NZD/USD, EUR/NZD, GBP/NZD Price Setups

NZD/USD, EUR/NZD, GBP/NZD – Outlook:

- NZD/USD is approaching crucial support as hawkish Fed rate expectations scale back.

- Fatigue in EUR/NZD and GBP/NZD rallies.

- What are the key levels to watch in key NZD crosses?

Recommended by Manish Jaradi

How to Trade the “One Glance” Indicator, Ichimoku

The New Zealand (NZ) dollar undoubtedly looks weak against its peers as the market digests the possibility of NZ rates peaking. However, the currency is running into some pretty tough support against some of its peers that warrants caution in turning excessively bearish.

NZD is still suffering from the Reserve Bank of New Zealand’s (RBNZ) change in stance that it sees rates peaking at current levels after it last month raised its benchmark rate by 25 basis points to 5.5%. See “New Zealand Dollar Slides as RBNZ Hikes By 25 Basis Points, But Sees Peak in Rates”, published May 24. Moreover, the recent hawkish repricing higher of Fed rate expectations and weaker-than-expected China data has weighed on the risk-sensitive currency.

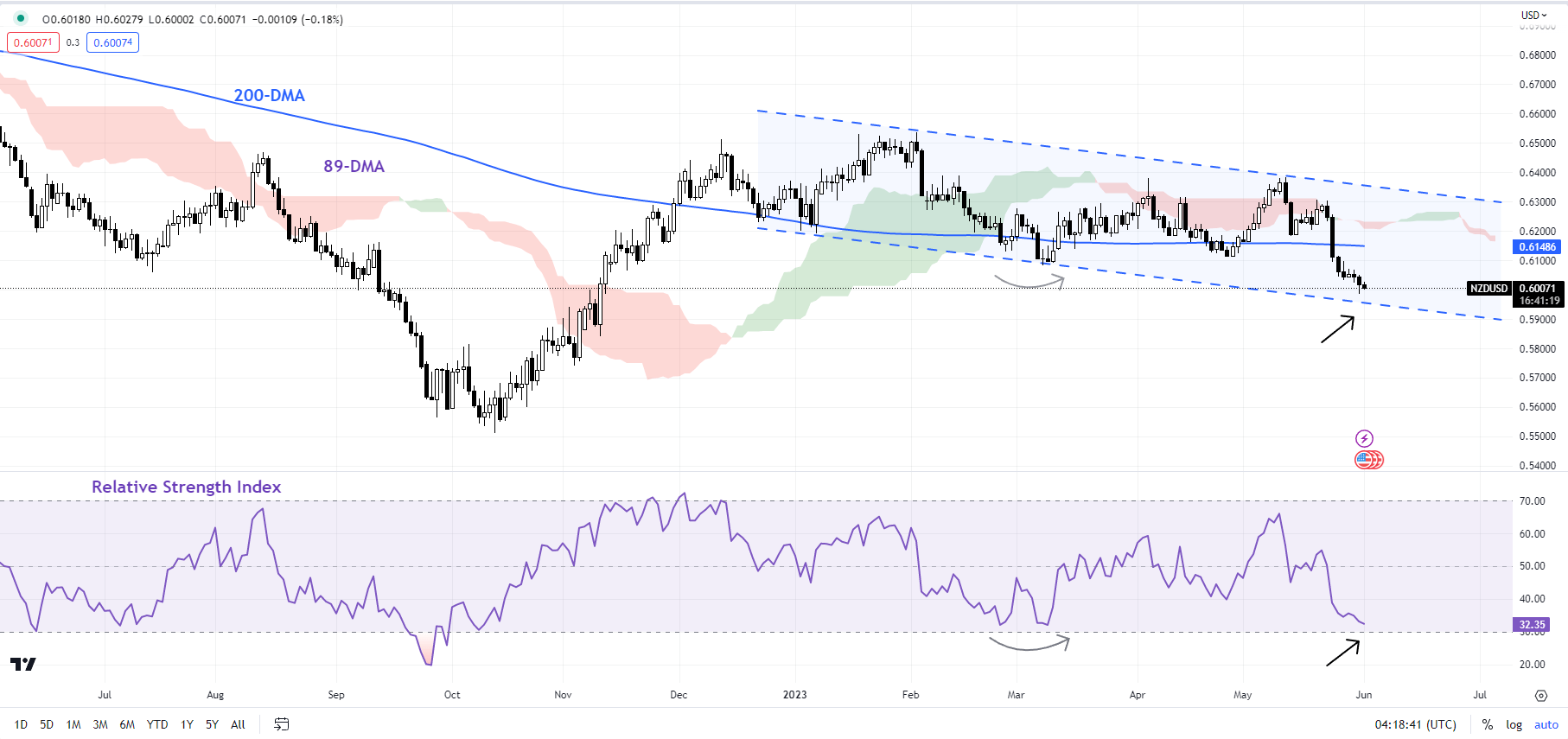

NZD/USD Weekly Chart

Chart Created Using TradingView

However, Fed officials’ remarks on Wednesday hinted at a pause at the upcoming FOMC meeting, providing some comfort to USD bears. Money markets are pricing in a 60% chance of a pause at the June 13-14 meeting, up from roughly a 40% chance on Tuesday. Furthermore, the Caixin/S&P Global manufacturing PMI data showed China’s factory activity unexpectedly swung back to growth in May, contrasting with the official factory activity data that showed a faster-than-expected decline in May.

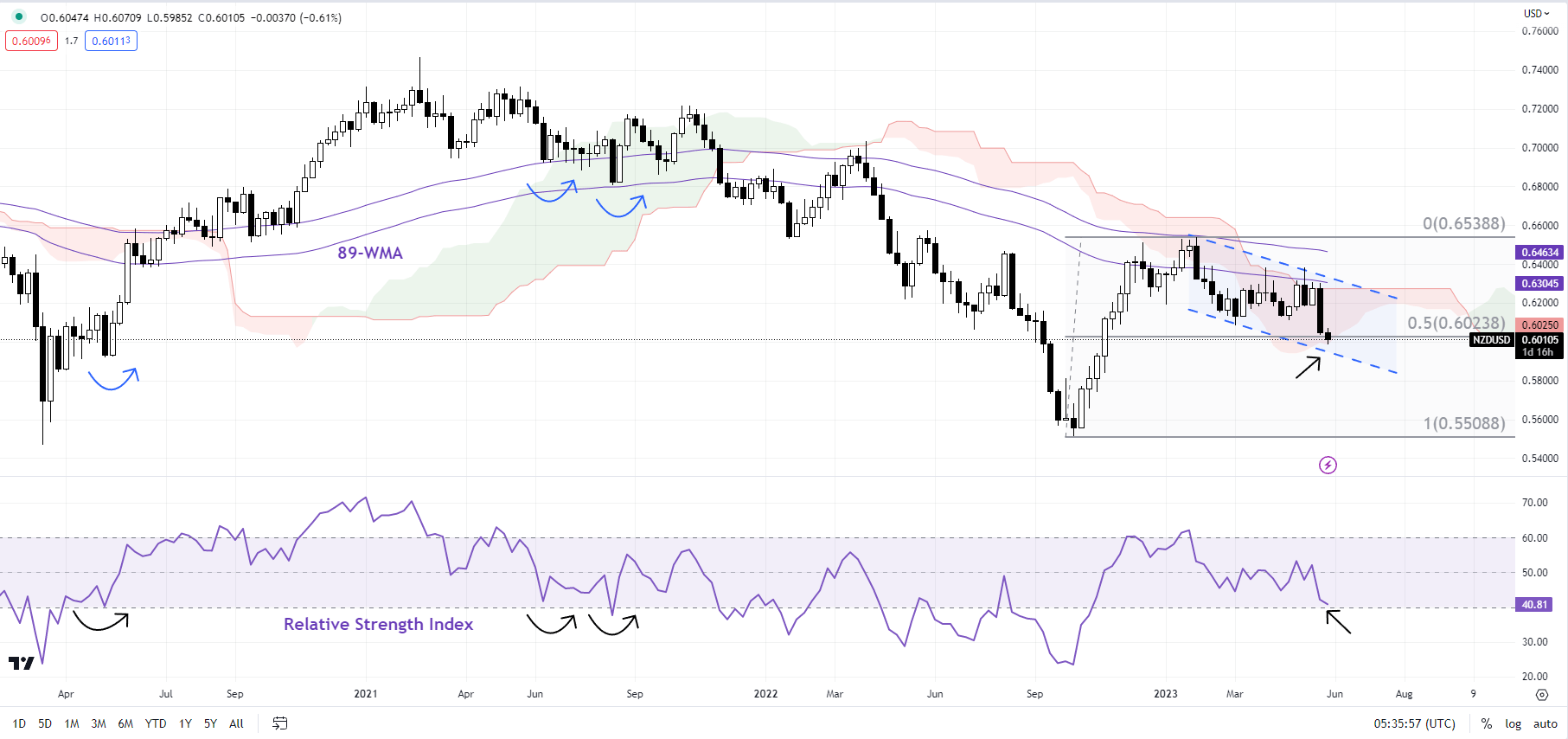

NZD/USD Daily Chart

Chart Created Using TradingView

NZD/USD: Watch channel support

NZD/USD is testing vital converged support on the lower edge of a declining channel from February and a 50% retracement of the October 2022-February 2023 rise. In general, 38%-50% retracements are considered to be reasonable, and not necessarily the end of the prior trend (uptrend in this case). Moreover, the pair late last year was able to retrace 100% of the August 2022-October 2022 slide – often a sign that bears are exhausted. Still, a break above the May high of 0.6385 is needed for the downside risks to fade.

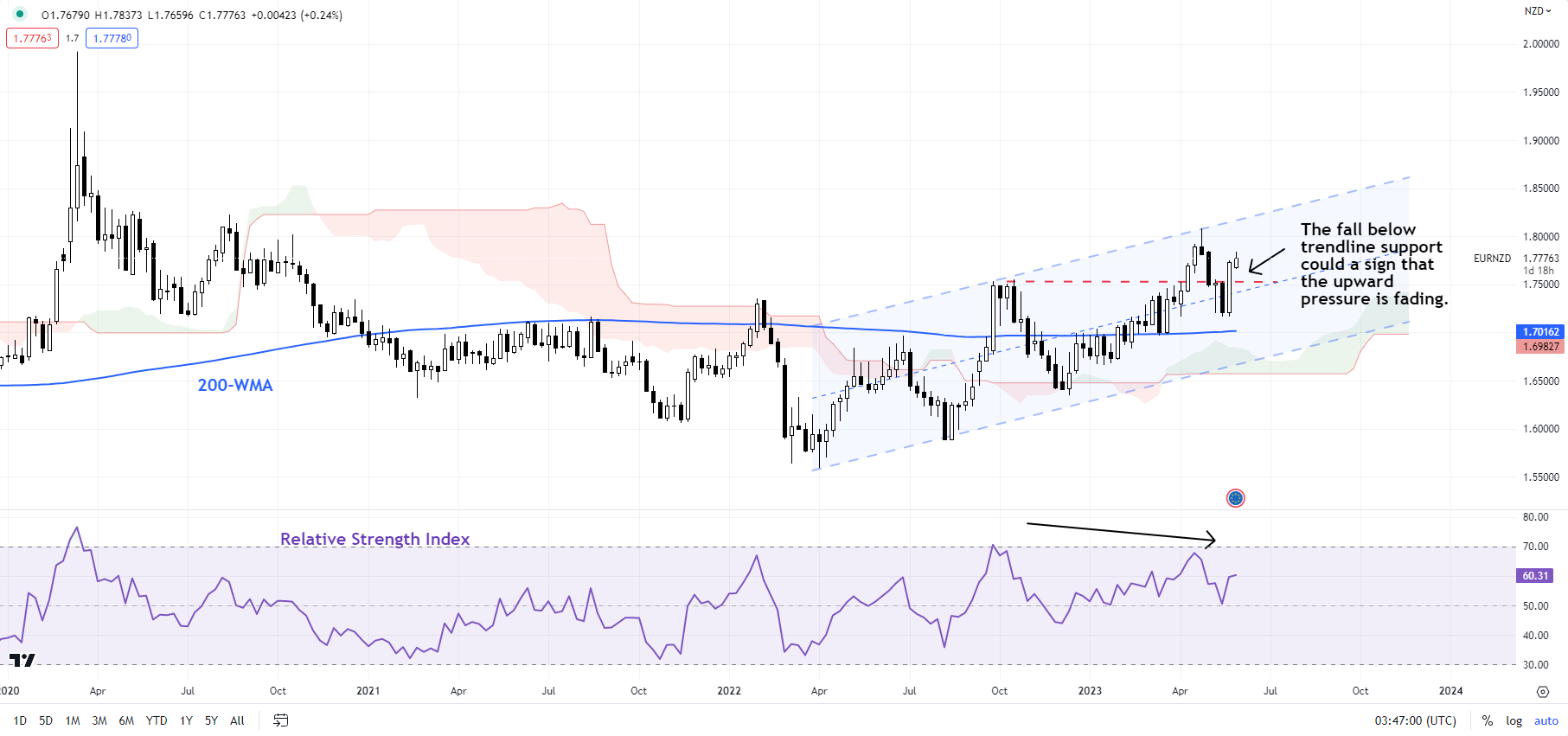

EUR/NZD Weekly Chart

Chart Created Using TradingView

EUR/NZD: Upward pressure appears to be waning

EUR/NZD’s drop below a crucial cushion at the October high of 1.7550 confirms that the upward pressure has waned for now. This follows a retreat from the top of a rising channel in 2015. The sharp rebound in the past two weeks has been associated with feeble momentum, raising the odds of a dead-cat bounce, rather than a fresh leg higher. EUR/NZD faces an initial cap at the early-May high of 1.7835, and unless this resistance is broken, the chances of a 1.7150-1.7850 range developing in the interim are high.

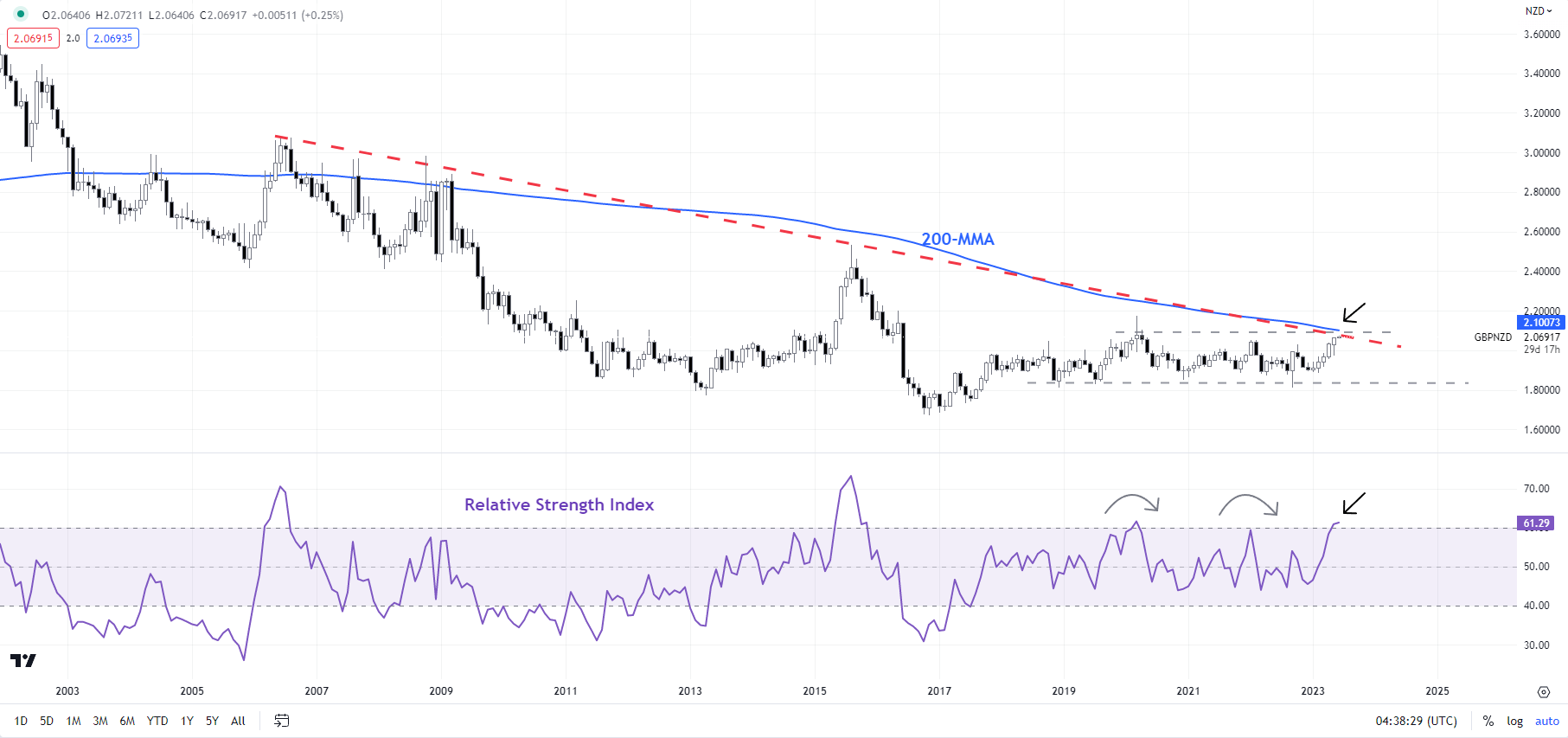

GBP/NZD Monthly Chart

Chart Created Using TradingView

GBP/NZD: Runs into a roadblock

GBP/NZD has had a spectacular run in recent weeks. However, the cross is looking overbought as it tests a major hurdle on the 200-month moving average and a downtrend line from 2006. The 14-month Relative Strength Index is now around 60 – levels that have been associated with a retreat in the cross in the past (see chart). Still, GBP/NZD needs to fall under immediate support at the April high of 2.04 for the upward pressure to ease.

Recommended by Manish Jaradi

How to Trade FX with Your Stock Trading Strategy

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.