Sellers in Control Following Failed $2000 Retest, FOMC Next

GOLD (XAU/USD) PRICE FORECAST:

MOST READ: US Inflation in Line with Estimates but MoM CPI Rises, DXY Ticks Higher

Gold prices attempted a recovery today and reached a high of around $1997/oz before sellers took control in the aftermath of the US CPI release. The CPI print appeared positive at first glance but the uptick in the monthly inflation figures mean the Fed are unlikely to commit to any rate cuts at tomorrow’s meeting. This saw the DXY rise temporarily and push Gold prices back to a key support area.

Supercharge your trading prowess with an in-depth look at how to trade Gold.

Recommended by Zain Vawda

How to Trade Gold

FOMC MEETING AND SAFE HAVEN APPEAL

As geopolitical tensions remain on a knife edge Gold is likely to remain supported and attract buyers on significant dips. The appeal of the precious metal remains high and with the inevitability of rate cuts at some point in 2024 Gold will likely remain above the $1800/oz mark for the foreseeable future.

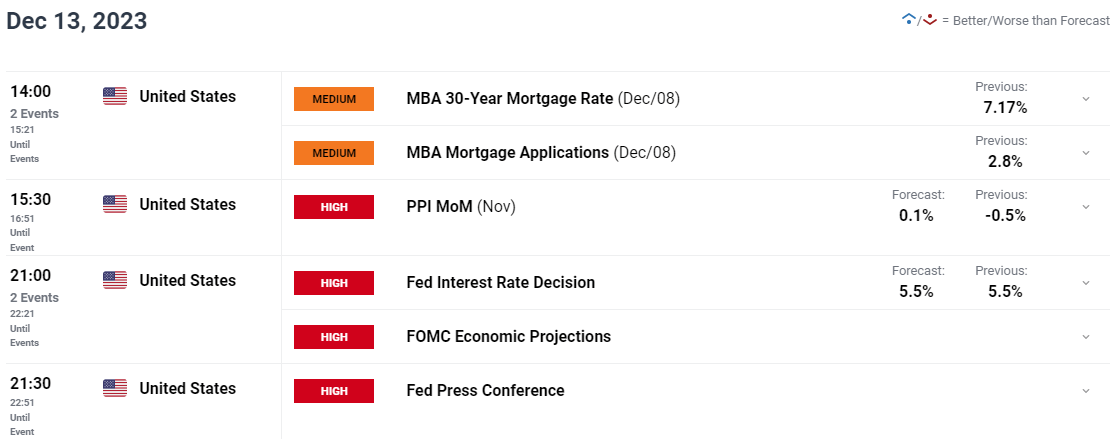

Heading into the FOMC meeting tomorrow and all eyes will be fixed on the Economic Projections and how they might differ from the current market expectations. Comments by Fed Chair Powell will also hold a significant amount of sway tomorrow and I do expect some form of push back by the Fed Chair regardless of what the Economic Projections reveal.

The immediate direction for Gold prices will rest on the reaction of the US Dollar and US Yields to the meeting tomorrow. Any significant deviations between market participants and the Fed could be the catalyst needed for Golds next move. Push back from the Fed and significant repricing regarding cuts in 2024 could give the US Dollar legs and push Gold closer the $1950/oz support area. If the Fed do adopt a more dovish approach and hint at rate cuts in 2024 in line with current market expectations, then we could see Gold bulls rejuvenated and push back above the $2000/oz. All in all, the US Dollar still holds the key as markets wait with bated breath.

For all market-moving economic releases and events, see the DailyFX Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL OUTLOOK

GOLD

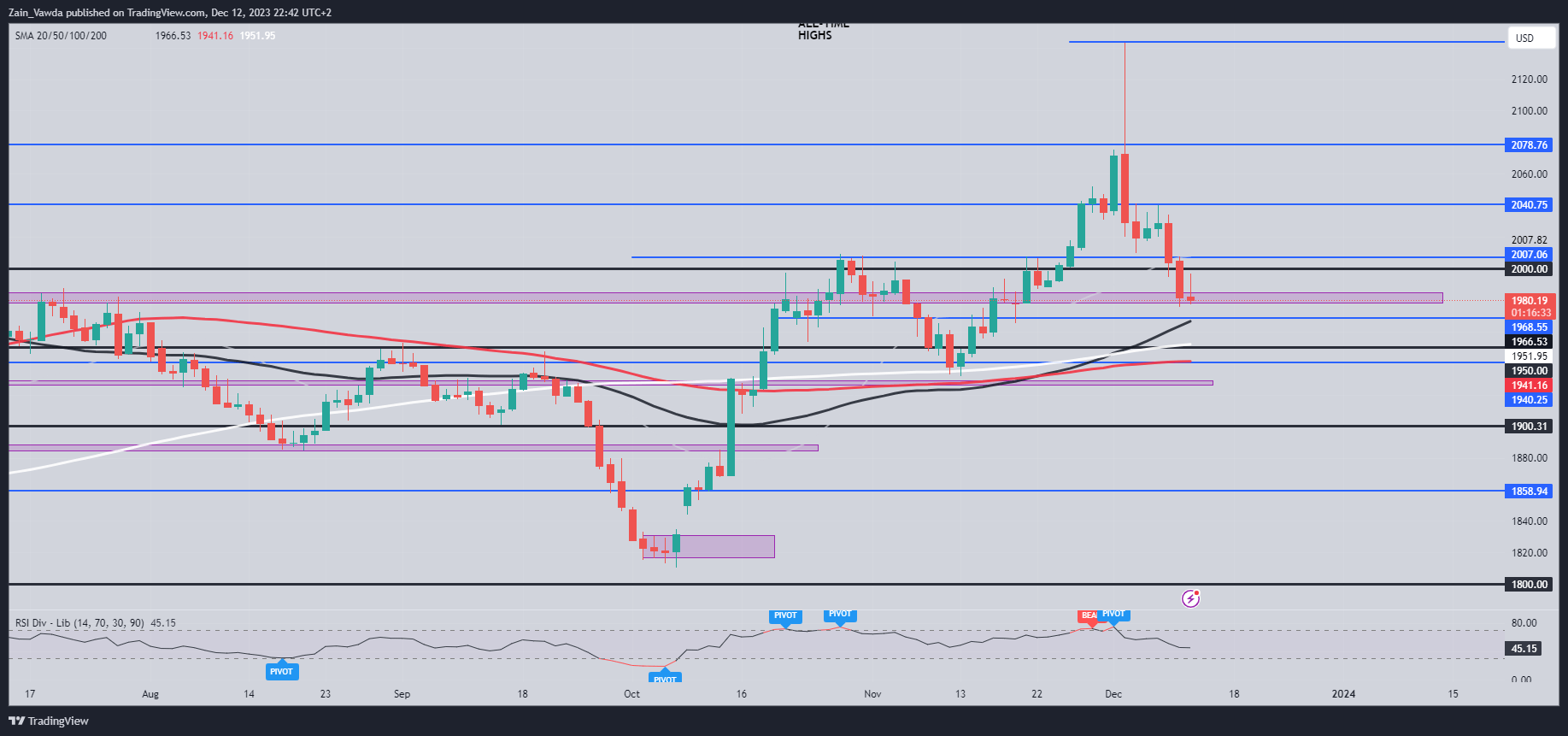

Form a technical perspective, Gold is resting in a key support area of its own heading into tomorrow's FOMC meeting. The range between $1977-$1984 remains a key area as it has consistently shifted between support and resistance of late. The daily candle today does not inspire confidence but the failure to print a fresh low may be indicative of the buying pressure still evident in the precious metal.

A break lower from here faces a raft of support before the psychological $1950 area is reached with 50-day MA resting around the $1968 support area while the 200-day MA rests just above the $1950 handle. Below this the $1940 and $1930 handle both provide some support and could come into play should we see an aggressive selloff tomorrow.

A ush higher here needs to gain acceptance back above the $2000 an ounce mark if the precious metal is looking to kick on and head back toward the recently created all-time high.

Key Levels to Keep an Eye On:

Resistance levels:

Support levels:

Gold (XAU/USD) Daily Chart – December 12, 2023

Source: TradingView, Chart Prepared by Zain Vawda

SILVER

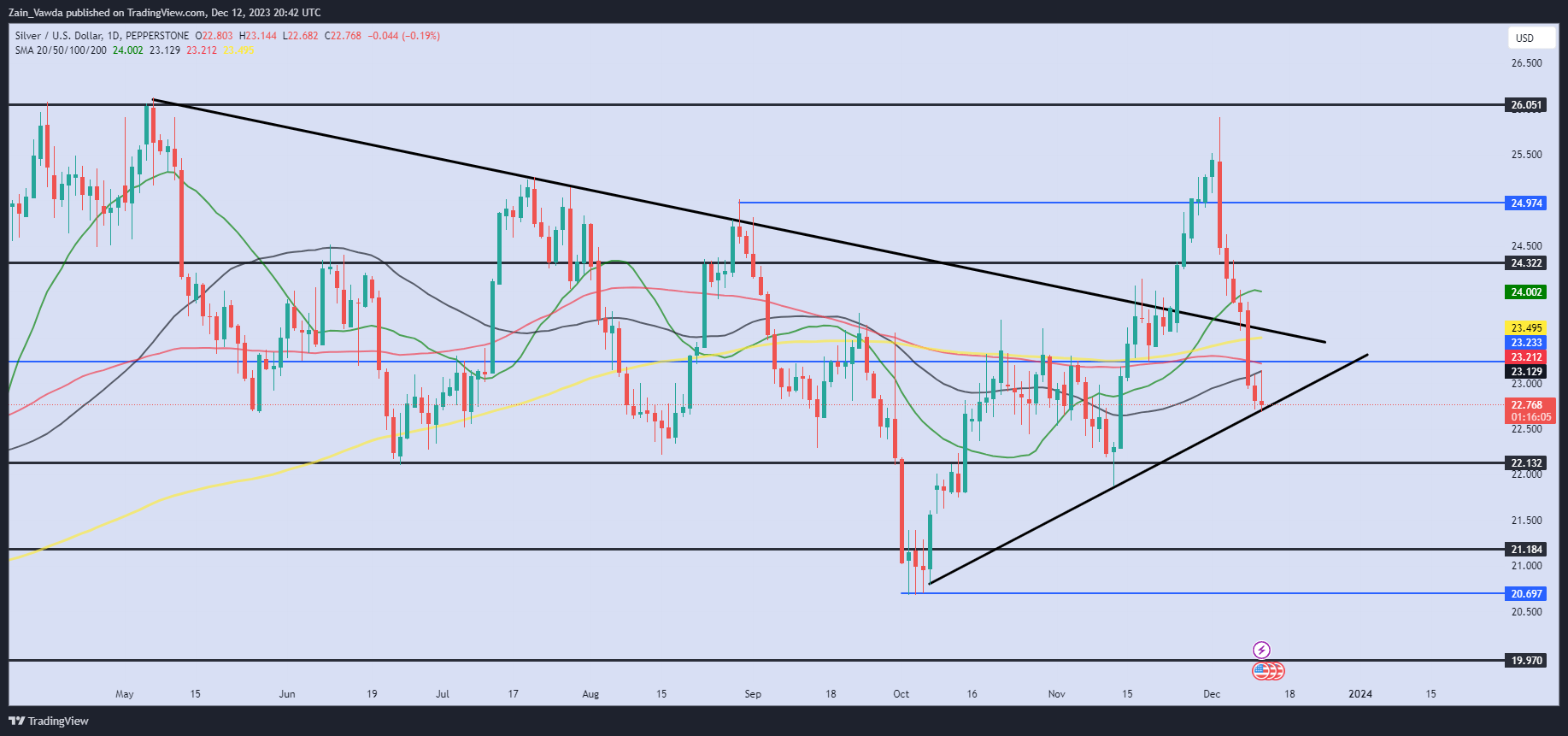

The technical outlook for silver is intriguing as price rests at a key inflection point heading into the FOMC meeting. Silver has fallen aggressively from recent highs with 8 consecutive dys of losses leading it back to the ascending trendline. This will be the third touch which would usually lead to a potential bullish pattern and fresh highs above the 26.00.

A daily candle close below the 22.00 will see structure broken and invalidate a bullish continuation and could see recent lows at the 20.500 mark come into play over the coming weeks. This just highlights the importance of the FOMC meeting tomorrow.

Silver (XAG/USD) Daily Chart – December 12, 2023

Source: TradingView, Chart Prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment, Retail Traders are Overwhelmingly Long on Silver with 89% of retail traders holding Long positions. Given the Contrarian View to Crowd Sentiment Adopted Here at DailyFX, is this a sign that Silver may break through the trendline and change structure?

For a more in-depth look at Silver client sentiment and tips and tricks to use it, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -28% | -2% |

| Weekly | 21% | -70% | -8% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.