Pound Unmoved After UK CPI Beat

POUND STERLING ANALYSIS & TALKING POINTS

- Inflation softens but percentage change is minimal.

- BoE expected to keep rates on hold in November.

- Technical analysis shows encouraging signs for GBP bears.

Elevate your trading skills and gain a competitive edge. Get your hands on the British Pound Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

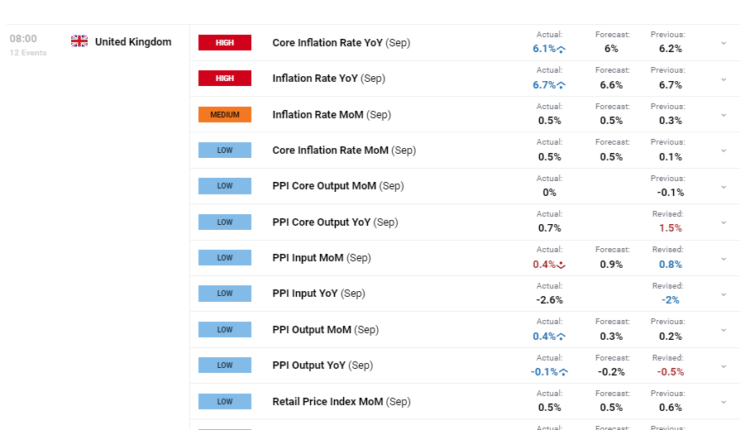

UK CPI data (see economic calendar below) showed a continued decline in both headline and core inflation respectively despite actual figures marginally beating forecasts. Overall the report is largely in line with expectations but shows some resilience of inflationary pressures within the UK economy. Higher crude oil prices saw motor fuel being the largest upward contributor to the change in annual rates, while moderating pressures arose from food and non-alcoholic beverages and furniture and household goods (Source: ONS).

A decline in PPI is promising and being a leading indicator for CPI, could see future CPI figures fall as well. The BoE will look at this closely ahead of the November meeting.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

The British pound found some support post-announcement against the US dollar but little change was seen in money market pricing expectations (refer to table below). Bank of England (BoE) rate projections remain in favor of a pause in the November meeting and with global central banks likely adopting the same standpoint due to escalating geopolitical tensions in the Middle East, incoming data will be closely monitored to gauge the BoE’s next steps – jobs data due on October 24 next week.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart shows the pair trading within a bear flag formation (black) around the 1.2200 psychological level. Bears will be hopeful that the addition of a death cross (blue) could spark a break below flag support and push the pair lower towards subsequent support zones. From a momentum perspective, the Relative Strength Index (RSI) supplements this outlook with levels under the midpoint meaning a preference towards the downside.

Key resistance levels:

- 50-day MA (yellow)/200-day MA (blue)

- Flag resistance

- 1.2308

Key support levels:

- 1.2200

- Flag support

- 1.2100

- 1.2000

- 1.1804

BEARISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 69% of traders holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.