NFP Smashes Estimates as US Unemployment Rises to 7-Month High

US NFP AND JOBS REPORT KEY POINTS:

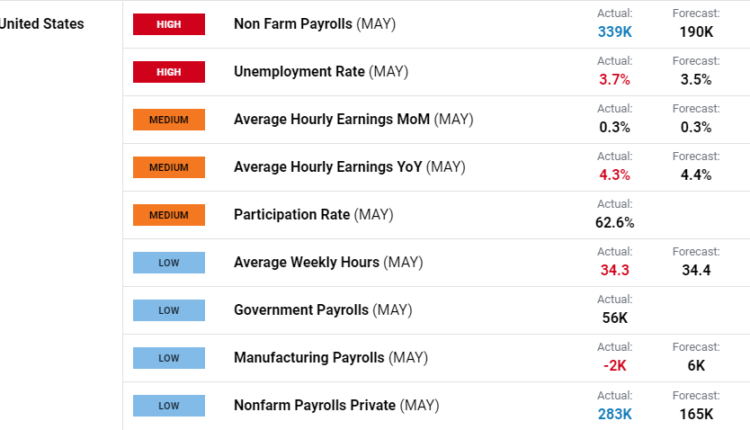

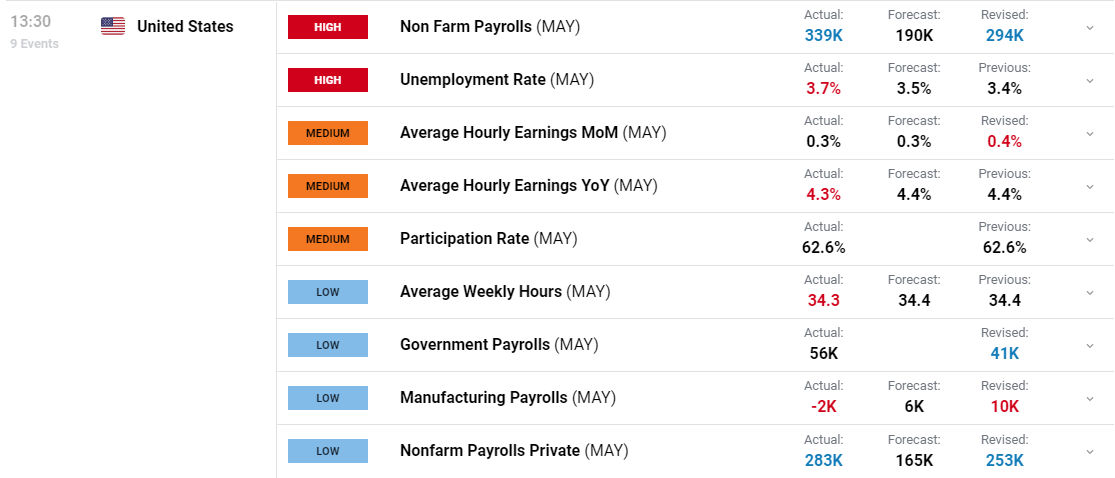

- The US Added 339,000 Jobs in May, Surpassing the Average Forecast of 190,000 New Payrolls. Aprils Figure Meanwhile Was Revised Higher to 294,000.

- The Unemployment Rate Rises to 3.7%, a 7-Month High.

- Average Hourly Earnings Came in at 0.3% MoM with the YoY Print Dropping to 4.3%.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Hiring in the US accelerated through May as the economy added 339K jobs in May 2023, beating forecasts of 190K and following a upwardly revised 294K in April. According to the U.S. Bureau of Labor Statistics employment continued to trend up in professional and business services, health care, construction, transportation, warehousing, and social assistance.

Customize and filter live economic data via our DailyFX economic calendar

The unemployment rate is at 3.7% (a 7-month high) with the number of unemployed persons now up to 6.1 million. It is important to note that the unemployment rate has ranged from 3.4% to 3.7% since March 2022, will unemployment finally tick higher toward the 4% mark?

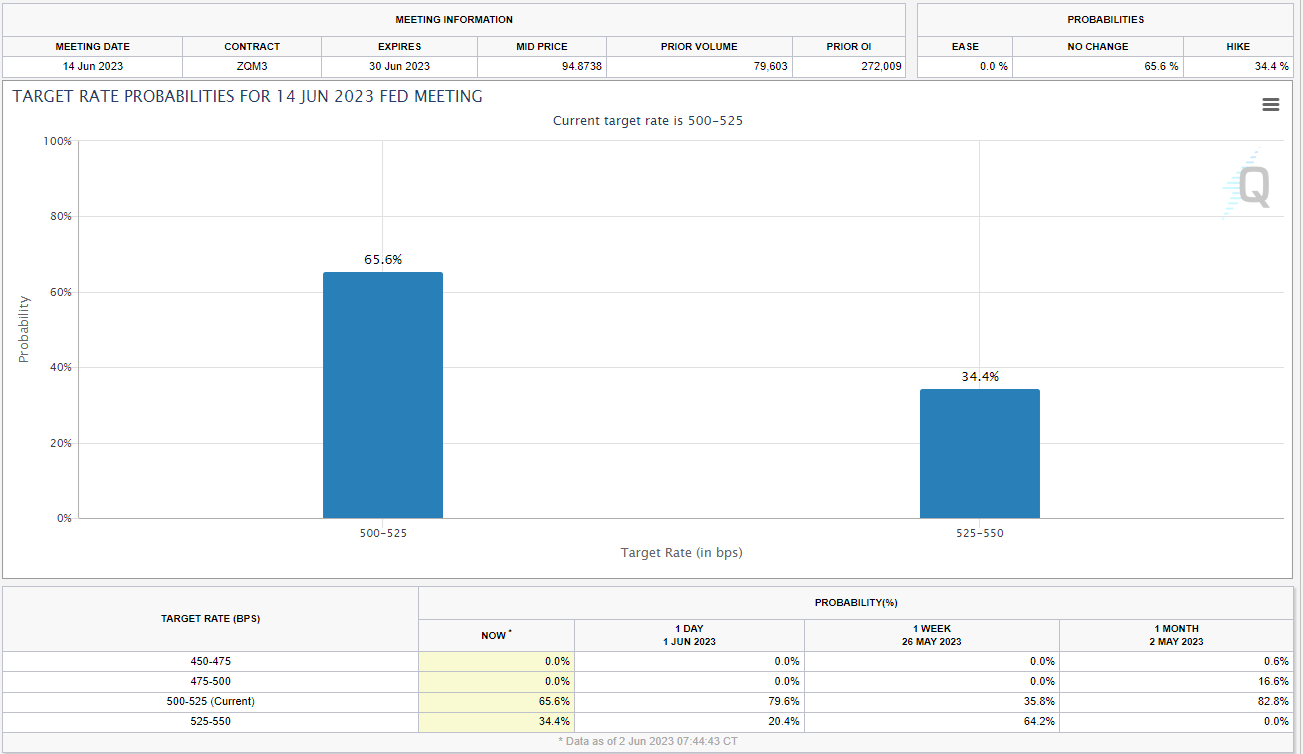

Looking more closely at the employment survey, average hourly earnings which remains a powerful inflation gauge for the Fed, increased by 0.3% MoM in line with forecasts bringing the annual rate back to 4.3% from 4.4% previously. The April MoM print has been revised down from 0.5% to 0.4% as well. This print is perhaps the only positive for the Federal Reserve as despite the robust job numbers, earnings isn’t popping off and unlikely to add further pressure on service prices as we head into the summer months. The data has seen the rate hike probabilities for a 25bps hike in June rise to 34% up from 25% ahead of the release.

Source: CME FedWatch Tool

FEDERAL RESERVE AND THE WAY FORWARD

The debt ceiling deal which had cast a significant cloud over markets of late is largely resolved as it makes its way to the desk of US President Joe Biden. Markets have reacted positively thus far with risk assets catching a bid once the debt ceiling agreement passed through the house and senate and the US dollar weakening as many had expected.

The US Dollar decline however could also be attributed to growing chatter regarding a possible pause from the Federal Reserve in June. There are some policymakers who believe a pause may be appropriate as markets seem to be feeling the strain of late as the effect of rate hikes filter through to the economy. However, data has remained a concern with the Core PCE (Feds preferred gauge of inflation) ticking higher and the overall inflation picture remaining a concern. As mentioned above the average hourly earnings is a plus for the Fed and the inflation picture as a whole while the uptick in unemployment may be cause for a pause from Federal Reserve. This will allow the Central Bank some time to better assess the impact of rate hikes as the “lag effect” finally appears to have run its course.

The Dollar itself does appear rife for a pullback at this stage. The dollar may find some support thanks to higher dollar deposit rates which could prevent a significant selloff in the greenback, however a pause by the Fed in June could make the Dollar Index (DXY) vulnerable for a push toward the psychological 100.00 mark.

Recommended by Zain Vawda

Trading Forex News: The Strategy

MARKET REACTION

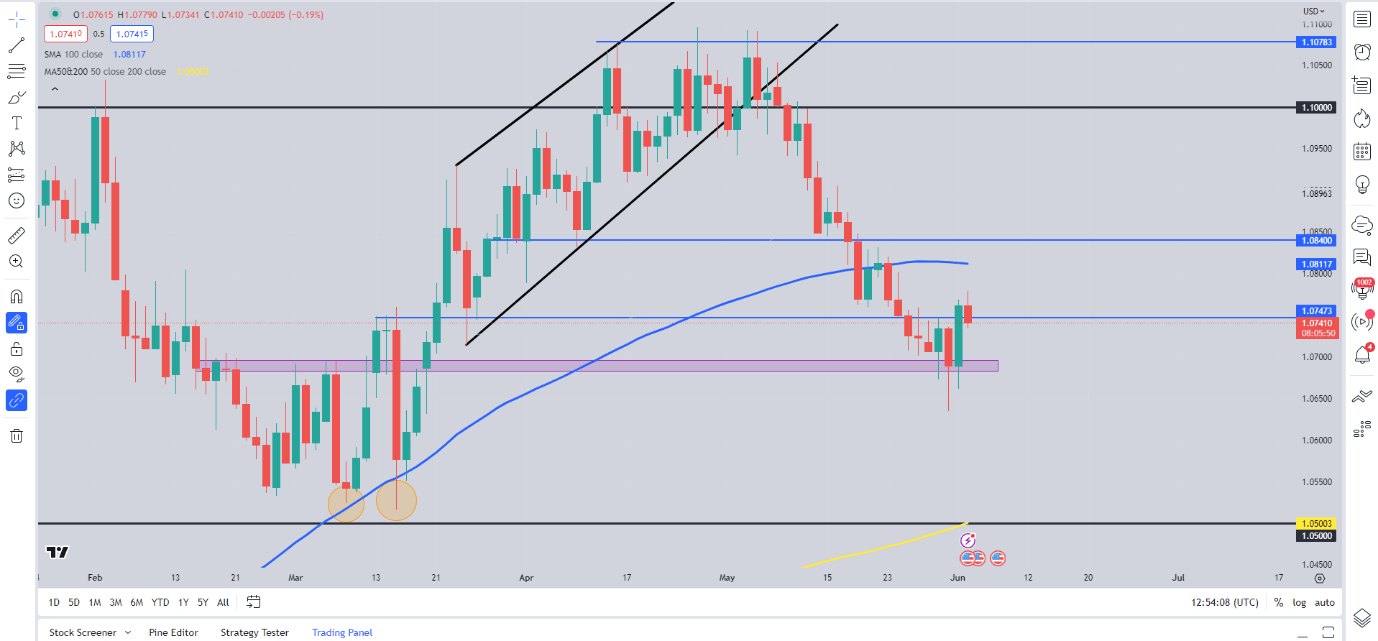

EURUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

Initial reaction on the EURUSD saw the dollar strengthen and gain approximately 30 pips to trade back below the 1.0750 level. Looking at the bigger picture EURUSD enjoyed an excellent Thursday as the US Dollar rally finally appeared to be fading. The 1.0680-1.0700 handle has been key of late as it has continued to provide support with yesterday’s bullish engulfing close hinting at further upside and a deeper retracement.

Key Levels Worth Watching:

Support Areas

Resistance Areas

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.