Services Sector Expands but ‘New Order’ Concerns Emerge

ISM Services PMI Reading Drops but the Outlook Remains Positive

The services sector is the largest by far and contributes the most to total US GDP. As such, it provides a crucial signal of the overall health of the US economy. The PMI report aggregates opinions of the companies’ purchasing managers who often see shifts in trends before they filter into the broader economy.

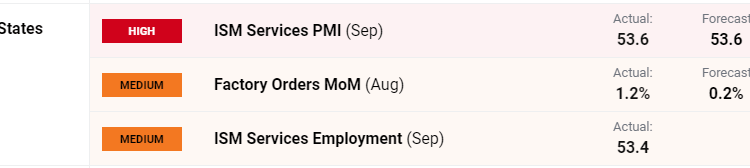

The composite measure declined from 54.5 to an expected 53.6 in what is still being regarded as a positive outcome. Figures over 50 indicate sector expansion while anything below 50 indicates a contraction.

Customize and filter live economic data via our DailyFX economic calendar

One notable subcategory is the ‘new orders’ data which revealed a sharp drop in September from 57.5 to 51.8. However, the drop remains above 50 and is still viewed in a positive light but needs to be monitored in next month’s print. Business activity/production on the other hand was seen increasing, while prices remained flat month on month and employment dropped. This week is crucial for labour market statistics with the JOLTS report revealing that a significant number of jobs remain available and ADP employment disappointed for September. Keep an eye out for tomorrow's initial jobless claims and Friday’s NFP report.

Find out how to prepare and trade around news releases in the dedicated guide below:

Recommended by Richard Snow

Trading Forex News: The Strategy

Market Response:

The US dollar (DXY) dipped after the ADP miss but recovered intra-day after the overall positive services report. A strong services sector suggests the economy is robust – necessitating tighter financial conditions for longer. US yields also noted a slight move to the upside after the release.

US Dollar Basket (DXY) 5-minute chart

Source: TradingView, prepared by Richard Snow

The 10-Year US Treasury note witnessed a marginal move higher in a trading session that broadly saw yields ease on the day.

US 10-Year Treasury Yield

Source: TradingView, prepared by Richard Snow

We have released Q4 forecasts for major traded assets. Find out where the US dollar is headed by claiming the guide below:

Recommended by Richard Snow

Get Your Free USD Forecast

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.