Signs of Exhaustion, Acceptance Above 134.50 Needed for Bullish Rally to Continue.

USD/JPY PRICES, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free JPY Forecast

Most Read: Japanese Yen Dips as Treasury Yields Climb Ahead of Ueda Testimony. Higher USD/JPY?

USD/JPY FUNDAMENTAL BACKDROP

USD/JPY had a brief push above resistance at the 134.50 level in the Asian session. The rally last week is now showing signs of exhaustion with the dollar index struggling to maintain its recent bullish momentum.

Geopolitical risks have gained steam over the weekend with North Korea firing ballistic missiles toward eastern waters overnight following on from Saturdays ICBM launch. Saturday’s launch landed off Japan’s west coast and prompted joint drills between the US and South Korea as well the US and Japan. The sister of North Koreas leader Kim Jong Un stated that the use of the Pacific as a ‘firing range” would depend on the behavior of US forces and warned against the increasing presence of US military assets in the region. This comes as rumors swirl on a fresh Russian offensive in Ukraine and the ongoing US-China spy balloon issues further complicating the geopolitical outlook moving forward. The United Nations Security Council are expected to meet today at 20:00GMT to discuss the North Korean missile launches.

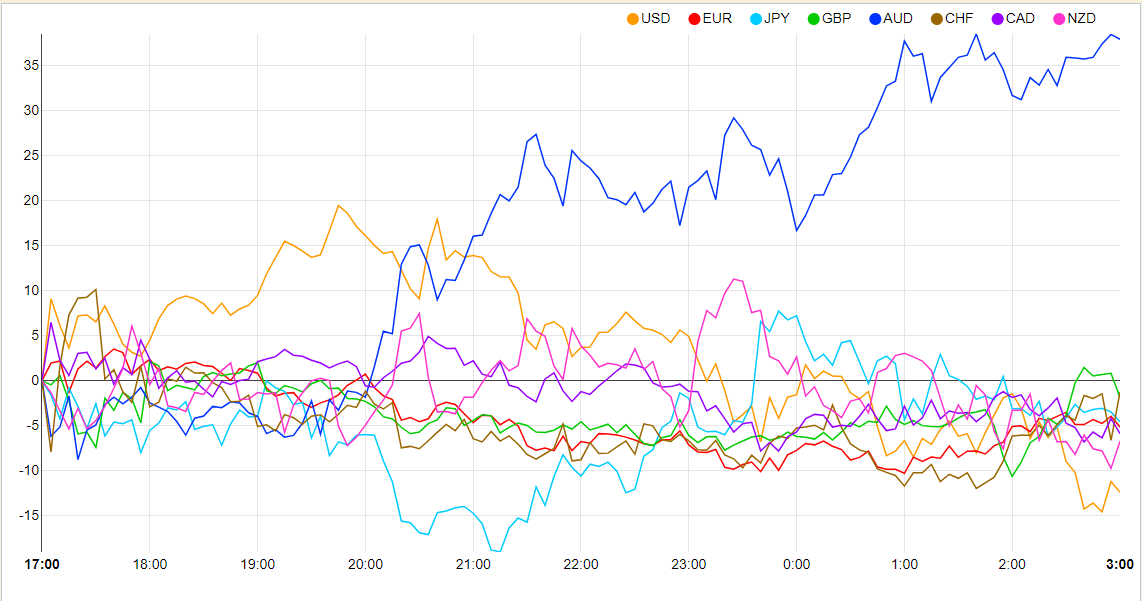

Currency Strength Chart

Source: FinancialJuice

Markets continue to look for guidance from the incoming Bank of Japan (BoJ) leadership, however, hopes of a shift from ultra-easy monetary policy may be too optimistic. As the nominees await parliament approval Finance Minister Suzuki said on Friday that the incoming Governor will need to keep inflation on target and sustain economic and wage growth while sidestepping question on changes in policy. Current deputy Governor Amamiya stated this morning that the BoJ do have the necessary tools to exit easy-monetary policy. The Deputy Governor elaborated by saying that the challenge is whether the conditions to exit such policy have been met and how to communicate that effectively to market participants. The Yen remained relatively unchanged following the comments as they remain rather vague, unclear and data dependent as most central banks continue to emphasize.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The US are celebrating Presidents Day today and thus we have a lack of market moving data during the US session. We could be in for a day of consolidation as thin liquidity and uncertainty weigh on USDJPY prices.

TECHNICAL OUTLOOK

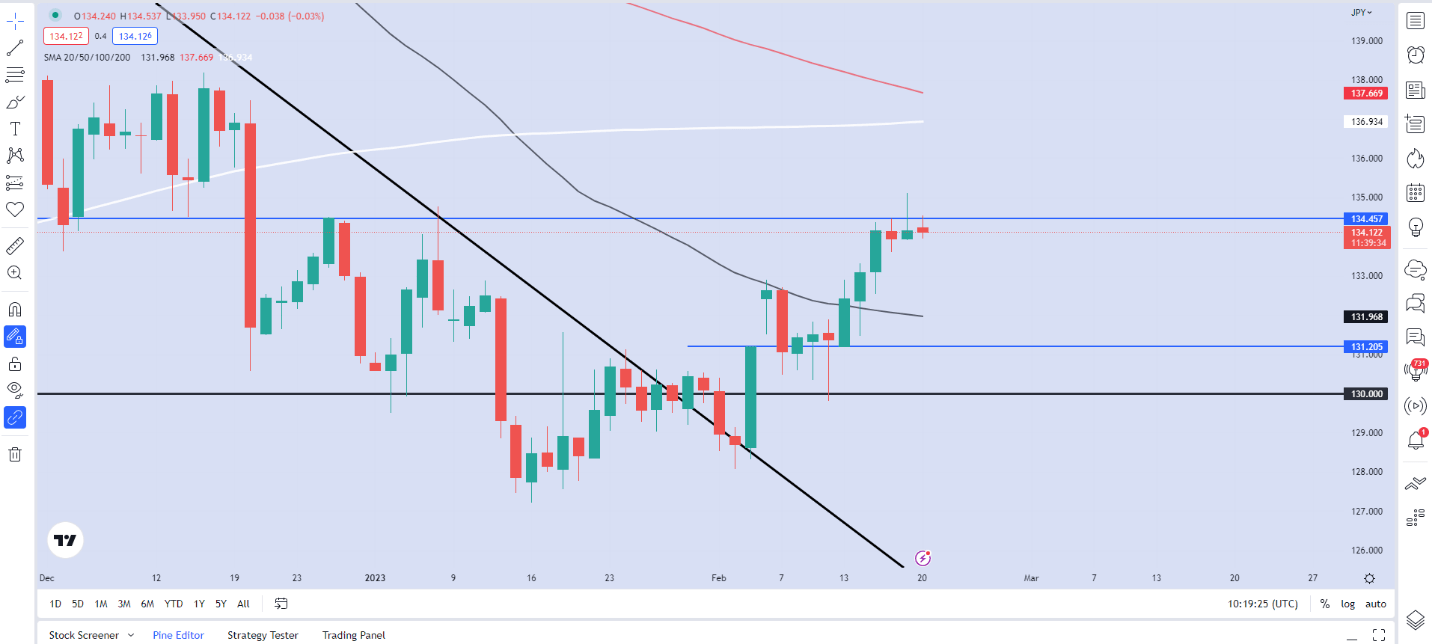

From a technical perspective, USD/JPY had a big rally to the upside of 300-odd pips last week but failed to close above the 134.50 level. The daily chart meanwhile shows 3 consecutive days of price probing the 134.50 resistance level and failing to record a daily candle close above.

With thin liquidity expected in the US session we may be in for a period of consolidation or potential retracement with a retest of the 50-day MA resting around the 132.00 handle growing ever more likely. The bullish bias remains intact for now with a daily candle close below the 131.20 level needed for a change in structure.

Alternatively, a break and daily candle close above the 134.50 level opening up a run toward the 200 and 100-day MAs resting at 137.00 and 137.50 respectively.

USD/JPY Weekly Chart – February 20, 2022

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.