Saudi’s Insist on Production Cuts at Extended OPEC Meeting

Crude Oil (Brent, WTI) News and Analysis

- Saudis advocate further oil production cuts but fail to win overwhelming support

- Oil technical levels to note after a gap higher at the open

- IG client sentiment hints at a bearish continuation despite gap to the upside

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade Oil

Saudis Argue for More OPEC Cuts but Will Have to go at it Alone for now

Yesterday’s OPEC meeting was anything but business as usual. Typically, OPEC nations have a good idea of what is to be agreed ahead of OPEC meetings, rendering the gatherings somewhat of a formality. This time however, the meeting extended beyond its typical duration as Saudi delegates insisted that more cuts are needed to revive oil prices from lower levels – a view that failed to gain widespread support.

In the end, it would appear that a compromise was reached, with the Saudi’s cutting production by 1 million barrels per day (bdp) from July. The cuts add to an existing combined 3.66 million bpd worth of cuts put in place to “stabilize” the oil markets. Throughout 2022, US President Joe Biden was adamant to bring down oil prices which was having an adverse effect in the general price of goods. After releasing a portion of the US Strategic Petroleum Reserves (SPR) into the broader market, oil prices have turned significantly lower. At the peak, WTI oil was changing hands at $130 per barrel.

Crude Oil Technical Levels to Consider

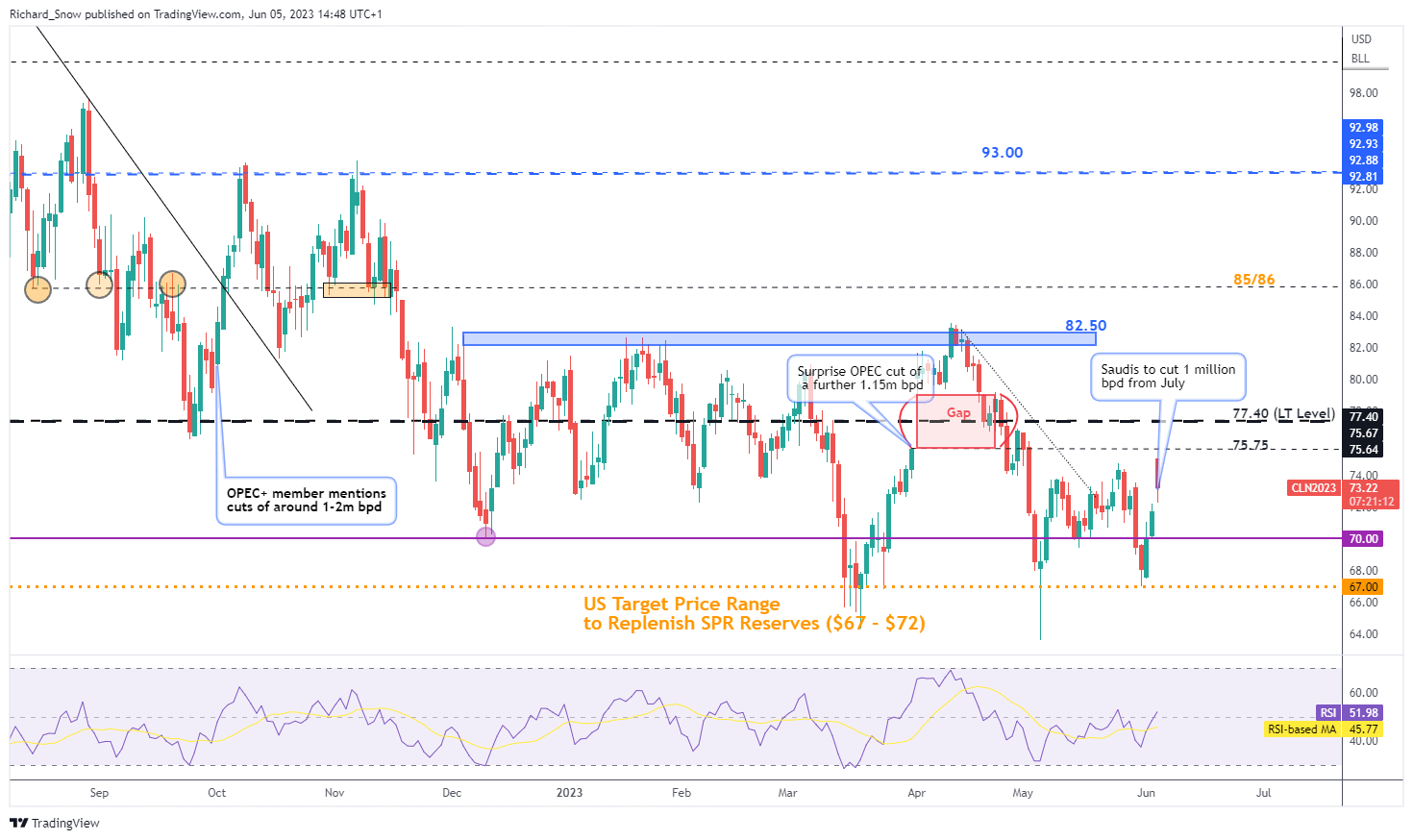

WTI Crude Oil

The market gapped higher at the open, boosted by the news of Saudi Arabia’s 1 million bpd production cuts. However, the market has pulled back a decent portion of the move as global demand concerns continue to weigh on the commodity. The sharp change in direction highlights the psychological level of $70 flat if the bearish momentum is to gain pace. $67 is the next relevant level of support although a lot of its effectiveness as pseudo support may have been removed after the Biden administration admitted that it will take years to replenish the SPR reserves. Previously the energy department signaled it would restore lost reserves when oil prices remain between $67 and $72 for an extended period. Levels of resistance appear at $75.75 – the close before the prior gap up in early May – as well as the longer-term level around $77.40.

WTI Futures Daily Chart (CL1!)

Source: TradingView, prepared by Richard Snow

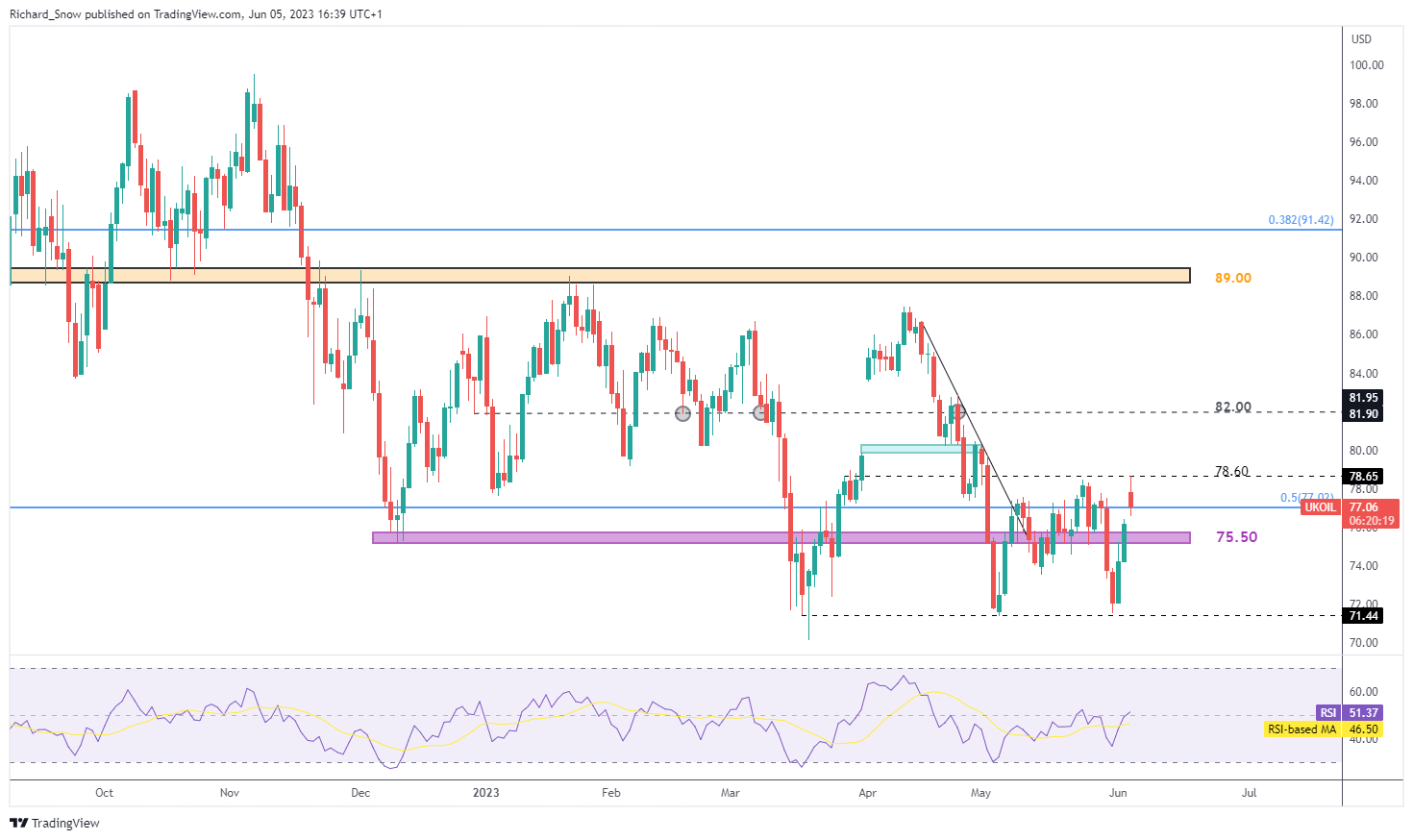

Brent Crude Oil

Brent crude oil gapped above the $77 level and headed towards $78.60 before pulling back on the day. In the two days prior, oil actually advanced off the recent swing low around $71.50, even closing above the zone of support at $75.50 but that momentum appears to be fading.

To the upside, if oil prices manage to rally from here, $82 appears at resistance with $89 a fair distance away. On the short side, If $75.50 fails to hold the swing lows around $71.50 re-emerge as support.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

IG Client Sentient Hints at a Continued Oil Sell-off

Oil– US Crude:Retail trader data shows 79.89% of traders are net-long with the ratio of traders long to short at 3.97 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggestsOil– US Crude prices may continue to fall.

The number of traders net-long is 11.72% higher than yesterday and 8.52% higher from last week, while the number of traders net-short is 1.31% higher than yesterday and 2.15% higher from last week.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil – US Crude-bearish contrarian trading bias.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.