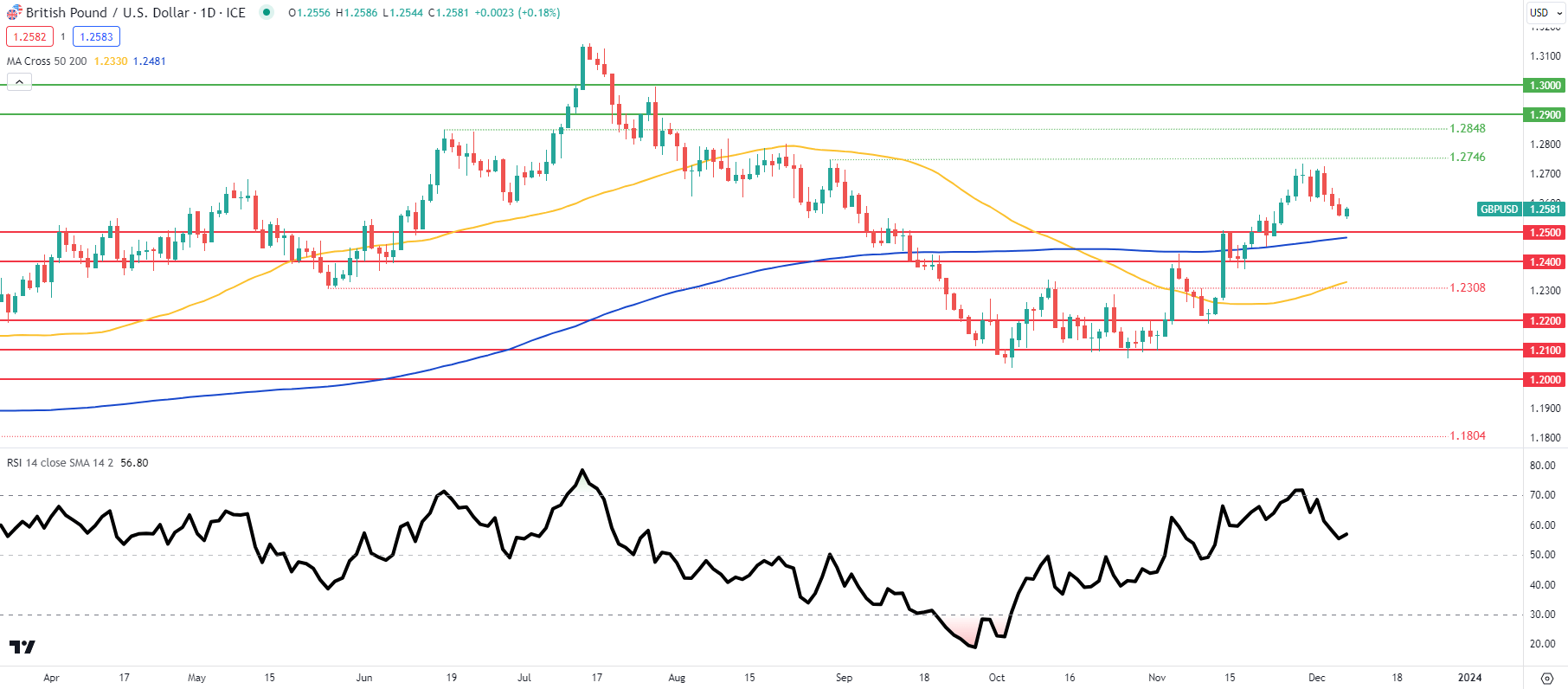

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action is nearing key support at the 1.2500 psychological handle/200-day moving average (blue) as the pair comes off overbought territory shown via the Relative Strength Index (RSI). Short-term directional bias will come from tomorrow’s NFP’s that are expected higher and may extend cable’s recent downside.

Key resistance levels:

Key support levels:

BEARISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net SHORT on GBP/USD with 51% of traders holding short positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.