UK Growth Revised Higher, GBP/USD Nears A Multi-Week High

GBP/USD – Prices, Charts, and Analysis

- UK GDP data beat estimates.

- Cable continues to move higher.

- US core PCE later in the session may impact cable.

Recommended by Nick Cawley

Traits of Successful Traders

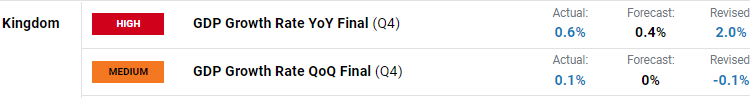

The UK economy expanded by 0.1% in Q4 2022, and data released by the Office for National Statistics (ONS) showed delayed, one-tenth of a percentage above expectations. The Q3 data was also revised higher by the same amount to -0.1%.

For all market-moving data releases and events, see the DailyFX Economic Calendar

According to the ONS,

‘The level of quarterly GDP in Quarter 4 2022 is now 0.6% below its pre-coronavirus (COVID-19) level (Quarter 4 2019), revised up from the previous estimate of 0.8% below. GDP is now estimated to have increased by 4.1% in 2022, revised up from the previous estimate of 4.0%. Compared with the same quarter a year ago, real GDP increased by 0.6%.’

UK GDP Quarterly National Accounts – October to December 2022

Cable (GBP/USD) pushed marginally higher on the ONS release and back above 1.2400 for the first time in a month. Sterling has been slightly better bid over the last few weeks against the US dollar. The greenback remains under pressure from ongoing market expectations that the Fed may finally have finished their aggressive rate hiking cycle with expectations also building that the US central bank may start cutting rates at the end of Q3/start of Q4. This afternoon (13:30 UK) we get the latest look at US price pressures with the release of the closely monitored US core PCE data. If inflation is the US remains stubbornly high and sticky, these rate-cut expectations will disappear, boosting the value of the US dollar.

Looking at the daily GBP/USD chart, while the pair may start to look expensive, using the CCI indicator, the rest of the set-up remains positive. Cable trades above all three moving averages, which are now in a positive order, while recent resistance turned support around the 1.2292 level continues to hold. The recent double top around 1.2448 is looking vulnerable to any move higher and a confirmed break above this level would leave 1.2667 as the next point of resistance.

GBP/USD Daily Price Chart – March 31, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -16% | 7% | -2% |

| Weekly | -18% | 18% | 2% |

Retail Trader Trim Long Positions

Retail trader data show 35.08% of traders are net-long with the ratio of traders short to long at 1.85 to 1.The number of traders net-long is 15.72% lower than yesterday and 19.11% lower from last week, while the number of traders net-short is 5.99% higher than yesterday and 16.96% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

What is your view on the GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.