Mixed Technical Signals and a Stronger US Dollar Weigh on Cable

GBP PRICE, CHARTS AND ANALYSIS:

Read More: Oil Price Forecast: WTI Prints Double Bottom Pattern. Recovery Incoming?

GBPUSD continues to struggle hovering around the 1.2600 handle as mixed technical and a strong USD weigh on Cable. A return of safe haven demand as the week began has benefitted the US Dollar and the Dollar Index with a host of key data releases in the week ahead.

Recommended by Zain Vawda

How to Trade GBP/USD

DOLLAR INDEX (DXY) DRIVES LOSSES ON CABLE

Following another week of gains for Cable, a return of strength to the US dollar has seen the pair fall around 100-pips toward the 1.2600 mark. Escalating tensions in the middle east over the weekend and at the start of the week has reignited demand for the US Dollar. This came about as Houthi rebel out of Yemen attacked 3 commercial vessels over the weekend with the US responding by shooting down some drones. The tension continues to simmer and there is concern that one wrong move by either side could spark a wider conflict in the region which could have a massive impact on the global economy.

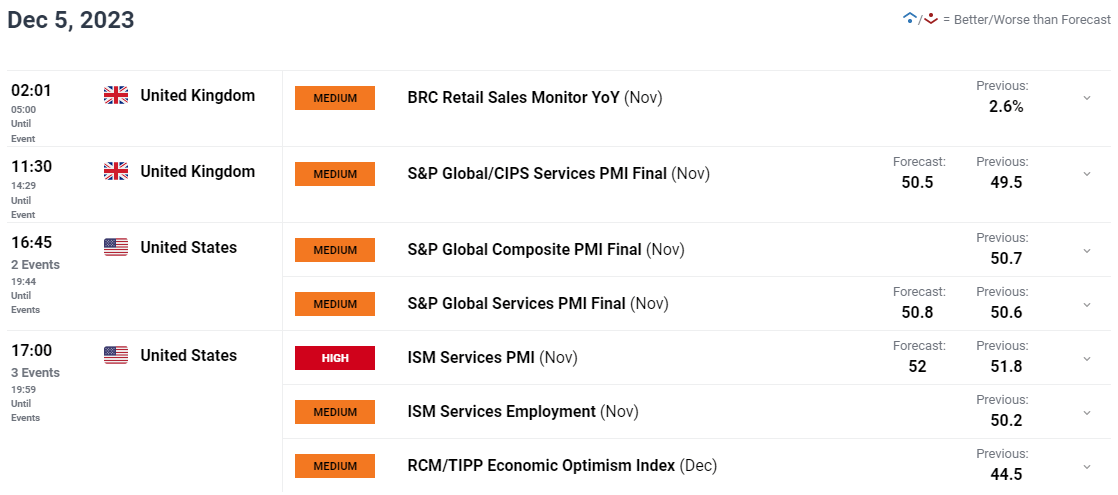

Dollar Index (DXY) Daily Chart

Source: TradingView, Chart Created by Zain Vawda

It will be intriguing to see the developments for the rest of the week and whether high impact US data will drive markets later this week or be overshadowed by the Geopolitical risks in play.

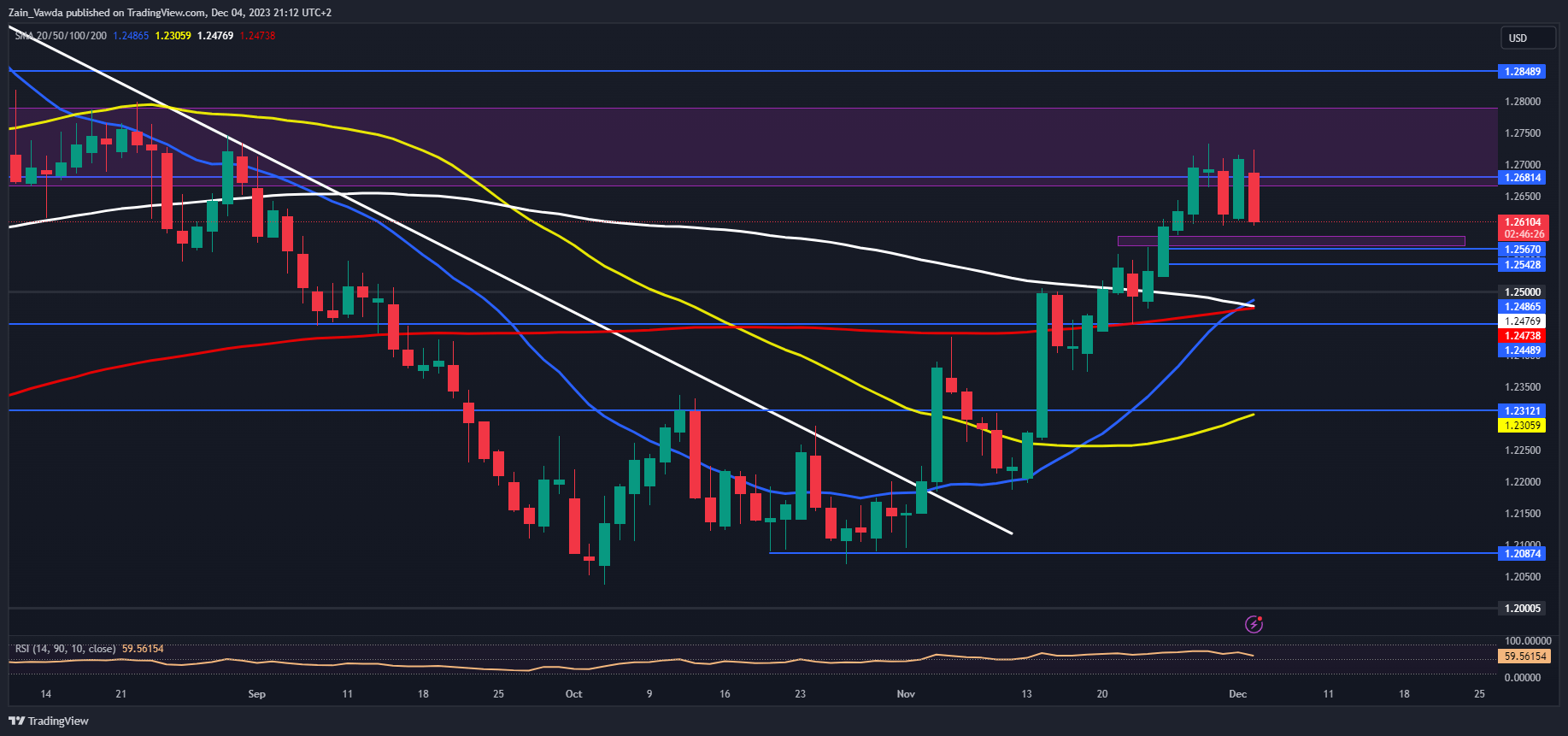

RISK EVENTS AHEAD

In terms of risk events the US dominates this week with only some mid-tier data out of the UK. This means we could see risk sentiment and US data drive GBPUSD for the majority of the week.

Tomorrow brings BRC retail sales data from the UK as well as S&P Global Services PMI before attention turns to the US session. The biggest data release tomorrow will be the ISM Services PMI number from the US with policymakers remaining concerned about robustness of the US Service sector and it role in the fight against inflation. A significant drop and miss of the forecasted figure could see expectations for rate cuts increase once more and weakness return to the US Dollar. This will also depend on the market mood and sentiment and whether the demand for safe havens remain strong.

For all market-moving economic releases and events, see the DailyFX Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL OUTLOOK AND FINAL THOUGHTS

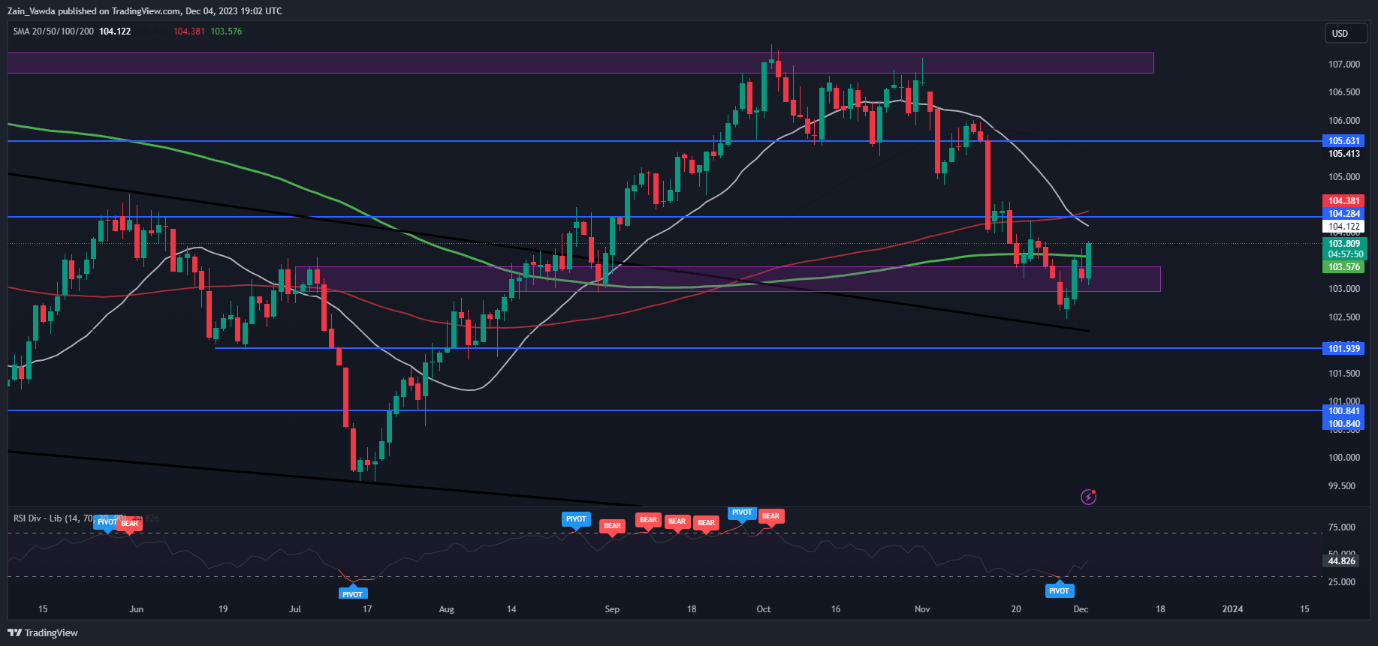

GBPUSD failed to find acceptance above the 1.2700 mark on a daily timeframe, spending the best part of 5 days attempting to break higher. Having printed a fresh high however, the pair was in line for a retracement which has been facilitated by a return in US Dollar Strength. The question now will be whether we can push on toward the 1.2500 handle and beyond?

There are some mixed signals being thrown up at present, we have just had a golden cross pattern play out as we have the 20-day MA crossing above the 100 and 200-day MAs hinting at bullish momentum. This is in contrast to the candlesticks with GBPUSD on course for a bearish engulfing close which could hint at further downside ahead tomorrow. This sets us up for an interesting day of price action ahead and one which may require a nimble approach to find worthwhile opportunities.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

GBP/USD Daily Chart, November 4, 2023

Source: TradingView, Chart Created by Zain Vawda

IG CLIENT SENTIMENT DATA

IG Retail Trader Sentiment shows that 51% of traders are currently NET SHORT on GBPUSD. We have seen quite a significant change with an increase of 23% in traders holding LONG positions as GBPUSD slid more than 100 pips today.

At DailyFX however we do adopt a contrarian view to client sentiment data. Given the increase in long position holders are we going to see a recovery heading into the Asian and European sessions tomorrow?

For a more in-depth look at GBP/USD sentiment and tips and tricks to incorporate it in your trading, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 23% | -9% | 4% |

| Weekly | -3% | -12% | -8% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.