Nasdaq 100 Blasts Higher as Meta’s Earnings Boost Tech, Apple in Focus Next Week

NASDAQ 100 OUTLOOK:

- Nasdaq 100 soars more than 2.0% as tech earnings boost sentiment

- Meta Platforms’ shares surge more than 14% after Q1 financial performance beats estimates

- Apple’s quarterly results will steal the limelight next week, with an upside surprise likely due to the strong U.S. consumer during the first three months of the year

Recommended by Diego Colman

Get Your Free Equities Forecast

Most Read: Exploring Seasonality in Wall Street, Europe, and Asia-Pacific Stock Markets

The Nasdaq 100 blasted higher on Thursday, rising for the second day in a row, bolstered by Meta Platform’s solid rally. Shares of the social networking company surged as much as 15% following strong first-quarter results, with top and bottom-line numbers clocking in above estimates and guidance surprising to the upside amid a rebound in sales.

This is how Meta performed relative to Wall Street’s projections:

Earnings per share: $2.20 versus $2.02 expected

Revenue: $28.65 billion versus $27.61 expected

Source: DailyFX Earnings Calendar

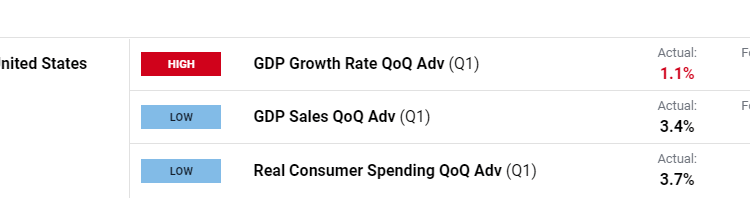

Strength in the tech and telecommunications space boosted the Nasdaq 100, sending the index 2.15% higher in the afternoon trade, despite rising U.S. bond yields. For context, the Treasury curve shifted sharply upwards following U.S. first-quarter gross domestic product data released in the morning. Although the 1.1% annualized expansion underwhelmed expectations, the headline figure overstated weakness, with inventories trimming growth by 2.26 percentage points.

A close examination of the GDP report reveals that personal consumption expenditures accelerated to 3.7%, its best rate since 2021. While household spending will downshift going forward as credit conditions tighten later this year in the wake of the U.S. banking sector turmoil, it is clearly not yet falling off the cliff or indicative of an imminent recession.

US ECONOMIC DATA AT A GLANCE

Source: DailyFX Economic Calendar

| Change in | Longs | Shorts | OI |

| Daily | -5% | 4% | 0% |

| Weekly | -3% | 3% | 1% |

With U.S. consumption holding up well despite numerous headwinds, some earnings reports in the coming days/weeks could continue to be favorable. Apple’s (AAPL) financial results due out next week, for instance, could surprise to the upside thanks to the strength of the U.S. consumer during the first three months of the year. If this scenario plays out, the iPhone maker's stock prices could perform well in the near term, further boosting the Nasdaq 100.

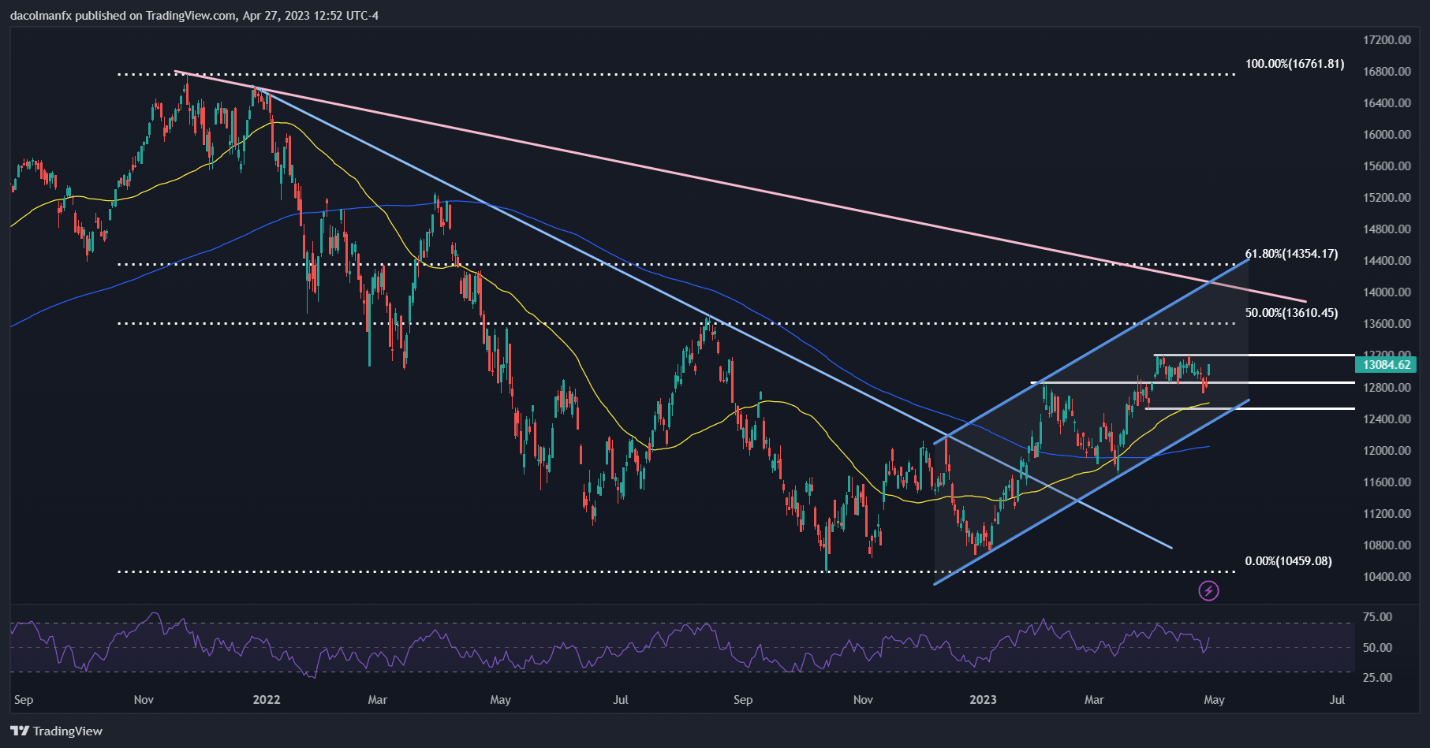

Focusing on price action analysis, the Nasdaq 100 is quickly approaching technical resistance near 13,200, an area that has acted as an ironclad barrier before, repelling prices lower several times this year. While the same dynamic could play out on another test, the possibility of a bullish breakout is growing, in which case, we could see a rally toward 13,610, the 50% retracement of the Nov 2021/Oct 2022 sell-off.

On the flip side, if sellers return and spark a bearish reversal, initial support appears at 12,875. If this floor is taken out, bears could become emboldened to launch an assault on 12,550, followed by 12,375, the lower limit of an ascending channel in play since December of last year.

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Chart Prepared Using TradingView

Comments are closed.