RBA Governor Lowe Unable to Deter Falling Aussie Dollar

AUD/USD ANALYSIS & TALKING POINTS

- RBA Governor Lowe’s hawkish sentiments did little for the AUD but shows intent to extend their tightening cycle if necessary.

- US economic data in focus today.

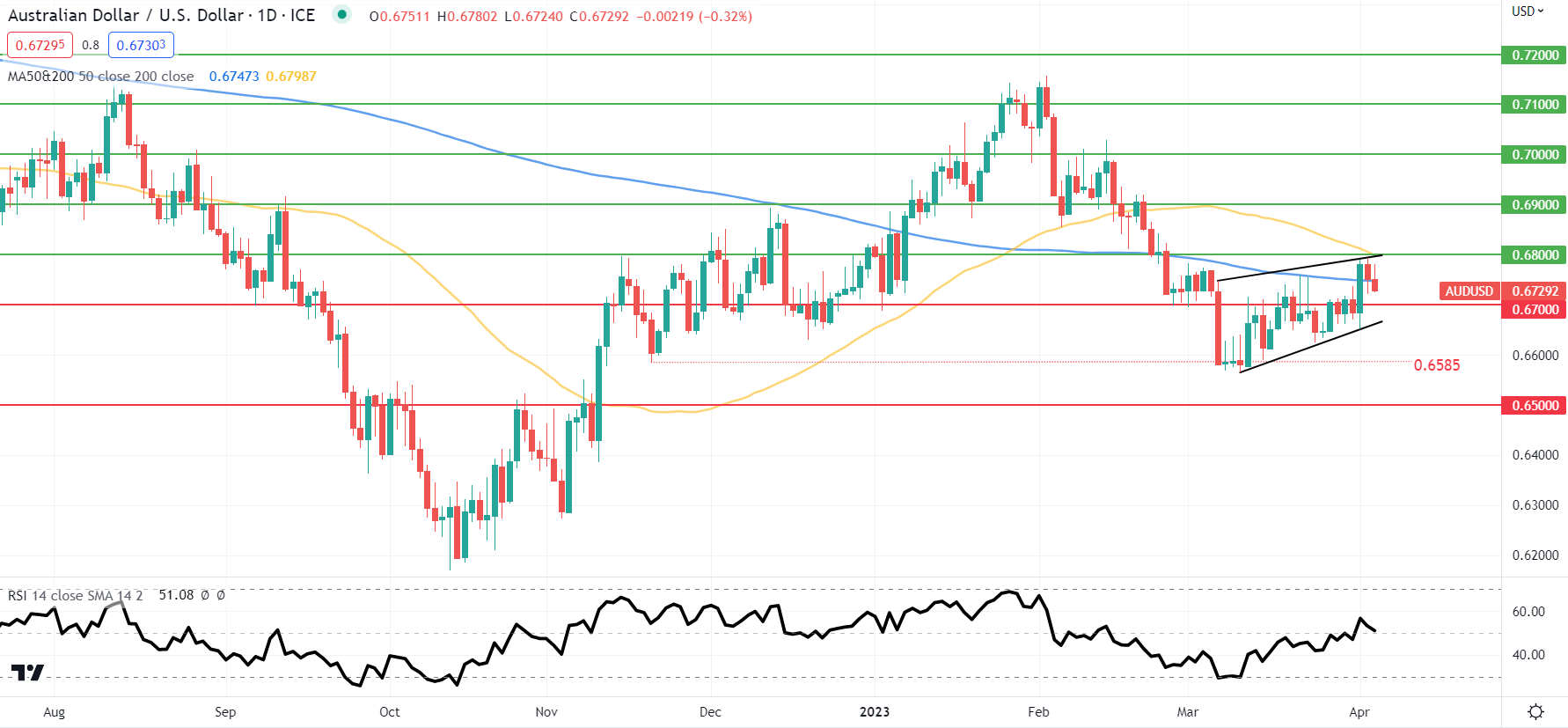

- AUD/USD looking towards rising wedge support, now below 200-day MA.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar extended its decline against the U.S. dollar this morning beginning with hawkish commentary from the Fed’s Mester last night. The Cleveland President’s call for a terminal rate above 5% while maintaining a restrictive monetary policy has given then greenback some support. Earlier this morning, the Reserve Bank of Australia’s (RBA) Governor Philip Lowe erred on the more aggressive side keeping their options open for more interest rate hikes although they decided to keep rates on hold. The approach adopted from the RBA seems to be more of a wait and see strategy considering the multiple factors at play in the global economy (still relevant banking crisis, the impact of the OPEC+ crude oil production cut and guidance from the Federal Reserve). Overall, the Australian economy has been resilient in the face of global recessionary concerns but the pro-growth AUD looks towards a positive China re-open for further upside.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

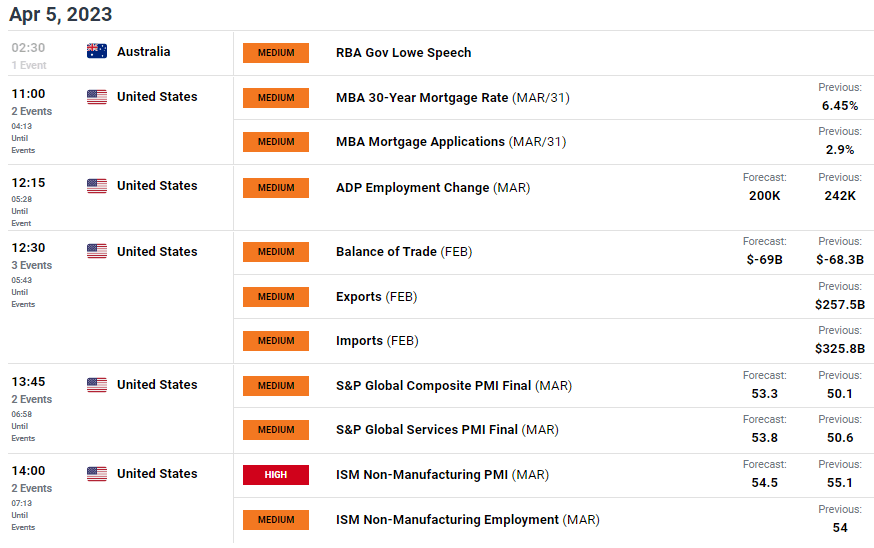

Later today, US labor data in the form of the ADP report will give markets a hint into the current state of the US jobs environment (should ADP numbers echo yesterday’s JOLTs data AUD could be bid) but the main focal point will stem from the ISM non-manufacturing release. This particular report is key for the US and USD crosses due to the fact that the US is primarily a services driven economy and could give the AUD some reprieve should actual data reflect the slight downside revision to the print.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action remains within the rising wedge chart pattern (black), trading below the 200-day MA (blue). A daily close below this key zone may open up room towards the 0.6700 psychological handle and wedge support.

Key resistance levels:

- 0.6800/50-day MA (yellow)

- 200-day MA (blue)

Key support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on AUD/USD, with 68% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term bearish disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.