Positive Start for Aussie Dollar

AUD/USD ANALYSIS & TALKING POINTS

- Encouraging Chinese expectations keep AUD bid.

- All eyes on RBA and FOMC minutes tomorrow.

- AUD/USD bulls eye 200-day MA.

Elevate your trading skills and gain a competitive edge. Get your hands on the Australian dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar capitalized on last week’s close above the 0.6500 psychological handle this Monday morning as markets mull over global monetary policy. Recent weak US economic data particularly from the labor market saw US Treasury yields slip alongside USD weakness. Australian jobs data was quite the opposite with unemployment holding steady while employment change beat estimates. Inflation expectations have pushed higher and that could place more pressure on the Reserve Bank of Australia (RBA) to sustain tight monetary policy with the possibility of additional interest rate hikes. Looking at money market pricing below, it is evident that markets have left the door open for more tightening. That being said, incoming data will be crucial for guidance around central bank strategy.

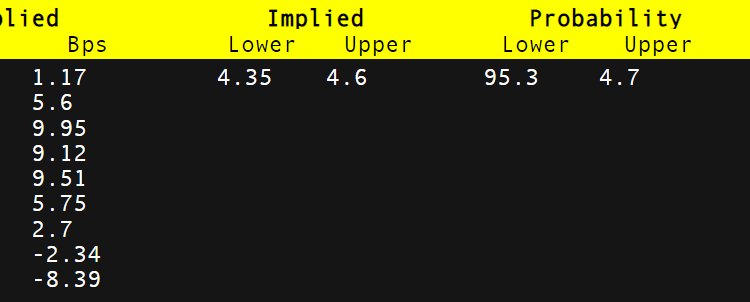

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

Supplementing the AUD this morning was the fact that China kept both its LPR rates steady after recent economic data showed some improvement. Prior stimulus measures may now be bearing fruit with markets viewing this in a positive light. Commodity prices are mostly bid across the board on the back of a weaker dollar and optimism around China – the pro-growth AUD thus benefitted. The economic calendar for the rest of the trading day looks to be relatively muted but tomorrow’s slew of RBA speakers, RBA minutes and FOMC minutes will likely bring some volatility to the pair.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

AUD/USD daily price action above has now confidently broken above the 0.6500 level and head towards the 200-day moving average (blue). Bearish/negative divergence remains in play via the Relative Strength Index (RSI) and could unfold with a peak around the 200-day MA resistance zone.

Key support levels:

- 0.6500

- 0.6459

- 50-day MA

- 0.6358

IG CLIENT SENTIMENT DATA: BULLISH (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 60% of traders currently holding long positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.