NFP Rises by 253k as Unemployment Falls and Average Hourly Earnings Rise

US NFP AND JOBS REPORT KEY POINTS:

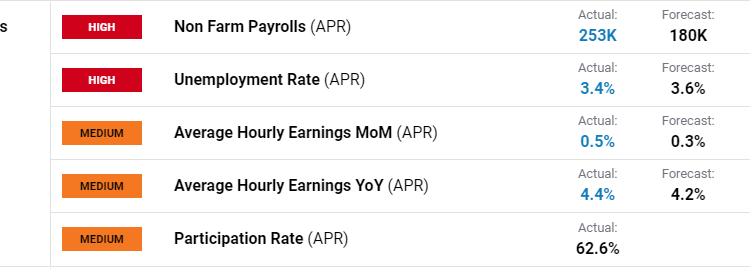

- The US Added 253,000 Jobs in April, Surpassing the Average Forecast of 180,000 New Payrolls.

- The Unemployment Rate Dropped to 3.4%, Matching the January Print Which was a 50-year low.

- The Positive Data Continued as Average Hourly Earnings Increased More Than Expected as Well, Likely to Add to Inflationary concerns.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Hiring in the US accelerated through April as the economy added 253K jobs in April 2023, beating forecasts of 180K and following a downwardly revised 165K in March. According to the U.S. Bureau of Labor Statistics employment continued to trend up in professional and business services, health care, leisure and hospitality, and social assistance. It is also important to note the overall change in total nonfarm payroll employment for February and March was revised down by 78k and 71k respectively, leaving employment for the two months 149k lower than previously reported.

Customize and filter live economic data via our DailyFX economic calendar

The unemployment rate, at 3.4 percent, and the number of unemployed persons, at 5.7 million, changed little in April. The unemployment rate has matched a 50-year low which was seen in January and has ranged from 3.4 percent to 3.7 percent since March 2022. The labor force participation rate, at 62.6 percent, and the employment-population ratio, at 60.4 percent, were unchanged in April. These measures remain below their pre-pandemic February 2020 levels (63.3 percent and 61.1 percent, respectively).

SOURCE: BLS

Looking more closely at the employment survey, average hourly earnings which remains a powerful inflation gauge for the Fed, increased by 0.5% MoM up from 0.3% in March, bringing the annual rate back to 4.4% from 4.3% previously. This print in particular doesn’t bode well for the Fed in the fight against inflation with two inflation reports ahead of next month’s FOMC meeting.

Recommended by Zain Vawda

How to Trade EUR/USD

FEDERAL RESERVE AND THE WAY FORWARD

The FOMC meeting didn’t disappoint this week while continuing stress among US Regional Banks weighs on sentiment and stokes recessionary fears. Fed Chair Powell for one said he doesn’t see a recession but rather miniscule growth for the US in 2023 even though some of his peers on the FOMC fear a recession is inevitable. The Fed Chairs confidence stemming from the strength of the labor market and low unemployment rate. However, given the increasing jitters around regional banks since the FOMC meeting recessionary fears have risen and the probability of rate cuts in 2023 have increased (By market participants at least).

The Fed did not rule out further hikes completely but given the banking sector stress of late it would seem the peak is in. As we move forward though jobs data will be of particular interest. If the US can keep the unemployment rate from rising too fast, they may be able to achieve Powells vision of marginal growth rather than a recession in 2023. Tighter credit conditions usually leads to higher unemployment which was is why this is a key metric moving forward. The Feds dream scenario would ideally be that tighter credit conditions lead to a slowdown in the economy to put in a dent in inflation while at the same time seeing only a marginal uptick in the unemployment rate.

The Dollar itself remains vulnerable as we hover near YTD lows. The ECB are expected to continue hiking with fellow central banks like the RBA striking a hawkish tone of late and markets unconvinced about the banking sector, the greenback could be in for a tough summer.

MARKET REACTION

EURUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

Initial reaction on the EURUSD saw the dollar strengthen and gain approximately 30 pips to trade back below the 1.1000 level.

Looking at the bigger picture EURUSD fell from YTD highs yesterday despite a hawkish tone from the ECB. The weekly timeframe was in overbought territory earlier in the week with the H4 timeframe printing a lower high yesterday. Looking at the daily chart above you can see we have closed below the ascending channel for the second time. A push lower could be in store for EURUSD but the 1.0900 handle may prove too strong a hurdle to overcome.

Key Levels Worth Watching:

Support Areas

Resistance Areas

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.