Outlook on FTSE 100, DAX 40 and S&P 500 Ahead of Next Week’s Central Bank Meetings.

Article written by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX 40 and S&P 500 Analysis, Prices, and Charts

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

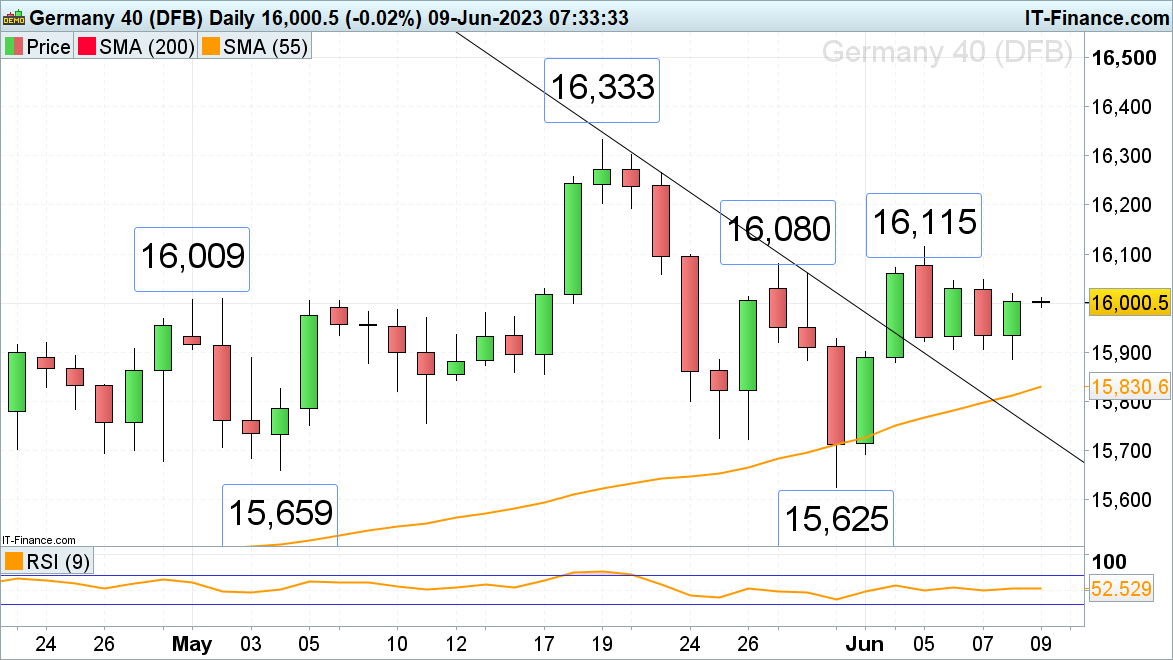

FTSE 100 continues to struggle

Given the swathe of ex-dividend names on Thursday, the FTSE 100 continues to struggle, lagging other global indices which have shown signs of strength on hopes that the Fed will opt to leave its hiking campaign on pause for longer after jobless claims came in weaker than expected.

The FTSE 100 still has the late May and current June highs at 7,655 to 7,660 in its sights. It will continue to do so as long as this week's 7,555 low underpins.

Minor support above this level can be spotted at Thursday’s 7,588 low.

Immediate resistance is seen along its May to June tentative resistance line at 7,624, a rise above which will target the 7,655 to 7,660 zone. A rise above this zonewould put the mid-May low at 7,679 on the map.

Further up meanders the 55-day simple moving average (SMA) at 7,727.

FTSE 100 Daily Price Chart – June 9, 2023

Recommended by IG

Traits of Successful Traders

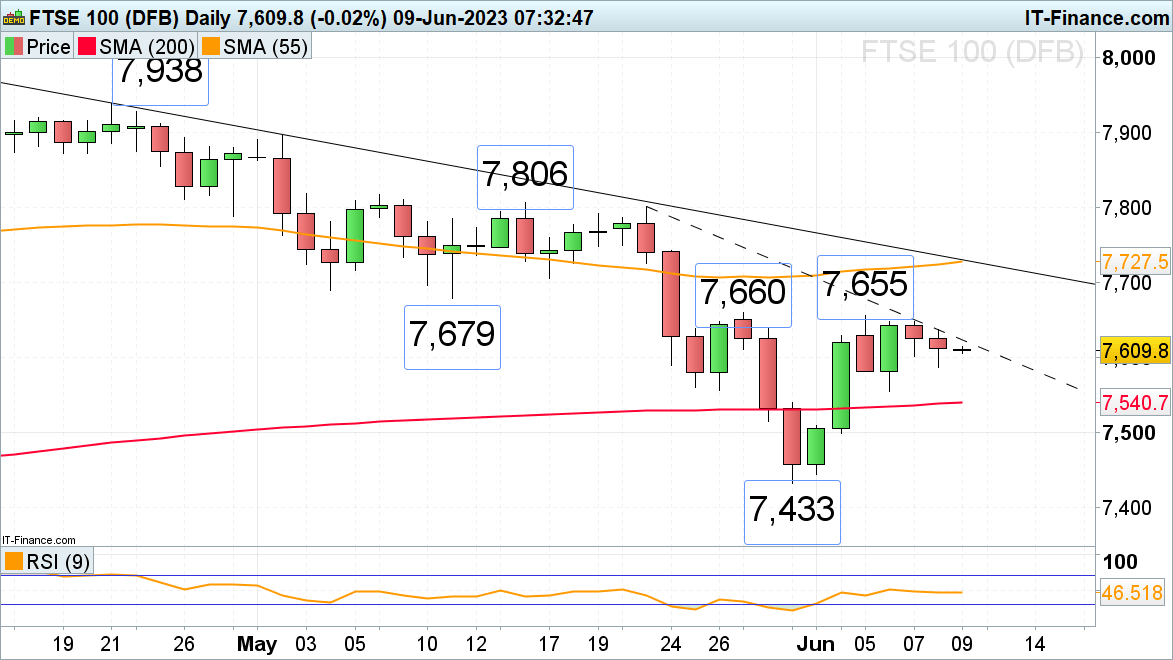

DAX 40 still tries to head higher

The DAX 40 is once again trying to reach a late May high at 16,080 on the back of a stronger close on Wall Street.

This is the case despite the Eurozone technically sinking into a recession. Gross domestic product (GDP) fell by a revised 0.1% in the first quarter of 2023 and the final three months of 2022, showing two consecutive quarters of negative growth.

A rise and daily chart close above the 16,080 high would target last week’s 16,115 high, above which lies the May all-time record high at 16,333.

As long as Thursday’s low at 15,886 underpins, further upside is expected to be seen.

DAX 40 Daily Price Chart – June 9, 2023

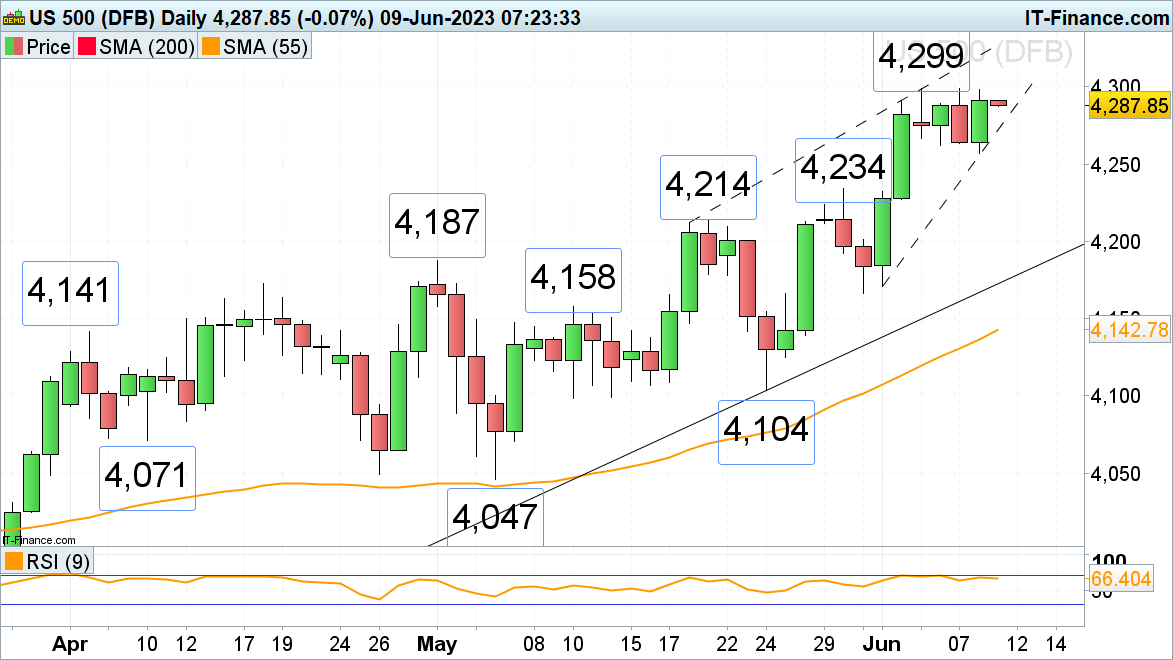

S&P 500 remains on track to reach Monday’s nine-month high

On Monday, the S&P 500 rallied to a nine-month high at 4,299, close to its August 2022 peak at 4,325, as traders await next week’s Federal Reserve Open Market Committee meeting (FOMC).

With the general expectation being that the Fed is to hold its rates steady at its June meeting, stock markets continue to look for a short-term bid. The 4,299 to 4,325 zone will remain in focus as long as no slip through Thursday’s low at 4,257 is seen.

Potential retracements should find minor support at this week’s 4,267 to 4,257 lows, below which sits far more significant support between the mid-to-late May highs at 4,234 to 4,214.

Comments are closed.