Prices in Freefall as Pivotal Technical Support Caves In

CRUDE OIL PRICE OUTLOOK

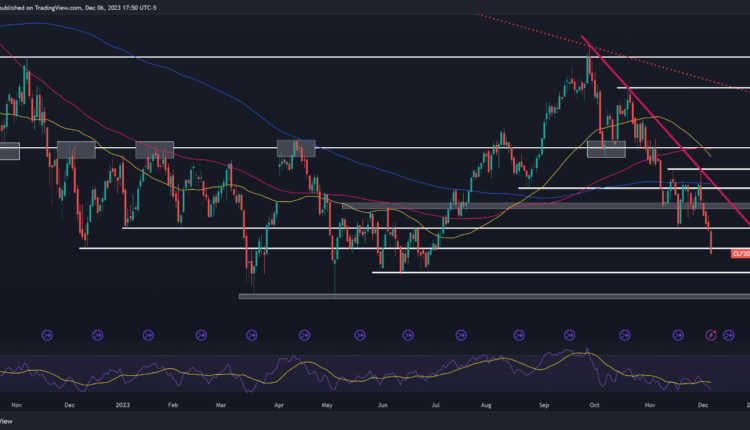

- Crude oil prices (WTI) plunge into freefall, breaking below the psychological $70.00 level

- The technical outlook remains bearish for now

- This article looks at oil’s key price thresholds to watch in the coming days

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Price Action Setups – USD/CAD Tepid After BoC Decision, USD/JPY Wavers

Crude oil prices, as measured by WTI futures, plummeted on Wednesday, falling for the fourth straight session and reaching the lowest level since late June. Factoring in today's precipitous decline (about 4%), WTI has lost nearly 9% of its value in December and has broken below the psychological $70.00 level, a bearish development from a technical standpoint.

The recent selloff in energy markets hasn’t been driven by a singular catalyst but rather a convergence of multiple factors. First off, investors have been dismayed by OPEC+ supply cuts announced in late November because they will be voluntary rather than mandatory, which can potentially enable members to circumvent individually committed reductions.

Disappointing growth in China, coupled with record U.S. crude production at a time of slowing economic activity, has also created a hostile environment for the commodity. The uptick in U.S. fuel stockpiles beyond the seasonal norm in recent weeks has strengthened the belief that demand destruction is taking place, further weighing on sentiment.

Eager to gain a better understanding of where the oil market is headed? Download our quarterly trading forecast for enlightening insights!

Recommended by Diego Colman

Get Your Free Oil Forecast

Related: US Dollar Setups – USD/JPY Gains as GBP/USD Trends Lower, AUD/USD Hammered

Speculative activity by over-leveraged CTAs, which tend to be trend followers, has reinforced oil's weakness, bolstering volatility and exacerbating prevailing directional moves. With CTAs becoming increasingly dominant, their influence on markets will continue to grow, giving way to more and more episodes of rapid and significant price swings.

Focusing on the outlook, oil’s path will likely hinge on the health of the U.S. economy. That said, if incoming information validates the view that a recession might emerge soon, prices could remain depressed and even head lower, with the next bearish zone of interest at $67.00. Subsequent losses could draw attention to March and May’s swing lows near $64.00.

In the event of a bullish turnaround, a possibility worth considering given some of the disconnects between physical and paper markets, initial resistance lies around $70.00. A successful breach and price consolidation above this threshold might rekindle buying interest, setting the stage for a rally towards $72.50. Further upside progress would shift the focus to the $75.00 mark.

Start your voyage to becoming a knowledgeable oil trader today. Don't let the occasion to acquire vital insights and strategies pass you by – obtain your ‘How to Trade Oil' guide immediately!

Recommended by Diego Colman

How to Trade Oil

CRUDE OIL PRICES (WTI FUTURES) TECHNICAL CHART

Crude Oil Prices Created Using TradingView

Comments are closed.