Pound Gears Up for FOMC as Markets Process UK Borrowing

POUND STERLING ANALYSIS & TALKING POINTS

- UK debt a cause for concern long-term.

- Cable traders look to FOMC minutes for guidance.

- GBP/USD faces key resistance at 1.2548.

Elevate your trading skills and gain a competitive edge. Get your hands on the British Pound Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound stays supported by a weaker US dollar and a hawkish Bank of England (BoE) Governor Andrew Bailey who made some critical statements regarding inflation and the future of monetary policy (see below):

“Inflation risks may need more aggressive action.”

“The inflation data for October ,released last week, were welcome news, but it is much too early to declare victory.”

“I am on the watch for signs that inflation will persist.”

“The Middle East events add to upside energy price risks.”

“It is far too early to be thinking about rate cuts.”

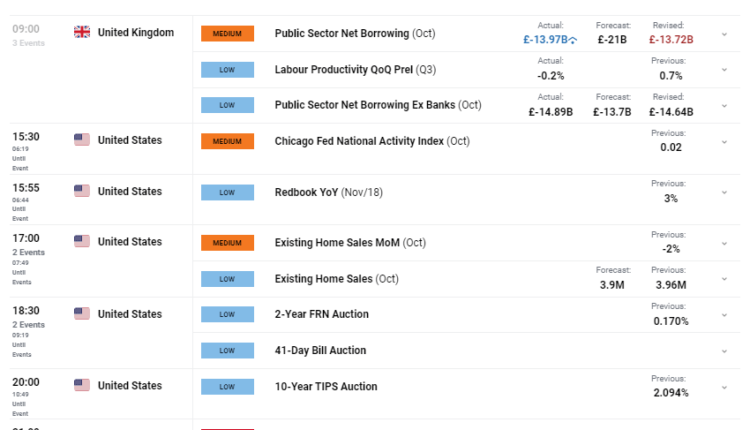

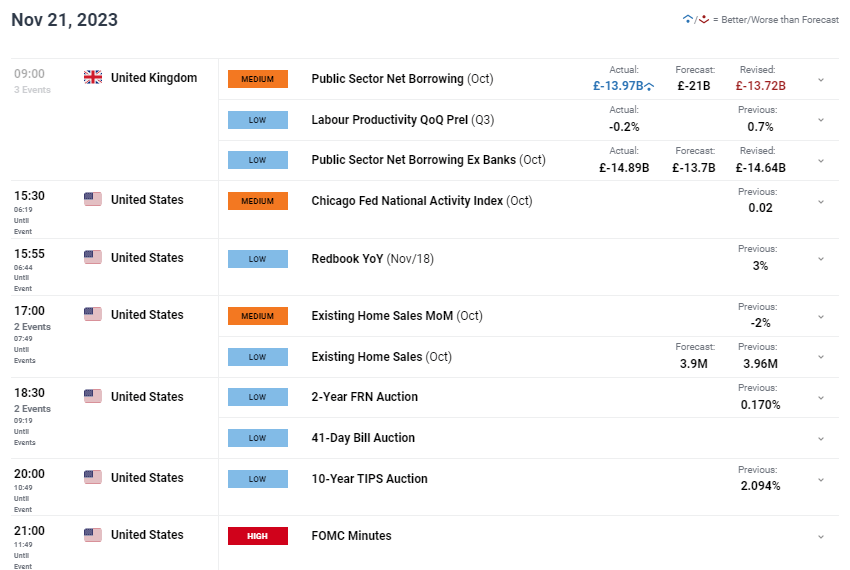

Earlier this morning, UK public sector borrowing data (refer to economic calendar below) showed actual figures significantly beating estimates although the figure remains deeply negative, and the lowest since June 2023. Debt to GDP remains above the 100% due to stimulus/support measures by the government during the COVID-19 pandemic. Sustained high levels of inflation and interest rates have exacerbated this deficit as the majority of the UK’s debt is inflation linked. High debt levels make it difficult for economies to absorb additional economic shocks while exposing the nation to credit downgrades.

Later today, the FOMC minutes will come into focus from the November rate announcement. The Fed pushed back against rate cut expectations and maintained a ‘higher for longer’ narrative but recognized the impact of high rates on the US economy (labor and inflation). More of the same is expected via the minutes but with recent US data showing a slowing economy and a weakening jobs market, any dovish messaging could be capitalized on by USD bears.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

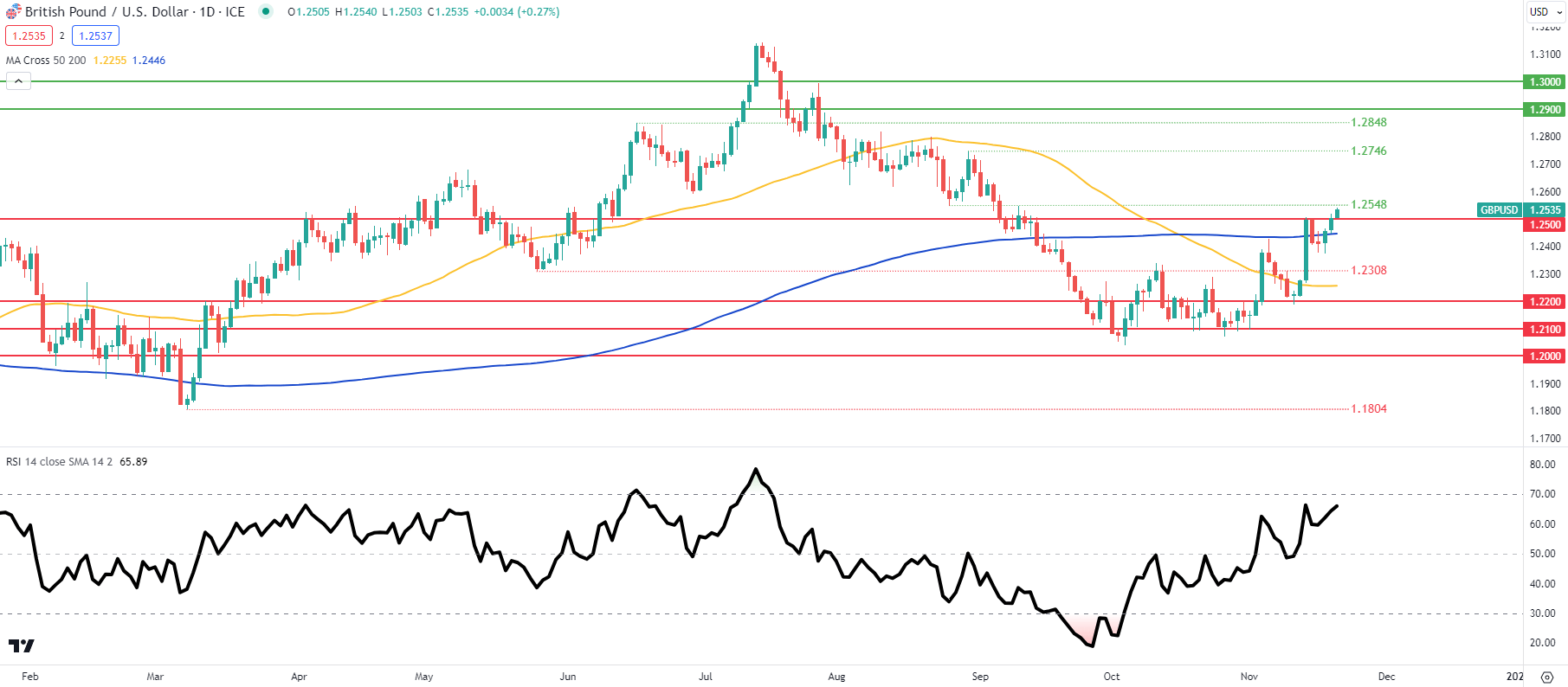

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action above is trading above the 1.2500 psychological handle for the first time since early September and retains it’s hold above the 200-day moving average (blue). Bulls are being held back around the 1.2548 swing resistance level that has been a key inflection point from April 2023. As cable approaches overbought territory on the Relative Strength Index (RSI), bulls may become wary short-term. It is important to remember that the UK Autumn statement will likely stir volatility across GBP pairs tomorrow as markets head into a less volatile Thanksgiving holiday later in the week.

Key resistance levels:

Key support levels:

BULLISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 52% of traders holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.