Signs of Weaker US Jobs Market Aid Aussie Dollar

AUD/USD ANALYSIS & TALKING POINTS

- Moderating US jobs data bolster AUD but one eye on NFP tomorrow.

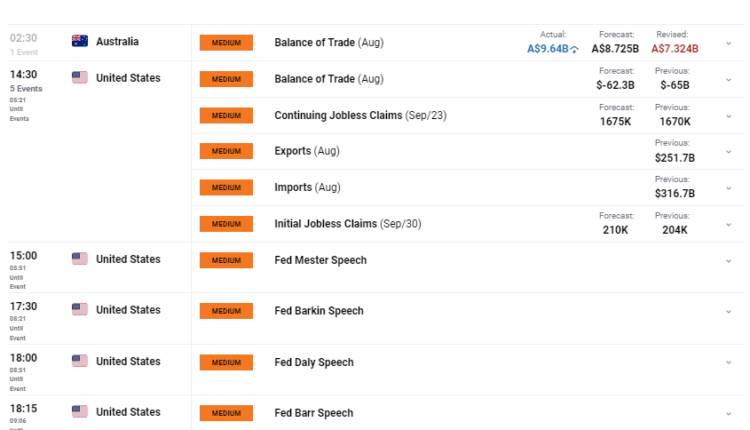

- US jobless claims and Fed speak the focus for today.

- Bullish divergence on daily chart a hopeful sign for AUD bulls.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar is attempting to claw back losses against the US dollar after US ISM services PMI’s softened alongside services employment figures (a positive for doves as NFP’s loom). ADP employment change supplemented this trend by missing forecasts. That being said, ADP figures have not been reliable indicators for NFP numbers of recent and with JOLTs job openings ticking higher, the door is wide open for the NFP to move in either direction.

Australia’s balance of trade earlier this morning surprised to the upside but still below the recent average; overall a net positive for the AUD. The day ahead remains focused on US specific factors including more jobs data via jobless claims that are expected to follow the ADP print. Should this occur, US Treasury yields may fall further and benefit the pro-growth Aussie dollar. Later in the session, Fed speakers will be scheduled to speak and it will be interesting to see how their outlooks may have changed after recent economic data.

In summary, the day ahead may not be as market moving due to traders being cautious ahead of tomorrow’s NFP’s where volatility should pick up once more.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

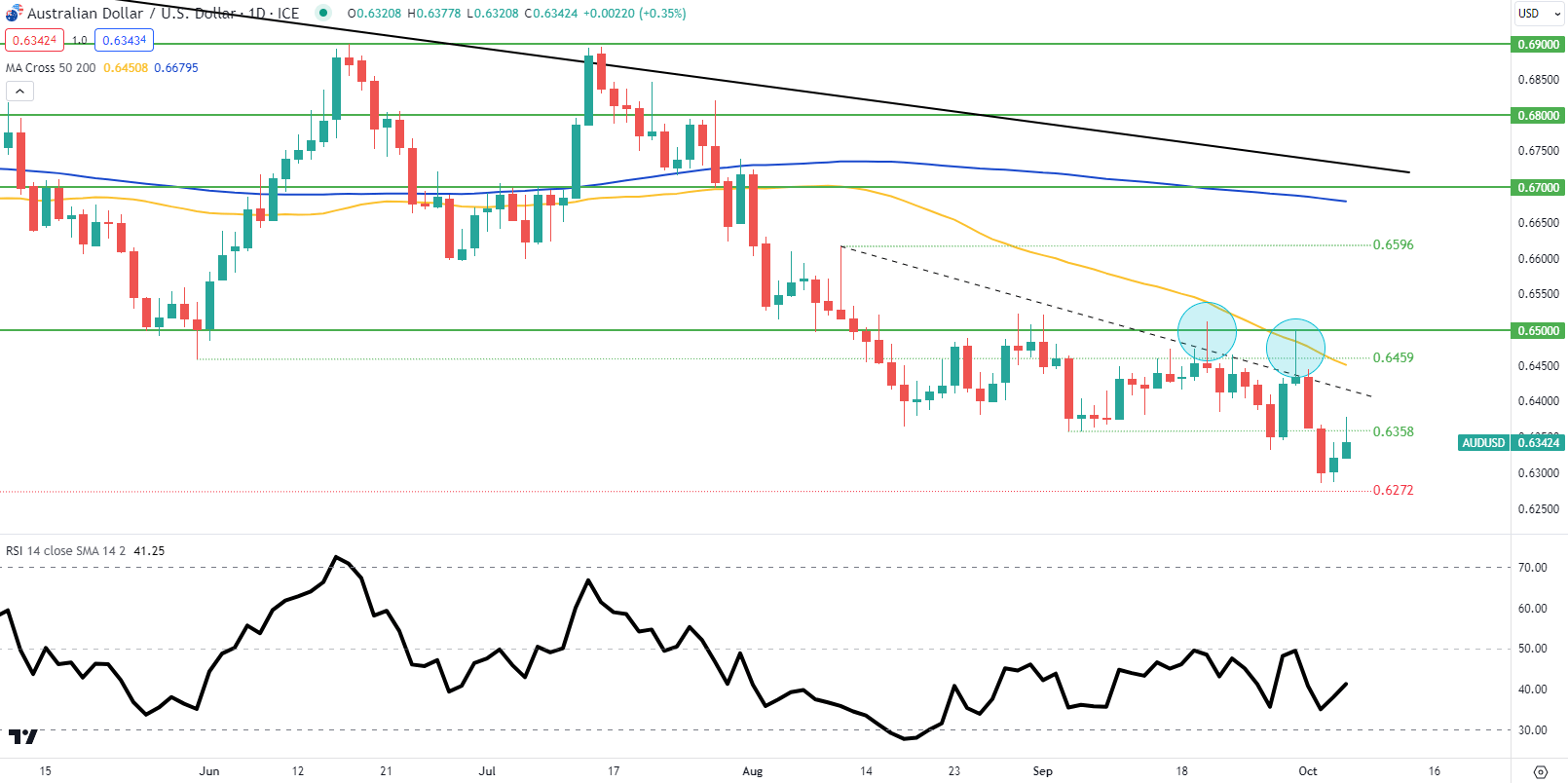

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action has not quite reached November 2022 swing lows at 0.6272 but is showing a push higher. The Relative Strength Index (RSI) seeing higher lows relative to prices exhibit positive/bullish divergence and could be suggestive of further upside to come. The next key resistance zone will once again come from the medium-term trendline (dashed black line) but this bullish move is highly dependent on tomorrow NFP’s.

Key resistance levels:

- 0.6500

- 0.6459

- 50-day moving average (yellow)

- Trendline resistance

- 0.6358

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 80% of traders currently holding long positions. Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.