S&P 500 Tags New Yearly High on Debt Ceiling Optimism

S&P 500 (ES1!) News and Analysis

- US stocks edge higher despite stronger dollar, higher yields

- Traders increase interest rate expectations as the threat of a US default subsides

- Key levels to note for a bullish continuation for the S&P 500

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Equities Forecast

US Stocks Edge Higher Despite Stronger Dollar, Higher Yields

Sentiment has taken a large stride forward this week as news emerged about a possible deal at the end of this week or sometime next week regarding the raising of the US debt ceiling. Markets no longer appear to be pricing in the possibility of a US default, which would have unthinkable ramifications not just for the US but for the wider market as a whole.

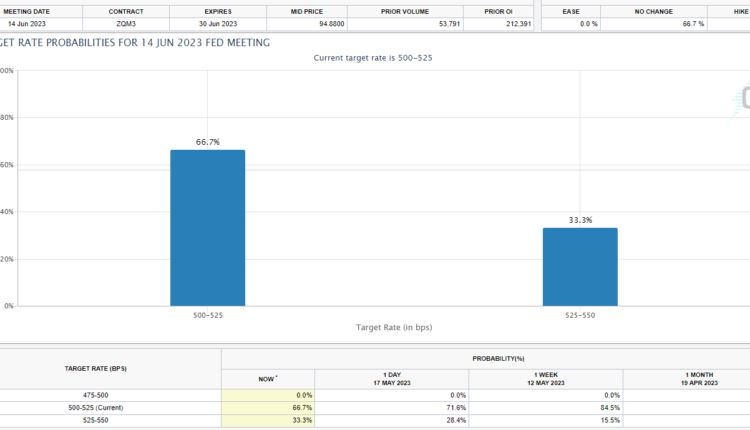

As concern around the debt ceiling wanes, markets are left to contemplate the rising probability of another 25-basis point hike form the Fed early next month as inflation shows little sign of improvement. According to the CME FedWatch tool, markets price in more than a 30% chance of a rate hike, up from 28.4% yesterday and 15.5% last week.

Source: CME FedWatch, prepared by Richard Snow

US yields, mainly the 2-year and 10-year treasuries continue to rise, elevating the dollar in the process. However, this has not appeared to weigh on the index but could serve to cap S&P 500 upside as the index briefly tagged a new yearly high.

Additionally, Fed speakers this week expressed an openness to another hike should the data deem it necessary. Later today (16:00 UK time) Fed Chairman Jerome Powell is due to speak at a Fed hosted conference titled ‘Perspectives of Monetary Policy’.

S&P 500 Technical Levels to Consider

The index’s recent bullish momentum had catapulted it to a new high for 2023, trading above 4200 and the February high of 4008.50. The latest move is significant given the previous inability to break into territory above 4200 for more than a day. Should the index head into the weekend clear of 4200, further upside resistance comes in at 4311.75, the 61.8% Fibonacci retracement of the major 2021 – 2022 selloff. Immediate support comes rests at 4208.50 followed by 4180 and lastly, 4110.

S&P 500 E-Mini Futures (ES1!) Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.