Rand Stumbles Ahead of US CPI

RAND TALKING POINTS & ANALYSIS

- Chinese optimism unable to deter USD upside.

- US & Chinese economic data the focus for the week.

- USD/ZAR trendline resistance remains in tact for now.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/ZAR FUNDAMENTAL BACKDROP

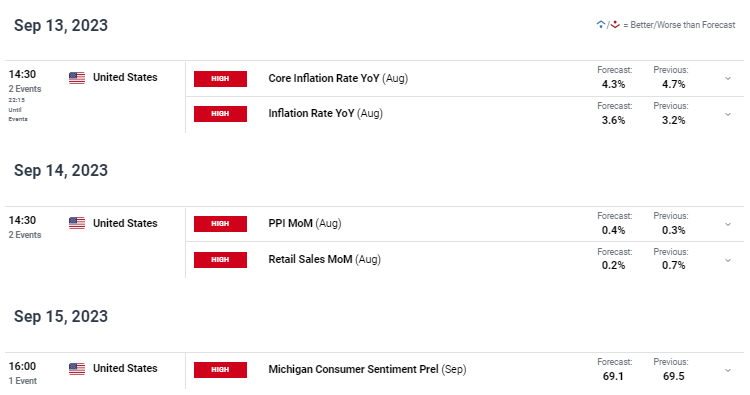

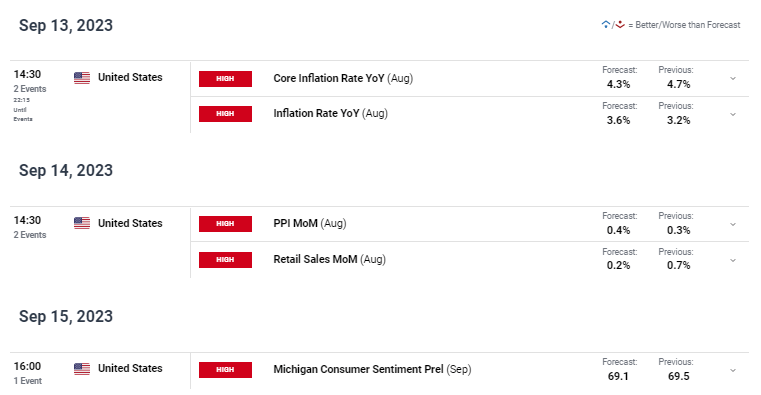

The rand has given up some of its recent gains against the USD this Tuesday as key US economic data looms. Tomorrow’s US CPI (see economic calendar below) is expect to tick higher on the headline figure while many analysts anticipate a beat on the core print that could weigh negatively on the rand – contributing to today’s dollar strength.

There has been some positivity around China and its stimulus measures but the US trading session swept some of these early Asian/European advances away. With no high impact South African specific data scheduled throughout the week, US and Chinese influences will play a major role. Chinese industrial production, retail sales, unemployment and 1-year MLF rate announcement will provide some short-term volatility early on Friday morning.

From a US perspective, PPI, retail sales and Michigan consumer sentiment will keep interest alive across USD crosses following on from CPI.

ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

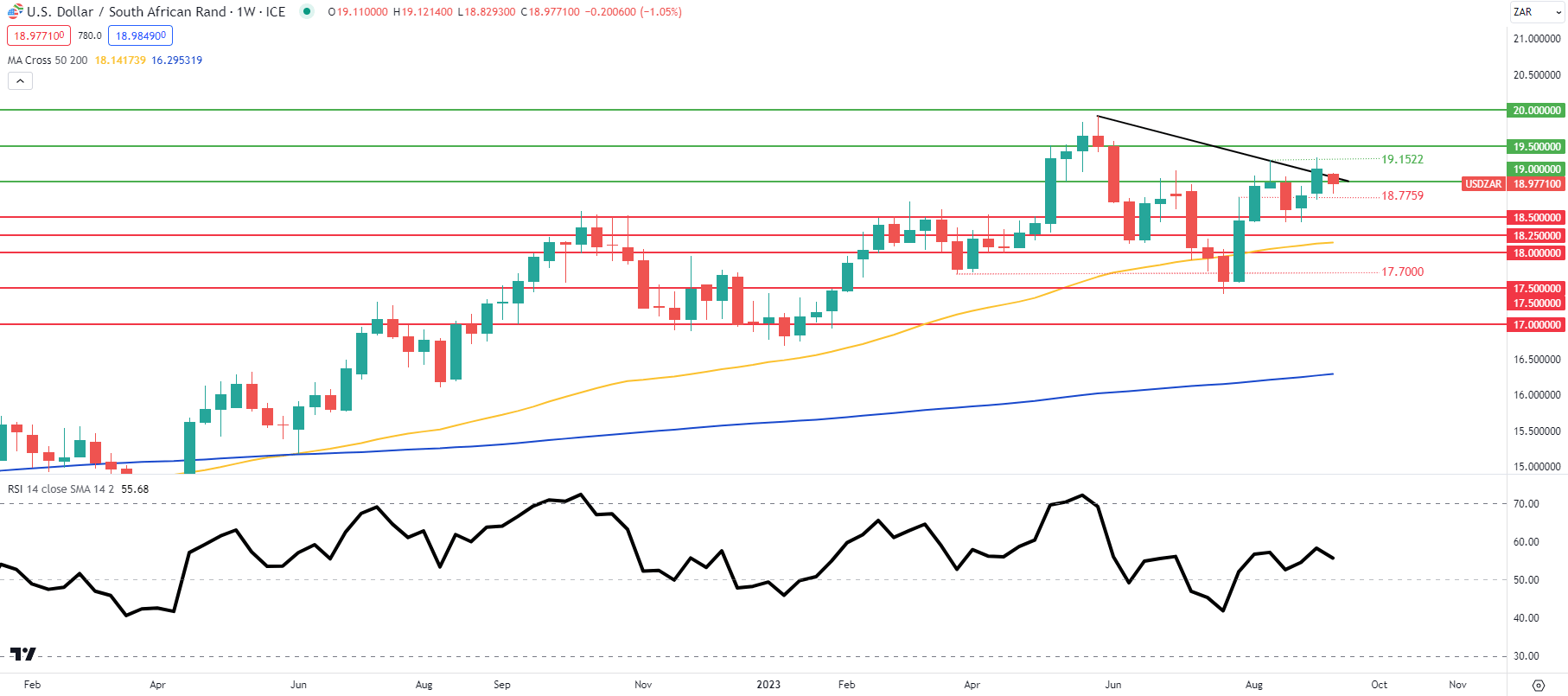

USD/ZAR WEEKLY CHART

Chart prepared by Warren Venketas, IG

Weekly USD/ZAR price action above shows last week’s close tentatively above trendline resistance (black). The lack of conviction could point to additional rand strength to come traders remain cautious ahead of tomorrow’s US CPI which should provide short-term directional bias for the EM pair.

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Warren Venketas

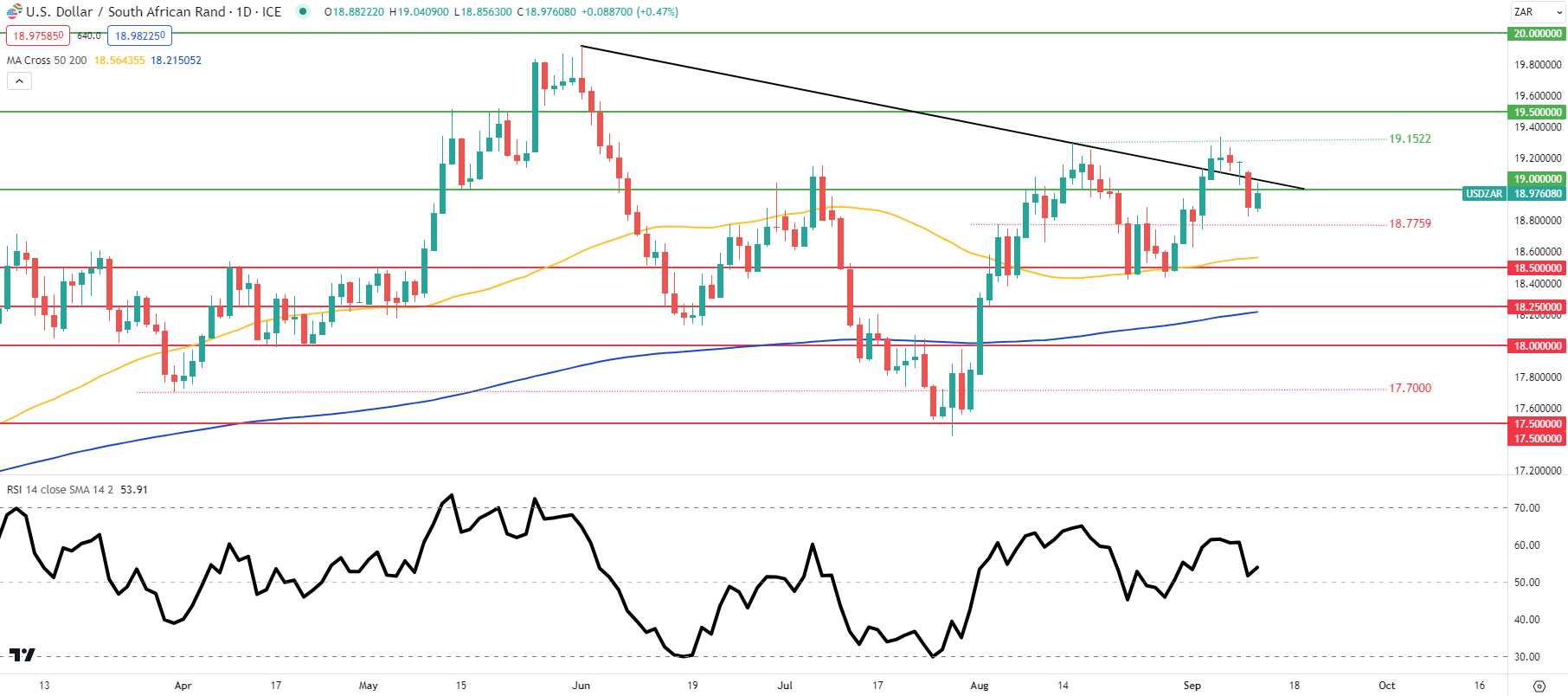

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

Looking closer at the daily chart above, USD/ZAR now sits below the 19.0000 psychological handle and should today’s candle close with another long upper wick, market inclination could skew towards the downside. It is important to remember that the two respective central banks in question (SARB and Federal Reserve) are beginning to diverge with South African inflation beginning to soften at a quicker pace than the resilient US economy who may still opt for additional monetary policy tightening dependent on incoming data.

Resistance levels:

Support levels:

- 18.7759

- 50-day MA (yellow)

- 18.5000

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.