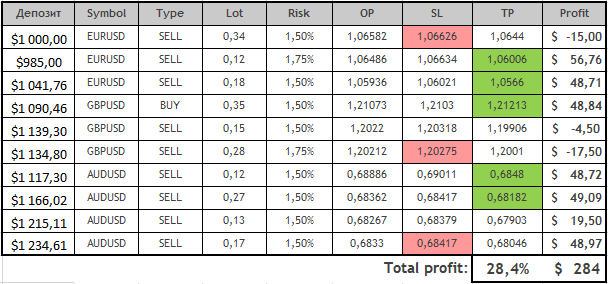

REVIEW OF TRADES OF THE OWL SMART LEVELS STRATEGY FOR THE WEEK FROM 20 TO 24 FEBRUARY, 2023 – My Trading – 27 February 2023

Today I present you an overview of deals made using the Owl strategy – smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from 20 to 24 February, 2023.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

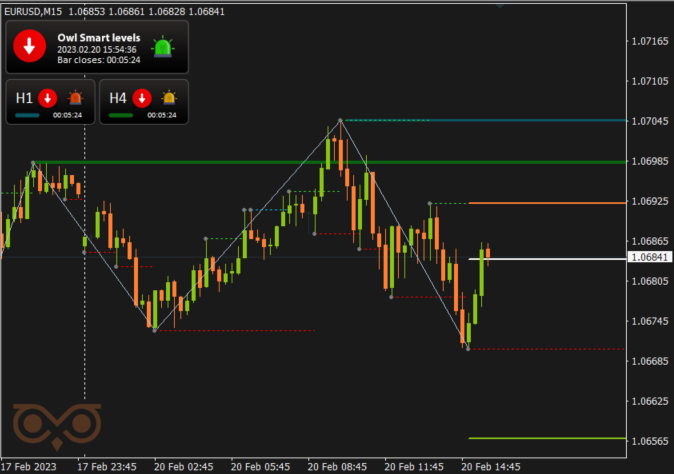

EURUSD review

The week for EURUSD started in a dead zone, the first signal appeared only at 13:30 GMT. It was cancelled since there is a rule in the trading strategy:

If the price is behind the order opening level at the moment the signal appears, or was already there, the signal should be ignored.

Figure 1. The canceled signal appeared at the close of a large green candle, above the white line.

If the price moves so sharply in the opposite direction there is a high probability of a reversal of the instrument in the opposite direction. We need to enter on corrective market movements but they usually tend to stretch over time.

On Tuesday several signals were also ignored. In the morning the market just did not reach the opening price and then another signal was canceled by a sharp price movement above the open price level.

Also on Tuesday one more condition for order cancellation allowed avoiding a loss trade:

If a new level Down of the Full Fractals Indicator appeared above the opening price level of a trade, in case of a BUY signal, the BUY LIMIT order should be deleted. The same applies to the SELL LIMIT order: if there is a new Up level of the Full Fractals Indicator below the opening price, the order should be deleted.

Figure 2. Signal cancellation when a new Up fractal appears.

The first trade was opened only on Wednesday night but it has closed with a minus, the price has slightly hit a stop and then has gone in the right direction. And the next deal has already brought long-awaited profit.

Figure 3. EURUSD SELL 0.12, OpenPrice=1.06486, StopLoss=1.06634, TakeProfit=1.06006, Profit=+56,76$

On Friday night, the Euro entered the dead zone. The price went out of the red zone only after 8:00 GMT and immediately gave an opportunity to enter the market in the direction of SELL.

Figure 4. EURUSD SELL 0.18, OpenPrice=1.05936, StopLoss=1.06021, TakeProfit=1.05660, Profit=+48,71$

In that way the strategy Owl Smart Levels worked very well during such a hard week filtered out many trades which could bring a loss.

PS: I personally determined one more filter for myself but I did not publish it in the strategy rules – do not enter the market if the stop is larger than 50 pips. Thus, the first negative trade on EURUSD would not have been opened (StopLoss of the first trade is 44 pips).

GBPUSD review

The Owl Smart Levels strategy on the EURUSD pair gave an opportunity to gain good profits this week, let's look at what happened on GBPUSD.

The British pound spent the whole of Monday and part of Tuesday in the dead zone. It got out of the dead zone only at 9:00 GMT, and then with a sharp upward price movement on the news about the business activity the market reversed all the indicators up in an hour. (Usually after such moves I take a pause in trading for 24 hours for this pair but there are no such rules in the strategy, so let's see what will happen).

Figure 5. Sharp reversal of GBPUSD into an upward trend.

The first buy trade was opened around midnight on Tuesday and very quickly closed its profit (Stop size was 43 pips, I usually skip such trades but EURUSD deal was registered in the table, so let's register this one too).

Figure 6. GBPUSD BUY 0.35, OpenPrice=1.21073, StopLoss=1.21030, TakeProfit=1.21213, Profit=+48.84$

Then GBPUSD entered the dead zone once more, and on Thursday again all the indicators defined a downward trend. The upward movement in the GBPUSD has not been developed which means that we will again wait for new signals to sell the GBPUSD for dollars. The next trade was closed manually following the rule:

If the Valable ZigZag Indicator showed the opposite direction the trade should be closed at the market price.

The next trade was closed with a minus again on a chaotic price movement up and down, and there were no more deals on GBPUSD this week.

Figure 7. GBPUSD SELL 0.28, OpenPrice=1.20212, StopLoss=1.20275, TakeProfit=1.20010, Profit=-17.50$

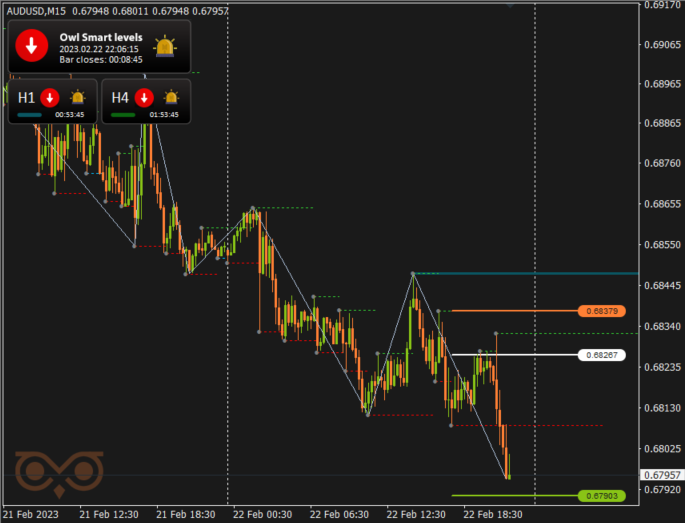

AUDUSD review

Like the British Pound, the Australian Dollar spent the beginning of the week in the red zone. The first trade was opened at 9:30 GMT. The profit on the trade was fixed only in the evening moving closer and further away from the TakeProfit level several times. Respectively, according to the rules of the strategy we missed all of the signals on Tuesday as we already had one trade on AUDUSD in the market.

Figure 8. AUDUSD SELL 0.12, OpenPrice=0.68886, StopLoss=0.69011, TakeProfit=0.68480, Profit=+48.72$

I will give you one more example of an order that should be deleted. A new level Up of the Full Fractals Indicator has been formed, so the pending SELL LIMIT order placed on the white line should be removed without waiting for the opening. As it would be expected, if the order had not been removed, we would have received a loss on this trade.

Figure 9. An example of signal cancellation for AUDUSD.

In the evening of February 22 we entered the market again at 17:45 GMT. The trade was closed profitably when the Valable ZigZag Indicator turned failing to reach TakeProfit level just 45 pips.

Figure 10. AUDUSD SELL 0.13, OpenPrice=0.68267, StopLoss=0.68379, TakeProfit=0.67903, Profit=+19.50$

On February 23 again there was a signal to sell the Australian dollar for the American dollar. The market went from the opening price level to the TakleProfit level for almost 12 hours, but still, around 16:00 GMT, the profit was fixed.

Figure 11. AUDUSD SELL 0.17, OpenPrice=0.6833, StopLoss=0.68417, TakeProfit=0.68046, Profit=+48.97$

On February 24, there were new sell signals but the market wasn't corrected, so the pending orders were deleted and there were no more trades on AUDUSD this week.

Thus, the Owl Smart Levels strategy got a perfect result on AUDUSD for the 9th week of 2023 with 4 out of 4 positive trades.

The total result of the week is +28.3% profit.

Total at the end of the 9th week of 2023 +28.3% profit at 1.5% risk per trade. I think this is a very decent result.

Download the Owl Smart Levels Indicator and check this result yourself applying all the trading rules according to the Instruction for the Owl Smart Levels Indicator.

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.

Comments are closed.