RBA Minutes Reveal Motive Behind the November Hike

Aussie Dollar (AUD/USD, AUD/JPY) Analysis

• RBA minutes: Anchor inflation expectations while the cash rate is comparatively low

• AUD/USD retreats off intraday high and 200-day SMA – watch for further USD weakness

• IG client positioning narrows but recent changes favor upside potential

RBA minutes: Anchor inflation expectations while the cash rate is comparatively low

The minutes from the November 7th RBA meeting revealed a very close call to hike rates by another 25 basis points with the goal of anchoring inflation expectations. Key to note within the committee's most recent forecasts was the assumption of further rate hikes which were built into the data. The decision was made a little bit easier with the Australian Cash Rate relatively low when compared with other major central banks.

While Australian interest rates are restrictive, the housing market appeared to show resilience, suggesting that demand was still posing potential problems in the sector and could impact price increases down the line. Earlier this morning the RBA Governor Michele Bullock took part in a panel discussion where she highlighted the changing inflation profile which started out as a supply-side issue but has more recently shown that demand is playing an increasingly greater role.

Learn How to Trade AUS/USD with Our Complimentary Guide

Recommended by Richard Snow

How to Trade AUD/USD

The AUD/USD Chart shows a rather interesting response to the released minutes which initially saw AUD/USD rising to test the 0.6580 level (April 2020 high). This is a significant level not only because it has come into play multiple times since the Covid-19 pandemic but also because it coincides with the 200-day simple moving average. In the London session, price action has already climbed down from the session high but remains above the prior zone of resistance (now support) of 0.6570. Potential bullish catalysts may surface if incoming inflation data in Australia trends higher or inflation expectations build.

AUD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

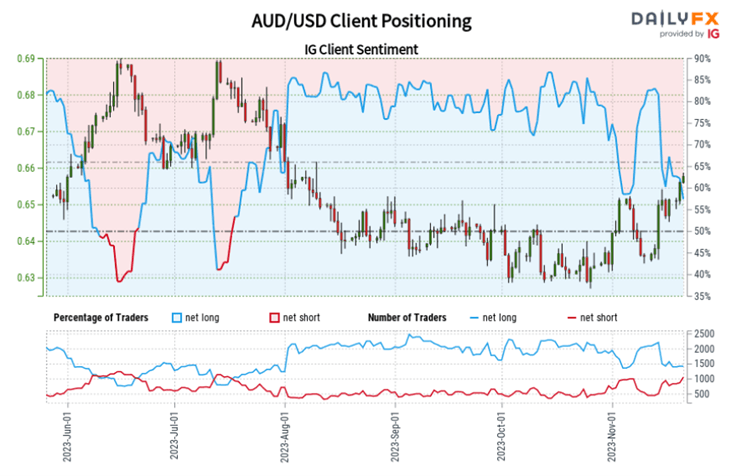

IG Client Sentiment Shows Diverging Positioning but Favours Upside Potential

AUD/USD: Retail trader data shows 58.99% of traders are net-long with the ratio of traders long to short at 1.44 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall.

Learn how to read and apply IG client sentiment to you trading process by claiming your free sentiment guide on the subject below:

| Change in | Longs | Shorts | OI |

| Daily | 2% | 0% | 1% |

| Weekly | -4% | 9% | 1% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.