Reprieve for the Euro as USD, Yields ease

EUR/USD News and Analysis

Recommended by Richard Snow

How to Trade EUR/USD

Persistent US Inflation and Worsening Euro Economic Prospects Weigh on EUR/USD

Ever since the bearish break below 1.0910, EUR/USD price action has been relentless. Aided by shifting US rate expectations, the dollar has strengthened against major currencies with the euro no exception. Traders initially expected around 75 basis points of Fed cuts before year end at the time when the banking industry suffered from a wave of uncertainty as three regional US banks imploded. The effects were felt in Europe where the already beleaguered Credit Swiss had to be absorbed onto local rival UBS.

Since then, the banking sector appears to have stabilized, despite banking indices yet to fully recover. More recently, persistent inflation in the US has forced traders to rethink the path of future interest rates as the Fed contemplates another 25-bps hike or a ‘skip’ – essentially allowing the Fed more flexibility.

EUR/USD Technical Levels of Consideration

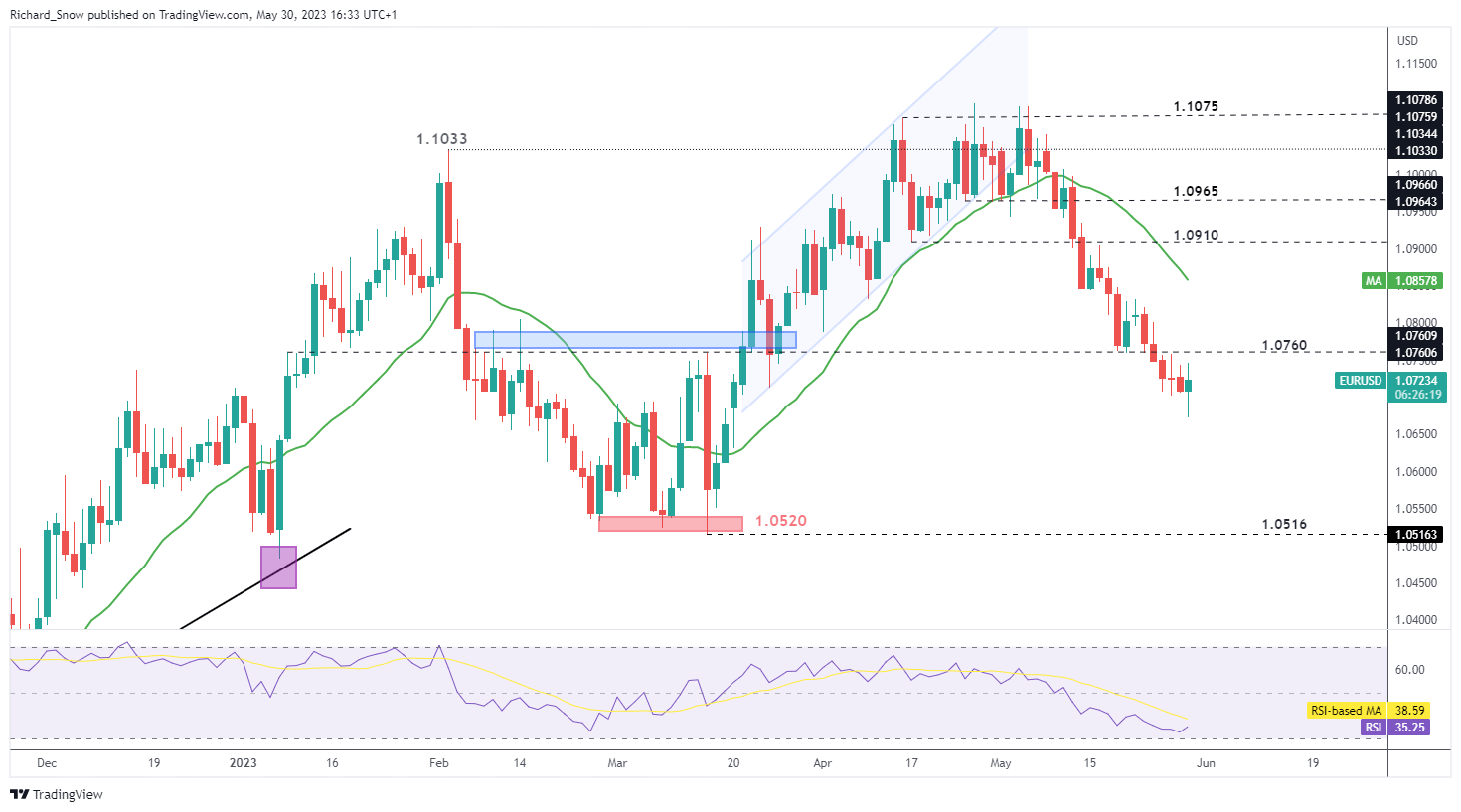

Throughout the sell-off, pullbacks have been very shallow – a signal of strong directional momentum. Price action has moved through prior levels of support with ease, trading below 1.0760 more recently. Today’s move higher attempts to test the same level, now as resistance. EUR/USD bears will be watching this level with great interest, looking for a rejection of higher prices and possible bearish continuation. Support comes in all the way at 1.0516 – the level observed in March.

Daily EUR/USD Chart

Source: TradingView, prepared by Richard Snow

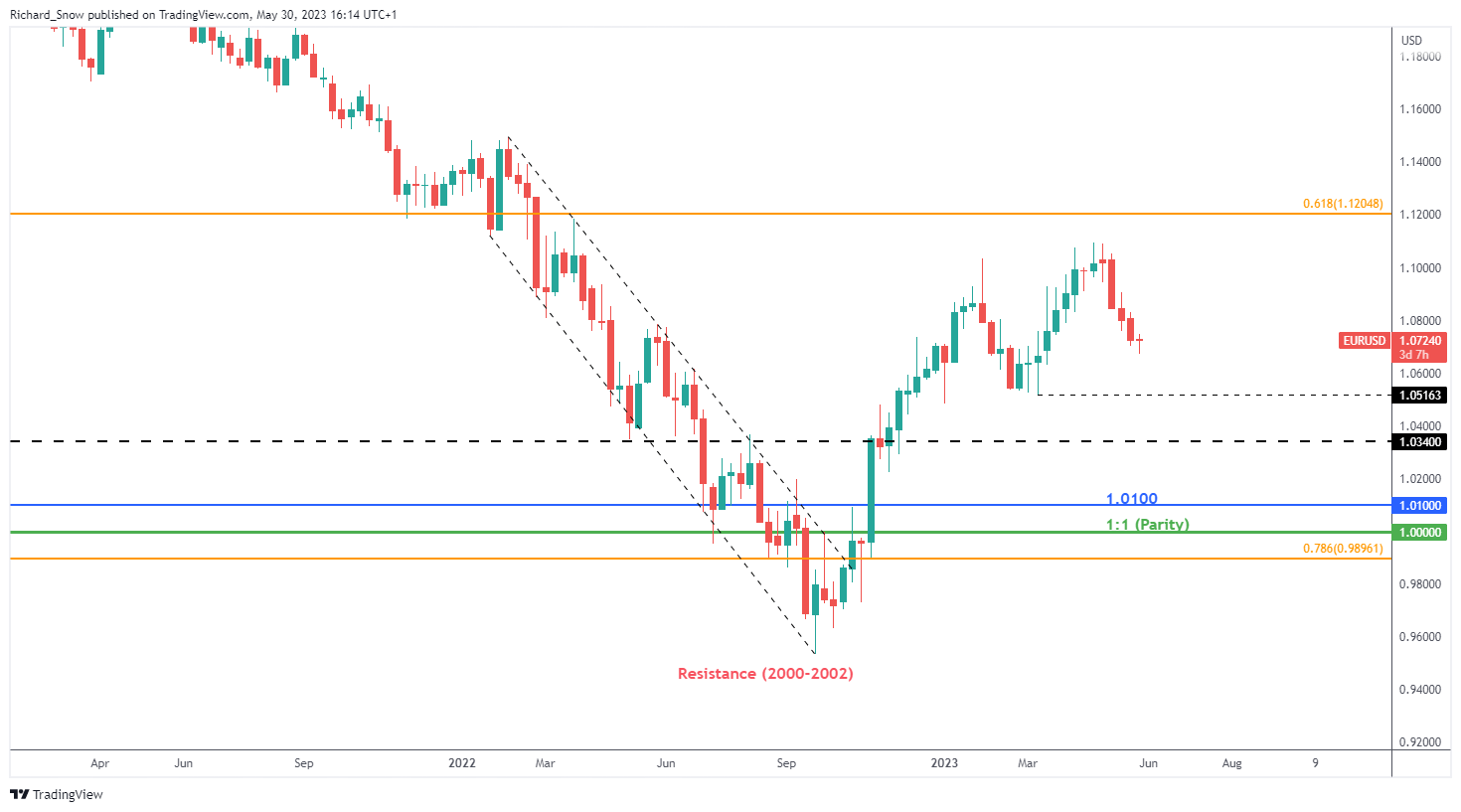

The weekly chart reveals the shorter-term trend in the context of the much broader bullish trend that is yet to be invalidated. The next level of consideration appears at the March low, where the viability of the longer-term trend ought to be reassessed.

Weekly EUR/USD Chart

Source: TradingView, prepared by Richard Snow

Major Risk Events Ahead

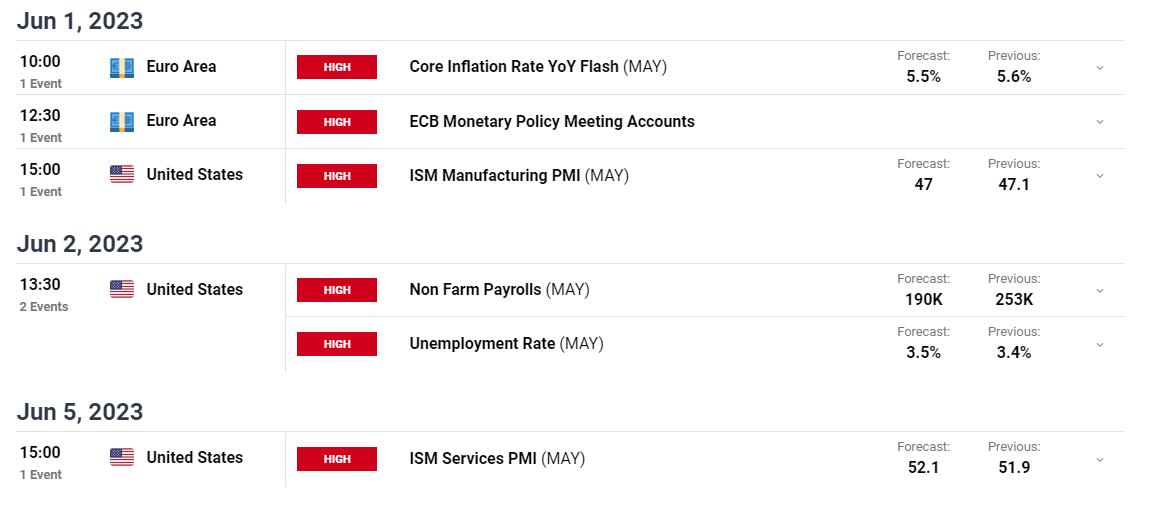

In the absence of the biggest market theme at the moment (US debt ceiling), EU and US event risks pick up this week with the inclusion of inflation, manufacturing and labour market data. On Thursday, EU inflation data for May will shed more light on whether the trading bloc may have peaked as far as core inflation is concerned.

On Friday US NFP data and the accompanying wage data will be watched closely by the Fed ahead of their mid-June FOMC meeting. Central banks are motivated to avoid a wage-price spiral – a situation where higher wages improve the purchasing power of consumers who pay higher prices for goods, adding further to the elevated prices and resulting in further wage increases. The ISM services print is due on June 5th – the ‘X date’ for a potential US default if a deal cannot be agreed.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.