UK CPI Posts Massive Drop, GBP Offered

UK Inflation Drops Across the Board

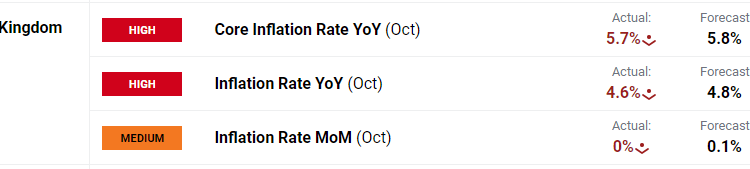

- UK headline CPI 4.6% vs 4.8 exp. Prior 6.7%

- UK core CPI 5.7% vs 5.8% exp. Prior 6.1%

- Largest contributors to CPI drop: housing and household services (energy) and food

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

UK inflation dropped on both the core (inflation ex volatile items like food and energy) and headline measures, bettering estimates for the month of October. The largest contributions to the decline came via encouraging drops in food and energy prices as goods inflation witnessed a massive decline from 6.2% to 2.9% when comparing October 2023 to the same time last year. The more closely monitored services inflation also witnessed a decline although it proved to be more modest, from 6.9% to 6.6%.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Trading Forex News: The Strategy

The massive 12-month decline in headline inflation is notable on the chart below and will no doubt be lauded by the UK government ahead of next week’s Autumn (budget) Statement. Rishi Sunak promised the UK public that his government would halve inflation by the end of 2023. The latest move solidifies the notion that the Bank of England is done hiking interest rates but inflation, average earnings and services inflation still remain elevated. These areas have previously been identified by the BoE as areas to focus on but more recently average earnings have received less attention.

UK Inflation Makes Positive Strides Towards 2% Goal

Source: Refinitiv, prepared by Richard Snow

Immediate Market Reaction

The immediate market reactions was relatively tame in the moments that followed the release with yesterday's lower US CPI having propelled cable higher on the day. The better-than-expected move in UK inflation this morning threatens to eat into those gains but thus far the effect has been minuscule.

GBP/USD 5-Minute Chart

Source: TradingView, prepared by Richard Snow

The daily GBP/USD chart reveals the effect of yesterday's US CPI print, sending cable nearly 2% higher on the day and above the 200-day simple moving average (SMA). The positive UK inflation data remains secondary to the recent trend of softer US data which has prompted the futures market to bring forward expectations of interest rate cuts in 2024, sending the dollar lower.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.