Play of the Day: AUD/CAD’s Retracement Opportunity

Comdoll traders gather ’round!

In case you missed it, Australia’s annual CPI came in at 5.4% in the 12 months to September. That’s still a long way from the Reserve Bank of Australia’s (RBA) 2% – 3% target by late 2025!

Given that the RBA almost raised its interest rates in its last decision, market players are now pricing in an interest rate hike in November.

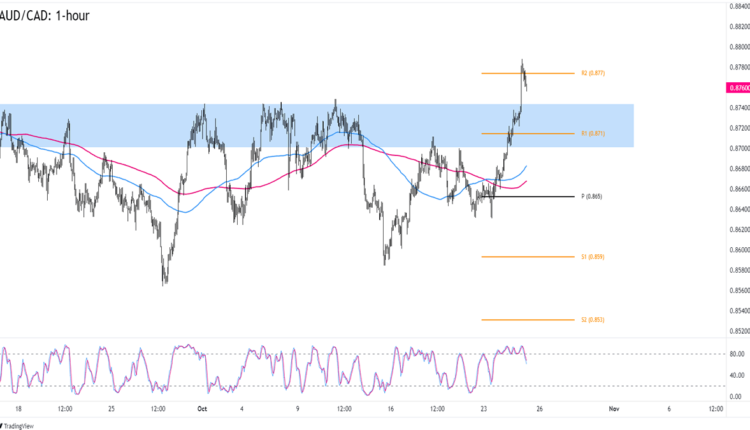

This is likely why AUD/CAD jumped all the way to the .8780 area before finding resistance at the R2 (.8770) Pivot Point level.

AUD/CAD 1-hour Forex Chart by TradingView

But that was a few hours ago. AUD/CAD is now trading lower as the markets consider mixed corporate earnings results in Europe.

How low can AUD/CAD go before the pair attracts buying pressure?

The .8700 to .8750 area of interest may draw in buyers ahead of BOC’s policy decision scheduled today at 2:00 pm GMT. For one thing, Canadian economic data released in the last few days have not convinced a lot of traders that the BOC may consider a rate hike.

Easing fears of armed conflict contagion in the Middle East may also make it easier for traders to buy “risky” assets like AUD while weighing on oil prices and the oil-related CAD.

Finally, the Canadian dollar has seen bearish pressure post BOC decision even when the central bank was widely expected to keep its interest rates steady.

If traders continue to price in a hawkish RBA and a not-so-hawkish BOC, then AUD/CAD may extend its weekly upswing and revisit its previous highs just below .8800.

Keep an eye on how AUD/CAD reacts to the .8750 psychological level or R1 (.8710) potential support zones to see if there’s enough buying interest before and after the BOC’s decision.

Don’t forget to cover AUD/CAD’s average daily volatility in your trading plans so you’ll have a better idea on where you can place your entry and exit targets!

This content is strictly for informational purposes only and does not constitute as investment advice. Trading any financial market involves risk. Please read our Risk Disclosure to make sure you understand the risks involved.

Comments are closed.