NIO attempts recovery from major sell-off after Q2 results

- Nio loses 8.1% at Tuesday open

- Q2 results showed revenue dropping 15% YoY.

- Q2 adjusted EPADS missed estimated by $0.04.

- Vehicle margin improved from Q1 but was cut in half from a year ago.

- Q3 delivery outlook calls for 55K to 57K, more than double the year before.

Nio (NIO) stock has been recovering from a major gap down on Tuesday's open. Due to poor second-quarter results released early Tuesday, Nio fell as low as $9.46 after the open but has recovered up to $10.05 or -8.1% about 45 minutes into the session.

Nio, the Chinese EV automaker, reported Q2 earnings and revenue that missed analyst expectations for the second quarter. Nio reported adjusted earnings per average diluted share (EPADS) of $-0.45 on revenue of $1.21 billion. Wall Street analysts’ consensus had been EPADS of $-0.41 on revenue of $1.27 billion.

Nio missed revenue and GAAP earnings consensus in the first quarter as well. During that quarter, reported in June, Nio’s revenue of $1.55 billion had missed expectations by about $80 million.

Nio stock earnings news: Q2 was dismal, but Q3 outlook improves drastically

Revenue fell 15% YoY as vehicle deliveries, vehicle sales and margin all slipped. Deliveries in the quarter dropped 6% YoY to 23,520. Vehicle sales plunged 25% to $991 million. Vehicle margin declined from 16.7% one year ago to 6.7%, although that figure was better than Q1’s 5.1%.

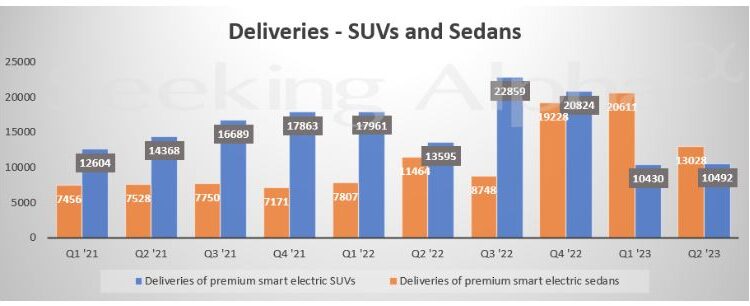

Part of this slide in margin can be attributed to customers opting for less pricey sedans rather than SUVs. Deliveries of SUVs fell 23% YoY, while sedan deliveries grew nearly 14%. Vehicle margin dropped drastically during Q4 of last year when SUV sales began dropping off precipitously.

SUV deliveries were reported at 13,595 in Q2 2022 but just 10,492 in the current second quarter. Sedan deliveries rose from 11,464 in the quarter last year to 13,028 this year.

NIO SUV/Sedan deliveries by quarter

An important caveat here is that Nio’s second quarter ended on June 30, and the following month of July saw deliveries of 20,462 that nearly overtook the entirety of the second quarter. While Q2 was a bust, the third quarter looks quite promising. Management is guiding for deliveries between 55,000 and 57,000 in Q3, which is an increase of about 150% from the second quarter.

July’s large-scale increase in deliveries has “propelled Nio to the top position in China's premium electric vehicle market for vehicles priced above RMB300,000,” said CEO and Chairman William Bin Li.

Based on disclosures in the press release, the government of Abu Dhabi – one of the seven members of the United Arab Emirates or UAE – now owns about 7% of Nio. During the second quarter, Abu Dhabi purchased an approximately $739 million stake directly from Nio and about $350 million in common stock from a subsidiary of Tencent (TCEHY).

NIO FAQs

Nio is a designer and manufacturer of electric vehicles based in Shanghai, China. Formerly known as NextEV, the company changed its name to Nio in 2017. Nio trades under the NIO symbol on the New York Stock Exchange (NYSE) and under the 9866 tag on the Hong Kong Stock Exchange. The company was incorporated in 2014 but went public on the NYSE in September 2020 with a $1.8 billion initial public offering. William (Bin) Li is the CEO of Nio, which he co-founded with President Lihong Qin, another Chinese business executive.

The main difference with other major EV brands like Tesla is that Nio offers battery swapping technology in addition to normal charging options. These swap stations allow drivers to switch out their batteries for fully-charged, identical batteries in less than five minutes, which allows owners to drive long distances without needing to stop for an hour to recharge like most other EVs. At the end of 2022, Nio had 1,305 battery swap locations and built its first swap station in Norway in May 2022. The goal for the customer is to reduce range anxiety.

Nio began its reign with the EP9 sport car back in 2016, and the vehicle is still being produced on a small scale. Since then, Nio has branched off into more mainstream fare. The ES8 was introduced in 2018. It is a full-size SUV with a range of 311 miles. The ES6 SUV dropped the following year and has a range of 379 miles. The smaller EC6 SUV arrived in 2020, and the ET5 and ET7 sedans were released in 2021 – the latter two with versions capable of achieving 621 miles of range. The ES7 and EC7 arrived in 2022 and 2023, respectively.

Yes. While the vast majority of Chinese automakers focus wholly on the Chinese market, Nio began its foray into Europe in late 2021. After beginning in Norway, Nio began entering the German, Danish, Dutch and Swedish markets in 2022 with plans to expand throughout the rest of the decade. Although they are not yet sold in the US, Nio vehicles are being tested in California under that state’s autonomous driving program.

Nio stock forecast

Nio’s share price has been beset by a dismal second quarter, but opportunistic traders will hope to enter here in order to benefit from third-quarter results. August deliveries, for instance, will likely be reported on either Friday or Monday.

NIO stock has descended back from its early August high just above $16 per share to a former supply/resistance zone ranging from $10.15 to $11.30. This would be a good spot to enter since the projected healthy delivery report for August should see NIO burst up to the $13 to $14 resistance range in short order. A break of $10.15, however, will produce more selling that sends the Nio stock price down to earlier resistance-turned-support at $9.50.

NIO daily chart

Comments are closed.