Owl Smart Levels Indicator guide – Trading Systems – 24 February 2023

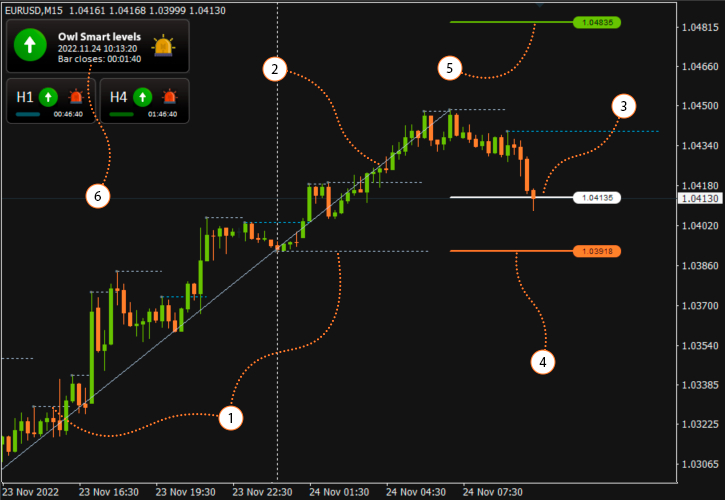

The Owl Smart Levels Indicator is based on the trading system Owl – Smart Levels. This trading system uses data of two indicators, Full Fractals and Valable ZigZag, which are included into the Owl Smart Levels Indicator in the modified form compared to their classical version.

The Owl Smart Levels Indicator is a full-fledged indicator and it includes all the plots based on the trading system with the same name. The indicator plots levels for opening an order on the chart as soon as an opening signal appears and at the same moment it sends a notification to the trader about the appearance of a new signal. That's why Owl Smart Levels is very easy to use. Only the necessary plottings are shown:

- the basic levels, in relation to which the value of order opening price, StopLoss and TakeProfit indexes are calculated, are plotted using the Full Fractals Indicator. Trace levels on the screen are auxiliary, so you can disable their display in the settings depending on your preferences;

- the Valable ZigZag Indicator determines the trading direction for the instrument. If the extreme ZigZag is directed upwards, it means that the trend at the moment is ascending, and only buy trades are allowed. If ZigZag is directed downwards, deals are only allowed to sell on a downtrend;

- the line sets the level of placing the order Buy Limit or Sell Limit;

- the line sets the StopLoss level for the order;

- the line sets the TakeProfit level for the order;

- the info panel can be enabled or disabled in the indicator settings for convenience.

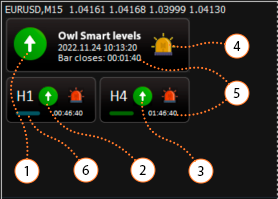

Convenient information panel

The trading system Owl Smart Levels is based on the Triple Screen method which is recommended in trading by the famous trader Alexander Elder. The principle of triple screen consists in simultaneous observation of charts of different periods. In particular, defining the trading direction – on the higher timeframe, while entering a trade – on the lower one. For user convenience the info panel displays data of the Valable ZigZag Indicator:

- the trend direction on the main (intermediate) timeframe;

- the trend direction on the higher timeframe;

- the trend direction on the second higher timeframe;

- signal indicators: red – no signal, yellow – there is a signal for placing Buy Limit or Sell Limit orders, green – you can enter the market at the current price;

- time before the current candle close;

- the color of the trend reversal levels on higher timeframes.

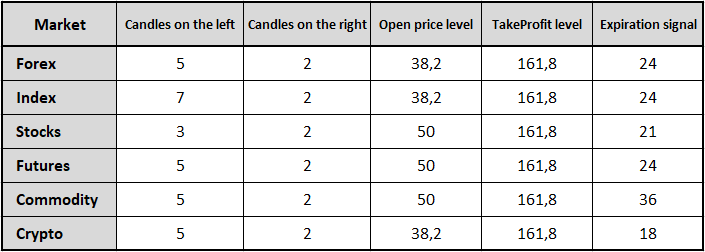

Recommended settings and tools

Due to the use of fundamental indicators the trading system Owl works equally well in all markets. You can trade on Forex, Indexes, Stocks, Futures, Commodity, Crypto by slightly adjusting the indicator settings.

There are 5 basic settings in the Owl Smart Levels Indicator:

- Candles on the left – the number of candle to the left of the signal candle, the High of which should be lower than the High of the signal candle to build a fractal Up;

- Candles on the right – the number of candle to the right of the signal candle, the High of which must be lower than the High of the signal candle to build a fractal Up;

- Expiration signal – the number of candle during which the signal is active;

- Open price level – Fibonacci level for placing a pending order for Buy Limit or Sell Limit;

- TakeProfit level – Fibonacci level for placing a TakeProfit order.

Table of recommended settings for each market

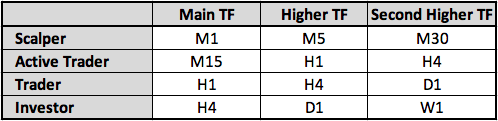

Depending on trading activity there are recommended settings for the triple screen system:

Conditions for placing orders

A Buy Limit order should be placed when the following conditions are matched:

- the Valable ZigZag Indicator on all three timeframes shows upward direction (arrows in the information panel show upward direction);

- there is a new UP fractal (the dotted line on top of the candle);

- IGNORE the signal if the color of the dotted line is blue (the new UP level is lower than the previous one);

- there is at least one DOWN fractal on the right side of the chart (dotted line at the bottom of the candle) before the swing point of the Valable ZigZag Indicator.

If these conditions coincide, the Owl Smart Levels Indicator plots on the chart the levels for placing a Buy Limit order (OpenPrice – white level, StopLoss – red level, TakeProfit – green level).

Sell Limit order should be placed when the following conditions are matched:

- the Valable ZigZag Indicator on all three timeframes shows a downward direction (the arrows in the information panel show the downward direction);

- there is a new DOWN fractal (the dotted line at the bottom of the candle);

- IGNOR the signal if the color of the dotted line is blue (the new level DOWN higher than the previous one);

- there is at least one UP fractal on the chart on the right (the dotted line at the top of the candle) before the swing point of the Valable ZigZag Indicator.

If these conditions coincide, the Owl Smart Levels Indicator plots on the chart the levels for placing a Sell Limit order (OpenPrice – white level, StopLoss – red level, TakeProfit – green level).

All pending orders should be deleted if they have not been triggered within 24 candle from the signal one (Expiration Bar). If the price has reached the TakeProfit level without catching the pending order, this order should be deleted.

Additional filters:

- a new trade should not be opened if there is already one position in the market for the current symbol;

- begin trading at 8:00 GMT on Monday; signals received before 8:00 on Monday morning should be ignored;

- finish trading at 16:00 GMT on Friday; the signals received after 16:00 should be ignored;

- ignore signals received during the first 10 candle after the trade was closed.

Closing a position and deleting a pending order

Open positions should be closed earlier in the following cases:

- if at least once the Valable ZigZag Indicator has changed its direction (one of the arrows on the information panel began to show the opposite direction);

- on Friday, at 16:00 GMT, it is recommended to close all positions at the current price;

- if new levels appear on the chart it is necessary to delete the pending order and set a new one according to the new levels.

Recommendation

When the Fibonacci level reaches 100% (Signal Fractal level) you can move your position to Breakeven (move the StopLoss level to the order opening level +1 point to compensate of the broker's commission).

Capital management

The trading system has a very high profitability factor (TakeProfit / StopLoss = 3.24), so even making 30% of profitable trades you will stay in the profit.

The order volume should be calculated in such a way that the maximum loss does not exceed 1.5% of your deposit.

If there is a loss on the current trading instrument then the risk of the next order should be increased by 0.25%.

Once a trade has been closed with a profit, the next trade should be opened with an initial risk of 1.5%. If you receive a large series of losing trades you should not exceed the risk per one trade of 3%.

If a trade was closed as breakeven, the next trade should be opened with the same risk as the previous one.

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.

Comments are closed.