Officials Mum on Policy Overhaul, USD/JPY Consolidates

USD/JPY News and Analysis

BoJ Officials Downplay Imminent Decisions around Policy Pivot

Recent comments from Bank of Japan (BoJ) officials have highlighted the uncertainty around when the BoJ will be in a position to withdraw from decades of ultra-loose monetary policy despite inflation breaching the 2% target for over a year now. BoJ deputy governor Himino earlier expressed that stepping away from negative interest rates will be beneficial for households as well as firms. BoJ officials have generally expressed positive sentiment around an eventual shift in policy, something that continues to support the yen.

BoJ Governor Kazuo Ueda has mentioned before that it is crucial for determinants of inflation to transition from supply side shocks to more demand driven effects. Two key areas in focus are inflation breaching the 2% target in a stable and consistent manner, as well as sufficient wage growth. Wage negotiations are set to get underway early next year after 2023 revealed the fastest salary growth in years.

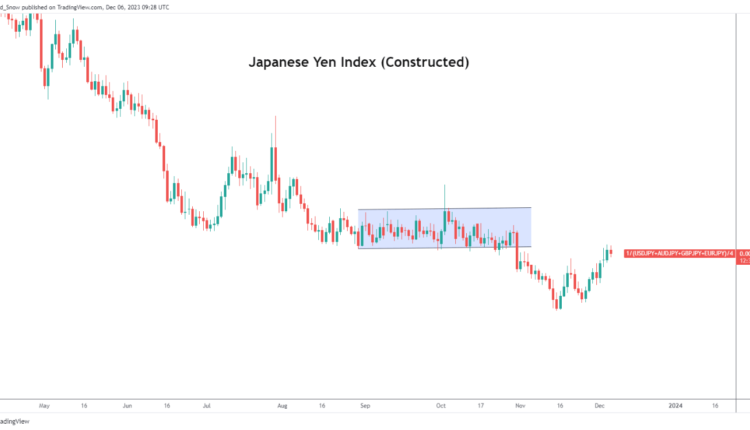

A broad look at the Japanese yen via the equal-weighted average of selected currencies below reveals a resurgent yen that is slightly lower today.

Japanese Yen Index (GBP/JPY, USD/JPY, EUR/JPY, AUD/JPY)

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

The eventuality of a policy pivot from the BoJ is supporting the yen which is also being helped by a weaker dollar as economic data softens and inflation improves. Markets are increasingly pricing in rate cuts in the US which is lowering borrowing costs and overall financial conditions in the US. US yields are declining at a faster pace than in Japan, providing relative support for the yen.

US and Japan 10-Year Government Bond Spread

Source: TradingView, prepared by Richard Snow

USD/JPY Consolidates Ahead of Major US Jobs Data

In the month of October, US Nonfarm Payrolls (NFP) hinted at a potential easing in the job market, as a lower 150k new jobs were added. NFP numbers have generally been in decline but remain above zero – underscoring resilience in the labour market. NFP, CPI, growth and sentiment data have all turned lower in recent weeks, weighing on the dollar but a 180k estimate for November might pose a challenge to further USD selling heading into the weekend, although, keep an eye on the unemployment figure estimated to remain unchanged at 3.9% but could weigh on the dollar if the print surprises to the upside and tags the 4% mark.

146.50 is the current level of support where price action appears content to trade around in anticipation of the next catalyst. Since this week is heavily focused on US jobs keep an eye on ADP private payrolls data today after the JOLTs report registered fewer job openings than expected in November. In the event of a bearish continuation, 145 flat is the next level of support. Upside markets appear at the blue 50-day simple moving average and the 150 mark.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade USD/JPY

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.