Rejection at $2000 Level Leaves the Door Open for a Move Lower

GOLD (XAU/USD) PRICE FORECAST:

MOST READ: USD/CAD Remains Rangebound as Canadian CPI Falls More Than Expected. Where to Next?

Gold prices continue to find acceptance above the $2000/oz a step to far. Yesterday saw an aggressive push above the resistance level only foe the Daily Candle to close back below the psychological level. Another attempt today was met with some strong bearish pressure as Gold surrendered its daily high to trade around $1993/oz at the time of writing.

Supercharge your trading prowess with an in-depth analysis of gold's outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

Recommended by Zain Vawda

Get Your Free Gold Forecast

US DATA AND DOLLAR INDEX (DXY) RECOVERY

The Fed minutes did little to excite markets yesterday largely due to the recent spate of US data showing positive signs. However, the overall mood remains a bit more tentative following hawkish comments from ECB and BOE policymakers keeping market participants on edge.

Of more importance however has been the recent bounce in both US Treasury Yields and the US Dollar Index finding support. This has allowed Gold bears an opportunity to pounce and keep Gold prices from exploding above the $2000/oz mark.

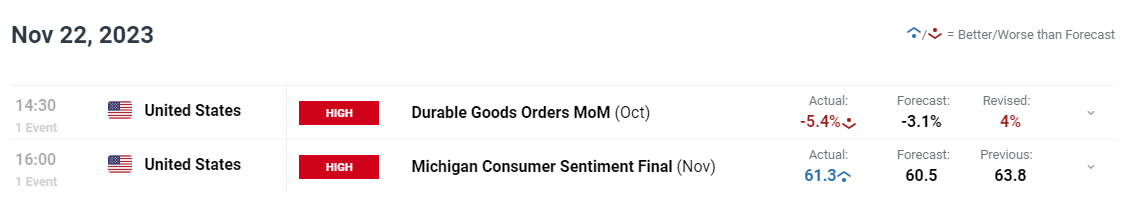

US Dollar Index (DXY) Daily Chart – November 22, 2023

Source: TradingView, Chart Prepared by Zain Vawda

A mixed day in terms of US Data today with Durable Goods Orders coming in below forecast for November with October being downgraded to 4% as well. Another sign that the strong demand which has been prevalent In the US in 2023 may be coming to an end. Michigan Consumer Sentiment beat forecast but came in much lower than the October print, continuing a renewed downward trend which began following the July print of 71.6. A sign that pessimism around the US economy still exists.

Now with the US Thanksgiving Holiday tomorrow we have no high impact US data releases for the rest of the week. Taking that into account we could see some volatility as market participants take profit and reposition ahead of the break. Alternatively, we could see Gold limp toward the end of the US session as liquidity begins to thin.

For all market-moving economic releases and events, see the DailyFX Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

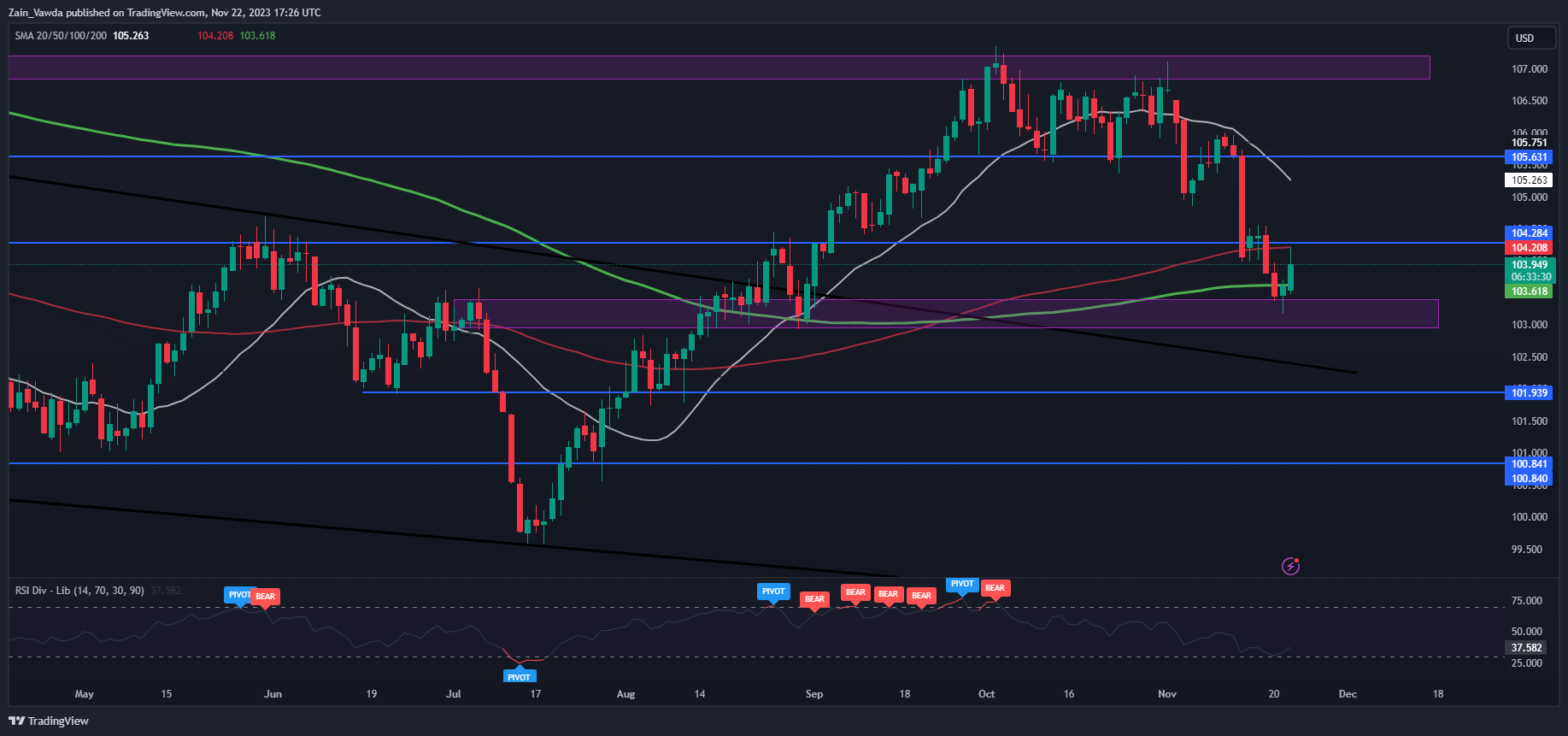

TECHNICAL OUTLOOK

GOLD

Form a technical perspective, Gold continues to throw up slightly mixed signals. It did appear that we had shifted back into bullish structure but following the rejection we are seeing today, this would hint at a new lower high which of course is bearish price action. If the rejection of the $2000/oz mark gathers steam, then immediate support around $1983 may prove a challenge as we saw earlier this week on the daily timeframe.

The other reason that I see the current technical picture as being a mixed one comes from the moving averages as we are seeing a golden cross pattern at the moment with the 50-day MA attempting to cross above the 100-day MA. This usually hints at momentum to the upside and would contradict today’s daily candle close.

All in all, not the easiest to break down from a technical perspective at the moment. Smaller timeframes may be best for those looking for opportunities during the rest of the week with liquidity also expected to be low owing to the Thanksgiving break.

Key Levels to Keep an Eye On:

Resistance levels:

Support levels:

Gold (XAU/USD) Daily Chart – November 22, 2023

Source: TradingView, Chart Prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment, Retail Traders are Long on Gold with 55% of retail traders holding Long positions. Given the Contrarian View to Crowd Sentiment Adopted Here at DailyFX, is this a sign that Gold may continue to fall?

For a more in-depth look at GOLD client sentiment and changes in long and short positioning download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 2% | -3% | 0% |

| Weekly | -12% | 36% | 5% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.