Siemens Positive Q1 Results Sends the Index Higher

DAX (Germany 30) Analysis

- Siemens Q1 earnings report keeps the DAX on the front foot

- Dax testing top end of the rising wedge pattern

- German inflation rises above the December print but rose less than expected

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Equities Forecast

Siemens Reports Strong Earnings – Raises Forecast for FY 23

Siemens announced a positive Q1 earnings report, as revenue climbed 10% YoY and orders came in very strong despite printing below Q1 2021. In fact, the results were so inspiring that the Group has revised its growth expectations for the rest of FY 2023. The stock has risen 7.27% and leads the index higher but there is a general lift across all sectors as risk sentiment appears to have been lifted once again after Jerome Powell’s statements earlier this week which were generally perceived to be slightly ‘dovish’.

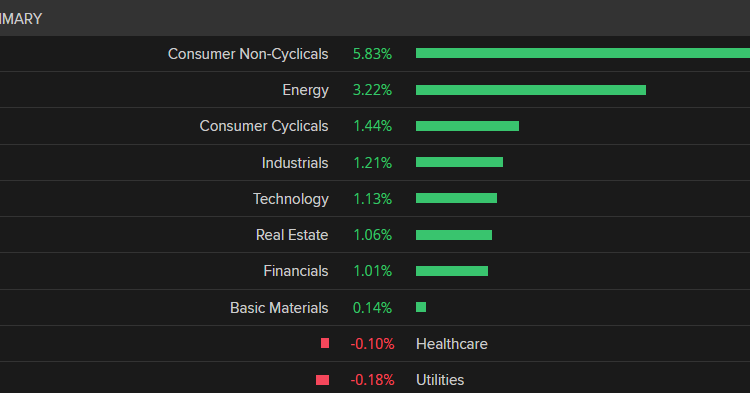

DAX Sector Summary: Dominated by Defensive Stocks but Risk Sentiment Remains Widespread

Source: refinitiv, prepared by Richard Snow

DAX Technical Levels to Watch

Given the impressive run witnessed in European equities, with the DAX no exception, we now focus on the all-time high at the end of 2021. The high of 16,290 back in 2021 witnessed a retest in early 2022 but ultimately created a double top that preceded the 2022 selloff.

The all-time high may require a period of consolidation or even a pullback before an attempt of this level given that the index has re-entered overbought territory. Furthermore, there was a gap higher at the open this morning as Siemens announced positive Q1 earnings and Asian equities saw a considerable uplift. Markets exhibit a tendency to want to fill gaps, adding greater weight behind the possibility of a pullback.

Price action also trades near the upper bound of the rising wedge formation, where, in the absence of an upside breakout, we may see a move towards the 78.6% Fibonacci retracement of the 2022 major decline.

DAX (Germany 30) Daily Chart

Source: TradingView, prepared by Richard Snow

Earlier today, the delayed German inflation data was released, coming in lower than forecast but higher than the December print – complicating hopes of softening inflation. Stickier inflation keeps the ECB motivated to hike interest rates which theoretically poses a challenge to upside moves in the index, something that has not materialized in the mature bull market.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.