The Game Changer EA – Trading Strategies – 22 September 2023

My Journey

I have always been passionate about the world of finance and trading. When I first started exploring the world of forex, I was struck by how difficult it can be for the average person to navigate. There is so much information out there, and it can be overwhelming to try and make sense of it all. I saw an opportunity to make a difference and help people achieve their financial goals. I knew that if I could develop trading experts that would be easy for people to use, it could help them make better trading decisions and ultimately, earn more money instead of losing. I am driven by the idea that technology can be used to level the playing field and give people the tools they need to be successful. I truly believe that my trading experts can make a real difference in people's lives and I am motivated by the opportunity to have a positive impact on the world. I am constantly learning and researching new ways to improve my skills, and I am dedicated to providing the best possible solution to help people achieve their financial goals. My ultimate goal is to create trading experts that will change the way people approach the forex market, making it more accessible and less intimidating, while helping them to be profitable. I feel confident that the trading experts I develop will help people earn and not lose, and that's a rewarding thing for me.

Expert Creation

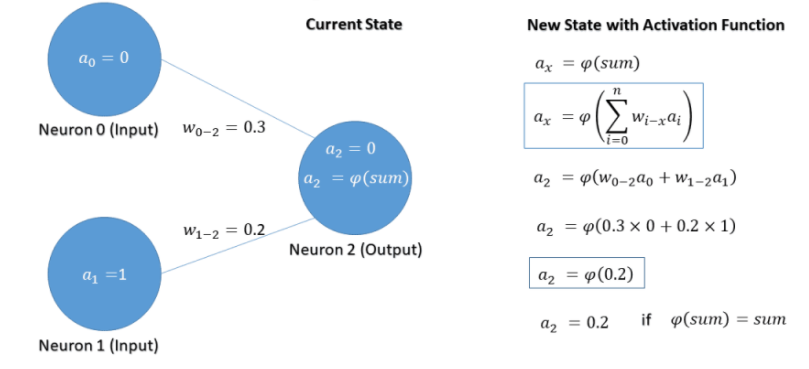

I developed Game Changer AI based EA on deep learning because I believe it can assist traders in the foreign exchange market, particularly those new to trading, by providing valuable insights and improving their decision-making. Deep learning techniques enable the EA to recognize intricate market patterns, offering traders an advantage in predicting future price movements. Deep learning is a subset of machine learning that employs artificial neural networks, featuring multiple hidden layers for handling complex data. It uses backpropagation for training, employs activation functions, includes Convolutional Neural Networks (CNNs) for images, and Recurrent Neural Networks (RNNs) for sequences. Transfer learning is common, and deep learning finds applications in computer vision, natural language processing, healthcare, and more, often leveraging hardware acceleration.

How to avoid over-optimization and over fitting in Neural Network (NN) Expert Advisor (EA) creation:

Avoiding over-optimization and overfitting in Neural Network (NN) Expert Advisor (EA) creation is crucial to ensure your trading model generalizes well to unseen data and performs effectively in the real forex market. Here are some strategies to help you achieve that:

-

Use Sufficient Data: Ensure you have a large and diverse dataset for training and testing your NN. The more data you have, the better your model can learn from various market conditions.

-

Split Data Properly: Divide your dataset into three parts: training, validation, and testing sets. The training set is used for model training, the validation set helps you tune hyperparameters and detect overfitting, and the testing set evaluates the model's performance on unseen data.

-

Regularization: Apply regularization techniques like L1 and L2 regularization to penalize large weights in the neural network. This helps prevent the model from fitting the noise in the data.

-

Dropout: Implement dropout layers in your NN architecture during training. Dropout randomly deactivates a fraction of neurons, which prevents co-adaptation of neurons and reduces overfitting.

-

Early Stopping: Monitor the validation loss during training. If it starts to increase while the training loss decreases, it's a sign of overfitting. Stop training early to prevent further overfitting.

-

Cross-Validation: Use k-fold cross-validation to assess your model's performance from multiple splits of your data. This provides a more robust estimate of how well your model will perform on unseen data.

-

Simple Models: Start with simpler NN architectures and gradually increase complexity only if necessary. Simple models are less prone to overfitting.

-

Feature Engineering: Carefully select relevant features and avoid using noise or redundant variables in your input data.

-

Hyperparameter Tuning: Systematically search for optimal hyperparameters (learning rate, batch size, number of layers, neurons per layer, etc.) using techniques like grid search or random search.

-

Ensemble Learning: Combine predictions from multiple NN models, each trained differently, to reduce overfitting and improve generalization.

-

Regular Monitoring: Continuously monitor the performance of your EA in a demo or paper trading environment. If it starts to underperform, re-evaluate and possibly retrain the model.

-

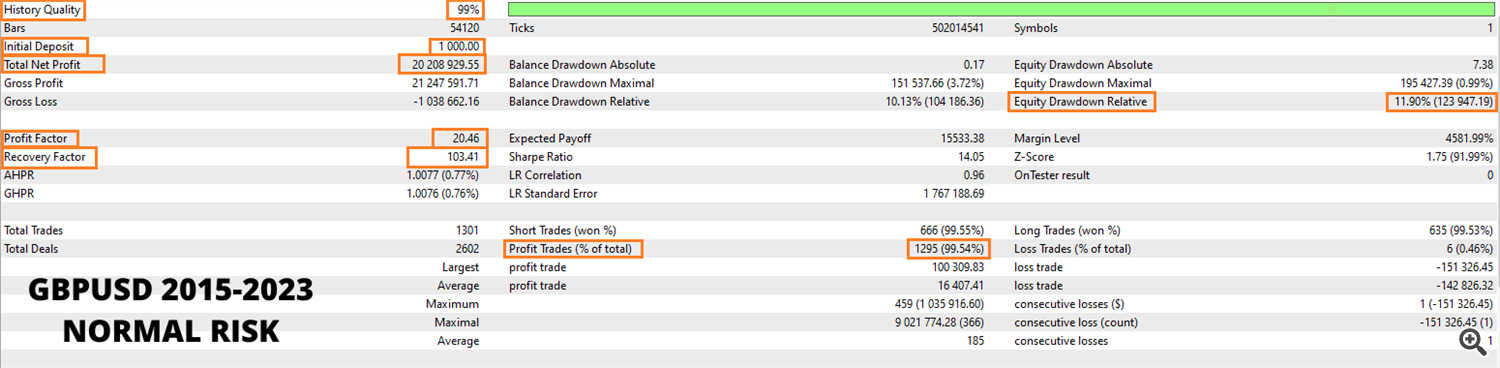

Use Proper Evaluation Metrics: Focus on relevant evaluation metrics like Sharpe ratio, Maximum Drawdown, and Profit Factor rather than just accuracy or loss.

-

Realistic Simulations: When backtesting, consider transaction costs, slippage, and other real-world factors to make the simulations more realistic.

-

Walk-Forward Testing: Periodically update and retrain your EA with new data to adapt to changing market conditions.

-

Diversification: Avoid relying solely on a single NN EA. Diversify your trading strategies to reduce risk.

-

Continuous Learning: Stay updated with the latest research and trading strategies in the forex market and adapt your NN EAs accordingly.

Remember that overfitting is a common challenge in EA creation, and it's essential to strike a balance between model complexity and generalization. Regular monitoring and adaptation are key to long-term success in algorithmic trading.

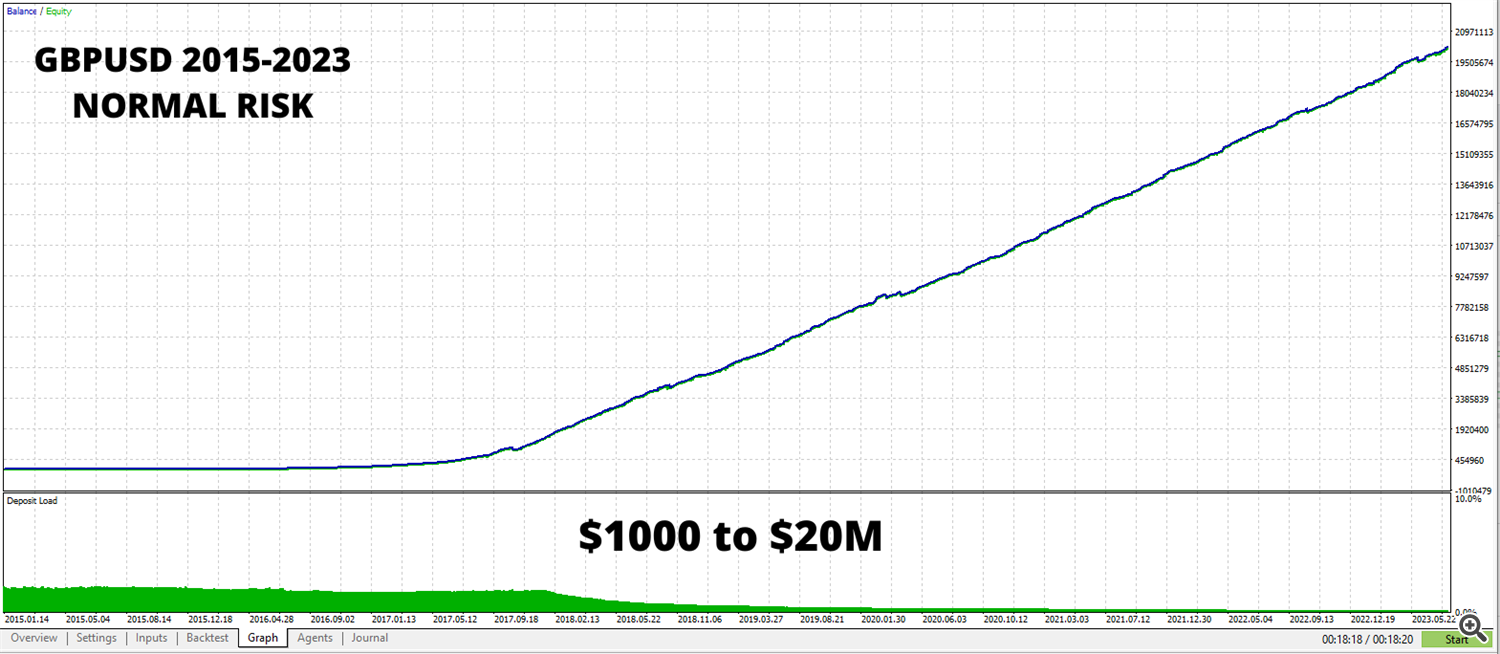

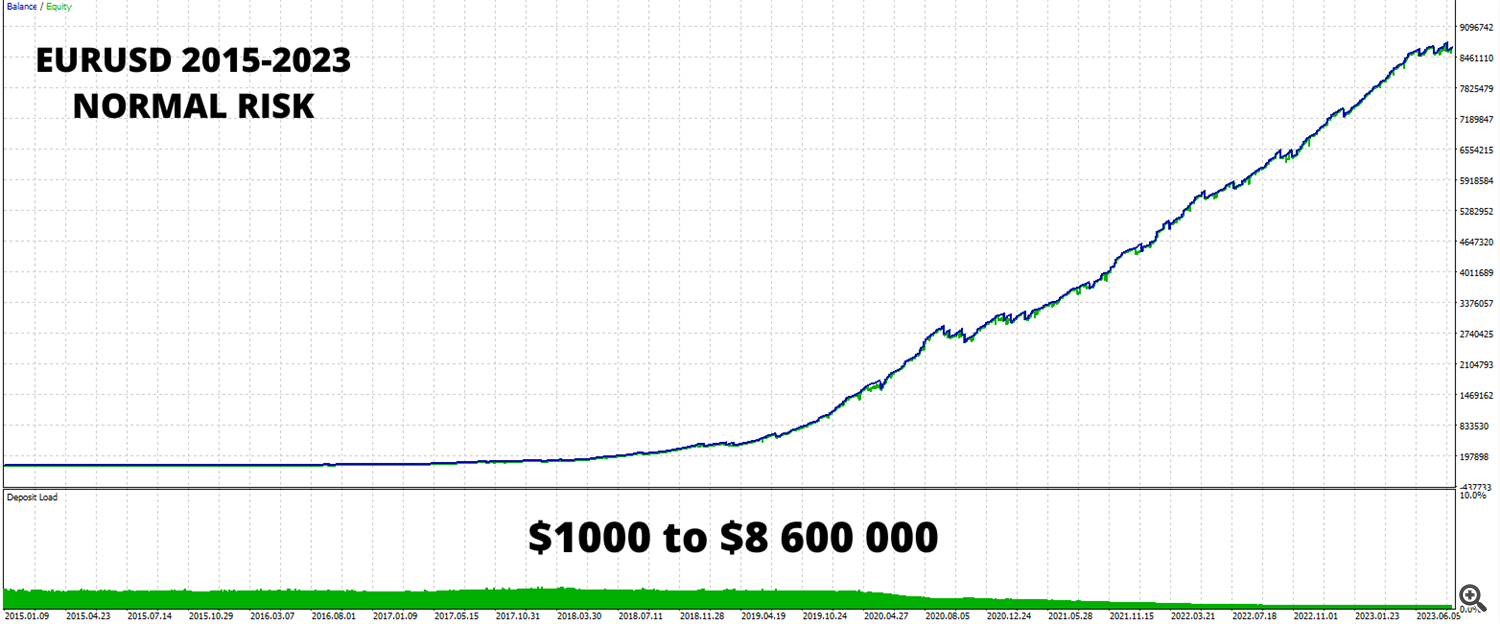

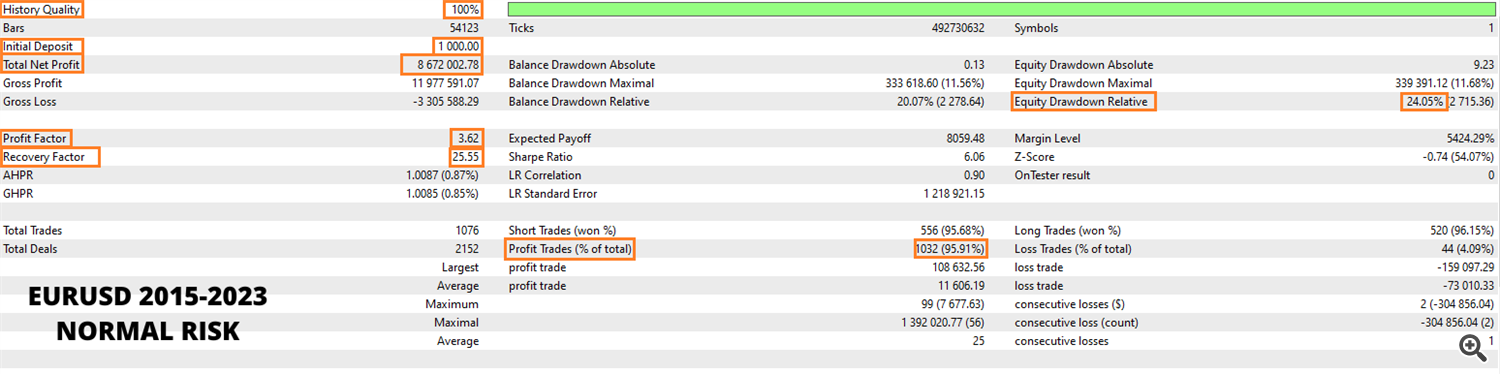

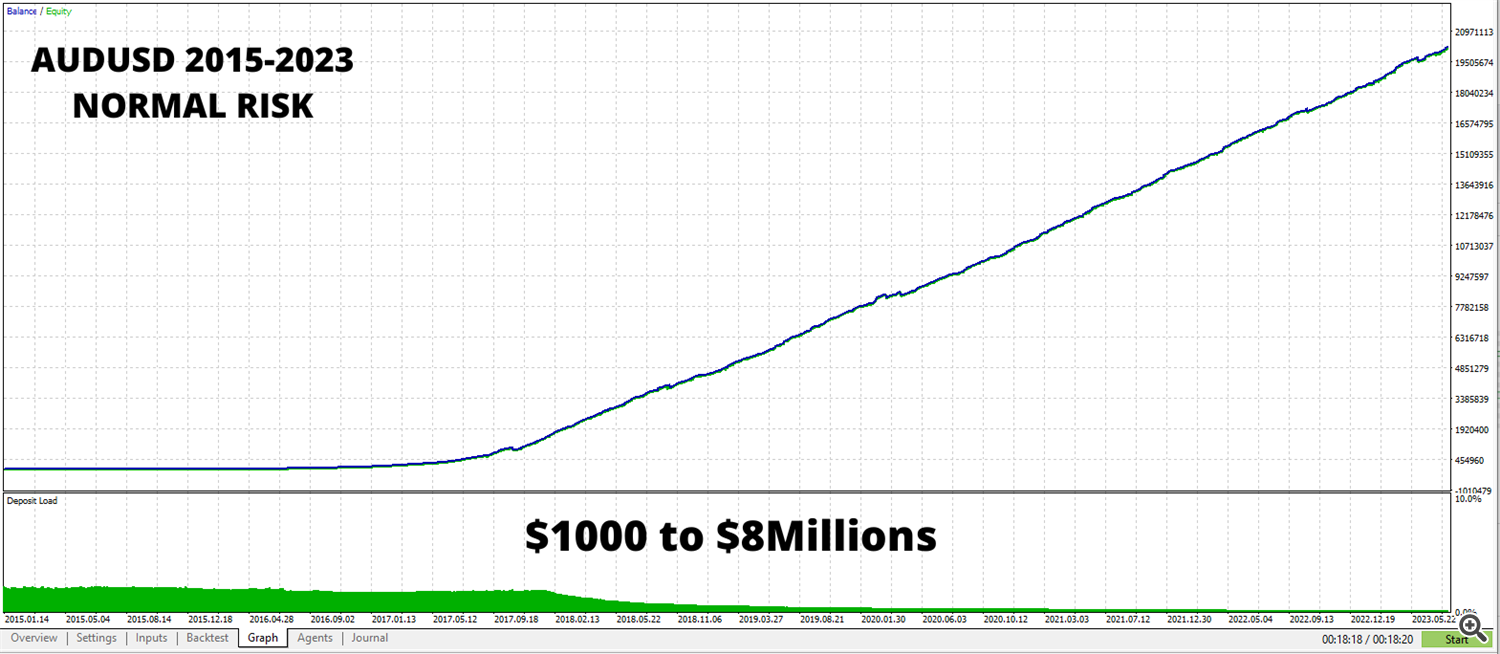

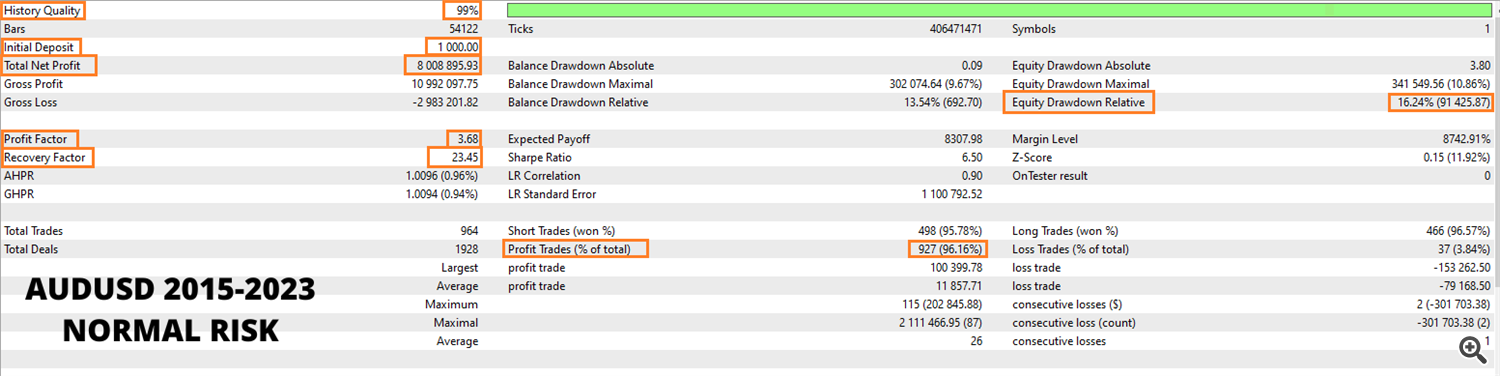

Result

In summary, I created Game Changer AI EA because I believe it can help traders make more informed decisions and be successful in the foreign exchange market. Using machine learning technology allows the EA to analyze vast amounts of data and make predictions with high accuracy, providing traders with a powerful tool that can help them achieve their financial goals.

I have dedicated significant effort to back testing, forward testing and tuning of my algorithm to make it performs optimally. With its ability to adapt to changing market conditions, it has proven to be a powerful tool for generating consistent returns. I am honored to have received recognition for my work and excited to continue to refine and improve my algorithm in the future.

If you have any questions for me, write here https://www.mql5.com/en/users/darksidefx

Comments are closed.