Scenario-Based Trade Setups Ahead of FOMC

USD/JPY Analysis

Recommended by Richard Snow

How to Trade USD/JPY

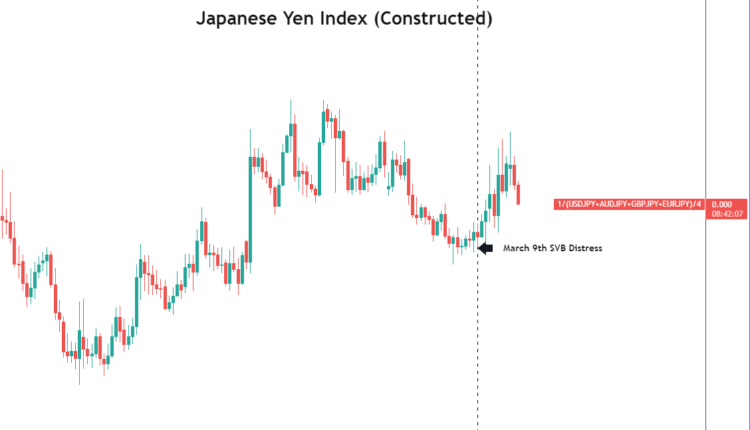

Japanese Yen Benefited from Safe Haven Appeal During Panic

From the 9th of March this year when SVB became the center of a potential systemic banking crisis, the Japanese yen received a boost as investors sought out safe haven assets. The chart below provides a rough indication of the overall performance of the yen compared to major currencies and trading partners in the case of the Aussie dollar. The vertical dotted line indicates the day the majority of the market began to panic which resulted in a clear move higher for the yen.

A sharp pullback appears after supportive measures were announced by the Fed and the US government revealed that discussions around the possibility of insuring all deposits have begun.

Equal Weighted Index of Relevant JPY Pairings

Source: TradingView, prepared by Richard Snow

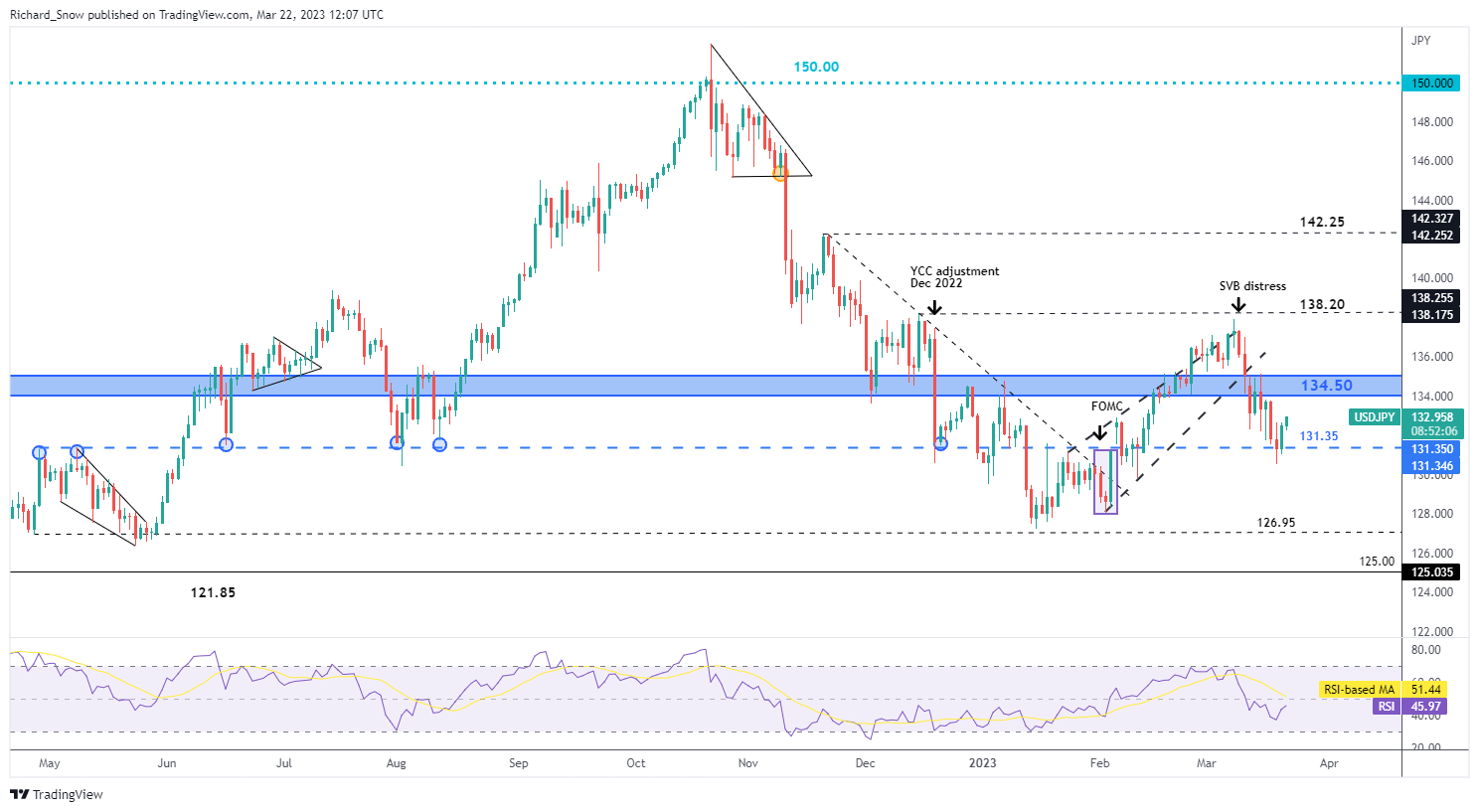

USD/JPY Scenario-Based Setups

The following logic provides two very different scenarios and, in reality, we may be faced with a trading landscape somewhere in between or an environment that takes longer to reveal itself. Nevertheless, USD/JPY remains one to watch.

Scenario 1: Banking Crisis

The recent instability proved just how quickly things can change in financial markets when interest rates are ramped up at break-neck speed. When panic set in, markets immediately repriced Fed funds futures lower – reflecting the belief that the Fed will be forced into a complete reversal, having to cut interest rates instead of hiking above 5%. US treasury yields plunged across the board, sending the dollar lower as a result.

Such an outcome could resurface in the event a banking crisis proves not to have been averted – which will be of interest to USD/JPY bears. Lower USD valuations combined with the safe haven appeal of the yen suggests, in such a scenario, the pair could trade lower.

Scenario 2: Banking Crisis Averted, Focus Shifts Back to Taming Inflation

In the event that the major concerns of the market (depositor protection, systemic banking crisis) are placated, the potential for upward revisions in the Fed funds rate and, by extension the dollar, such an environment could see USD/JPY trend higher once more.

Should markets perceive the prospect of additional rate hikes in a favourable light, this would suggest that recent support measures for banks are acceptable to the market – providing more breathing room to hike and bring down inflation.

A crucial level of support has held (131.35), as a more positive outlook takes shapes after the recent panic. A major zone of support with the mid-point of 134-50 appears next, with 138.20 in the distance. Should we see an increase in safe-haven yen appeal, 131.35 and 127 come back into focus.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

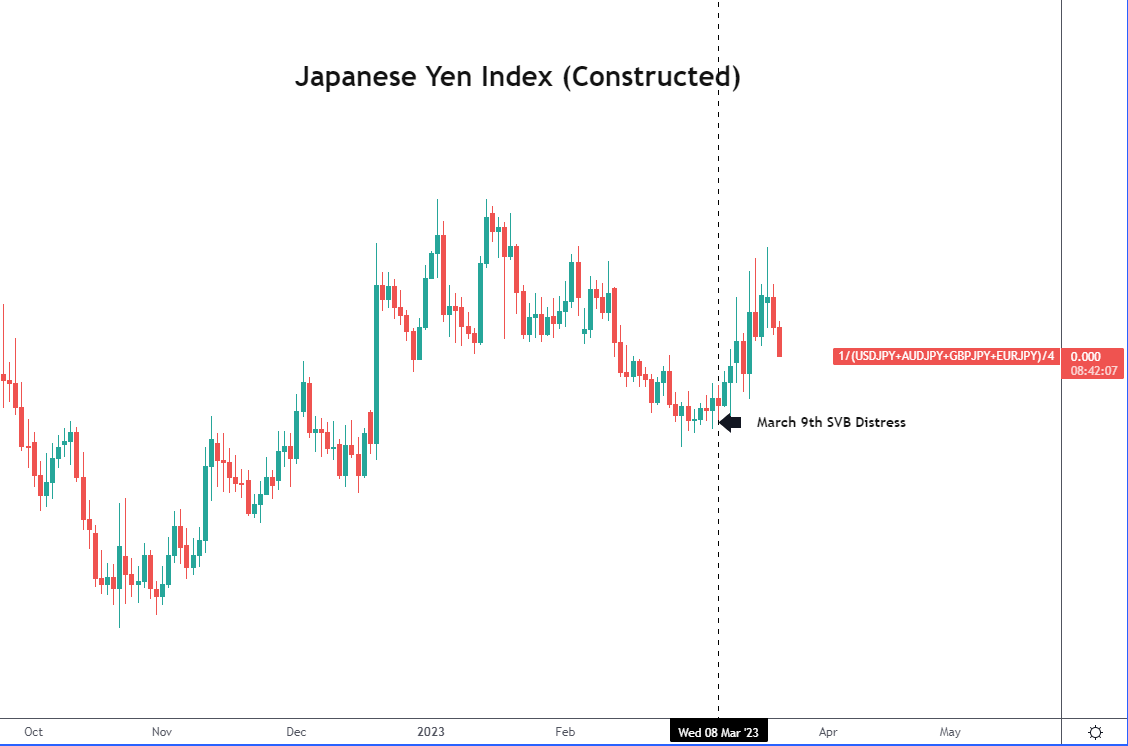

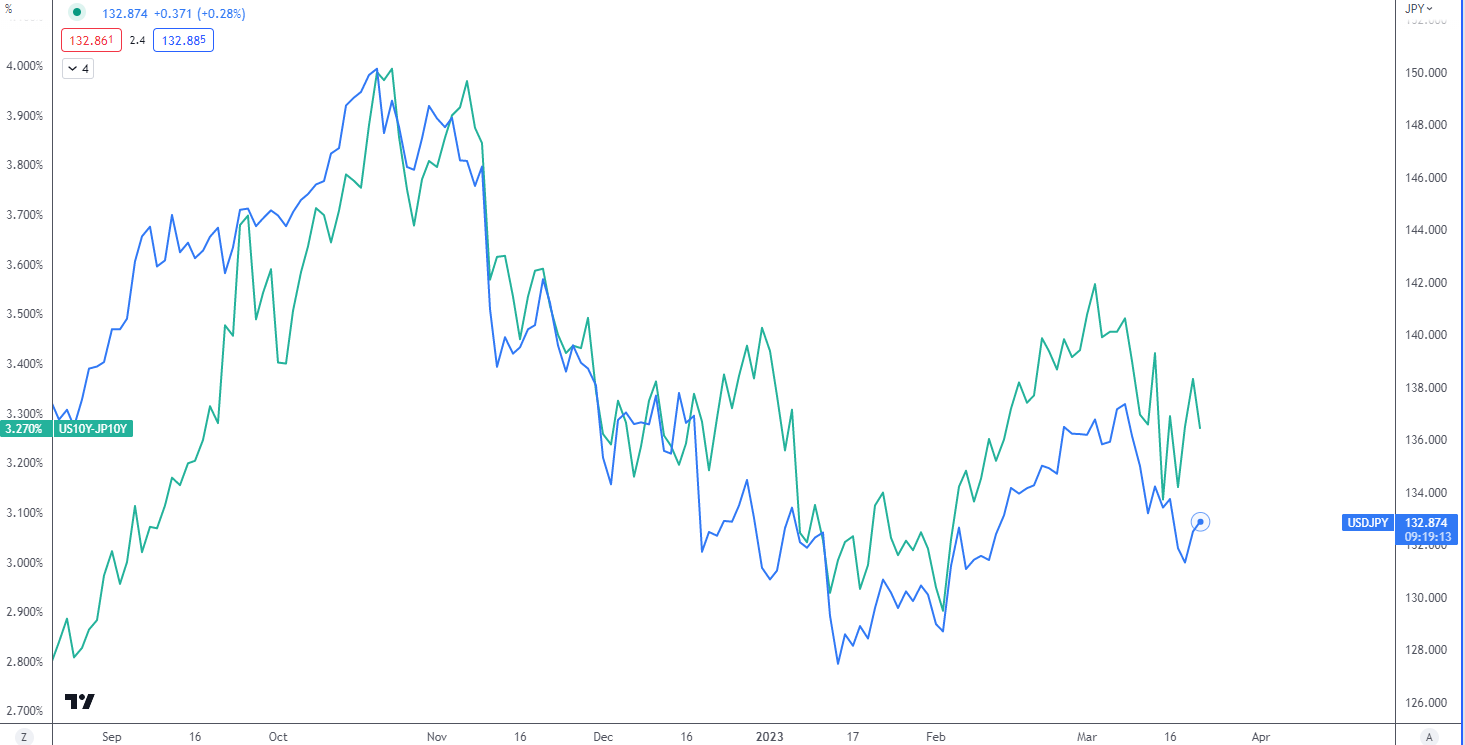

USD/JPY Outlook Depends on How Markets Perceive the Path of Future Interest Rates

Keep an eye out for the FOMC dot plot and summary of economic projections later today as it will reveal the thinking of the Fed with regard to future interest rates. USD/JPY trades very closely to the interest rate differential between the two nations – which is largely dependent on fluctuations in the US given Japanese yield curve control.

USD/JPY (Blue) vs US 10 year treasury yield – Japan 10 Year yield (green)

Source: TradingView, prepared by Richard Snow

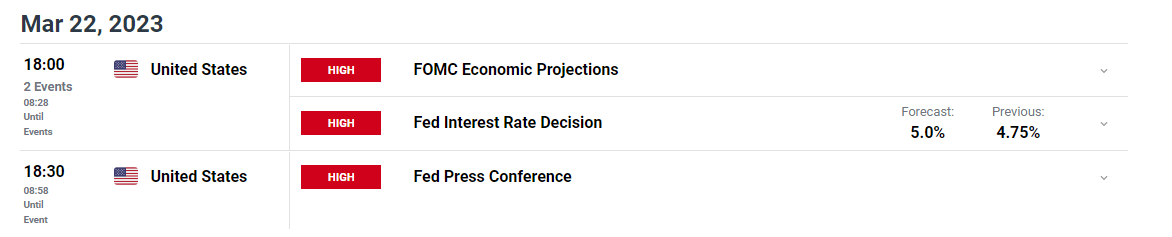

Major Event Risk: FOMC Decision (Projections), Japan CPI

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.