Nasdaq 100 Consolidates Higher After Breakout. Will the Fed End the Exuberance?

NASDAQ 100 FORECAST:

- The Nasdaq 100 consolidates higher and reaches its best level since January 2022 after staging a bullish breakout in recent days

- While the index’s technical outlook remains positive, the Fed could end the party on Wall Street

- The FOMC is seen holding interest rates steady at its December meeting, but policy guidance may be hawkish

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar on Edge Before Fed Decision, Technical Setups on EUR/USD & GBP/USD

The Nasdaq 100 and S&P 500 consolidated higher and settled at their best levels since early 2022 on Tuesday, continuing their upward trajectory after breaking key resistance thresholds earlier in the week in a context of falling U.S. Treasury yields.

Although stocks maintain a constructive profile from a technical standpoint, their good fortune could soon end if the Federal Reserve moves in to crush exuberance on Wall Street to limit the counterproductive and steady relaxation of financial conditions, which is jeopardizing efforts to restore price stability.

The FOMC will announce its last decision of the year on Wednesday afternoon, when it ends its two-day meeting. In terms of estimates, the central bank is seen holding borrowing costs unchanged for the third straight gathering, but could adopt a hawkish position, pushing back against the aggressive rate cut wagers accumulated by investors.

Over the past month, interest rate expectations have shifted in a dovish direction, with traders discounting more than 100 basis points of easing through 2024. This scenario appears extreme and inconsistent with the current economic reality of strong job growth and sticky inflation, so it would not be surprising to see policymakers go entirely in the opposite direction.

If the Fed comes out swinging, retains a tightening bias in its communication and signals that it will not slash rates as much as financial markets contemplate, Treasury yields could shoot higher as traders unwind dovish bets on the monetary policy outlook. This would be bearish for the S&P 500 and Nasdaq 100.

Will the Santa Rally continue? Find out in our equity market quarterly forecast! Download it now!

Recommended by Diego Colman

Get Your Free Equities Forecast

NASDAQ 100 TECHNICAL ANALYSIS

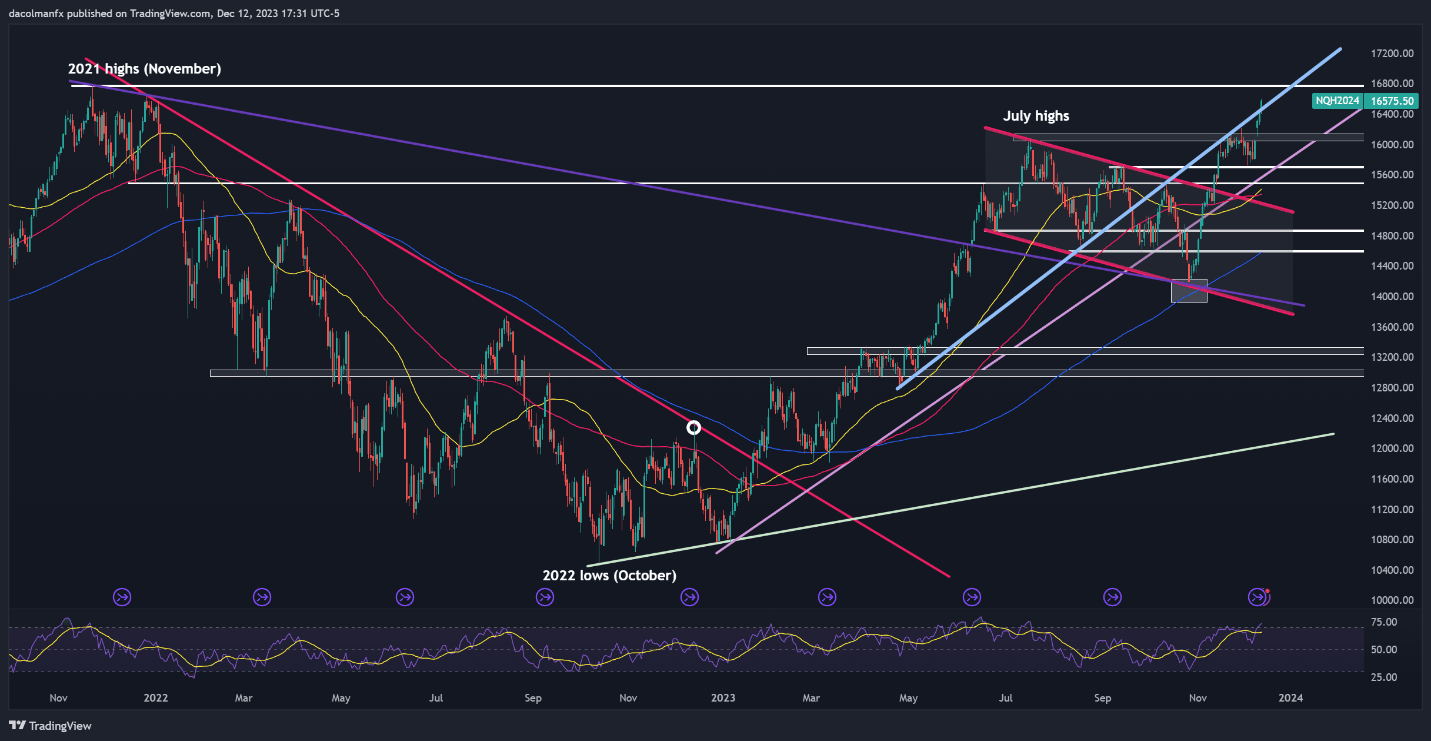

The Nasdaq 100 extended its advance on Tuesday, pushing past trendline resistance at 16,500. If this bullish breakout is sustained, the tech index is likely to consolidate upwards in the coming days, paving the way for a retest of its record. On further strength, a new high above 17,000 could materialize before the year is over.

On the other hand, if sentiment swings back in favor of sellers and downside pressure picks up steam, initial support is positioned near 16,500, followed by 16,150/16,050. The latter range may provide some stability for the market on a pullback, but a clean breakdown could open the door for a retracement towards 15,700.

Recommended by Diego Colman

The Fundamentals of Breakout Trading

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Chart Created Using TradingView

Comments are closed.