Mining Slowdown Weighs on Rand

RAND TALKING POINTS & ANALYSIS

- SA mining data , US PPI, retail sales and jobless claims data pool together to limit rand upside.

- Michigan consumer sentiment the focal point tomorrow.

- USD/ZAR seeks fundamental catalyst as prices hover around key resistance zone.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/ZAR FUNDAMENTAL BACKDROP

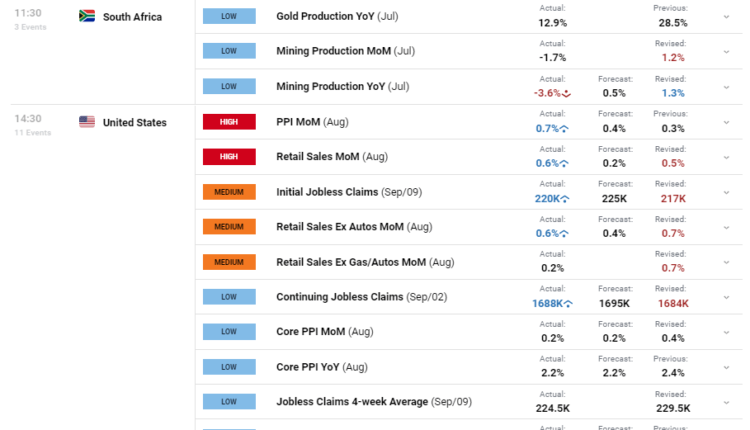

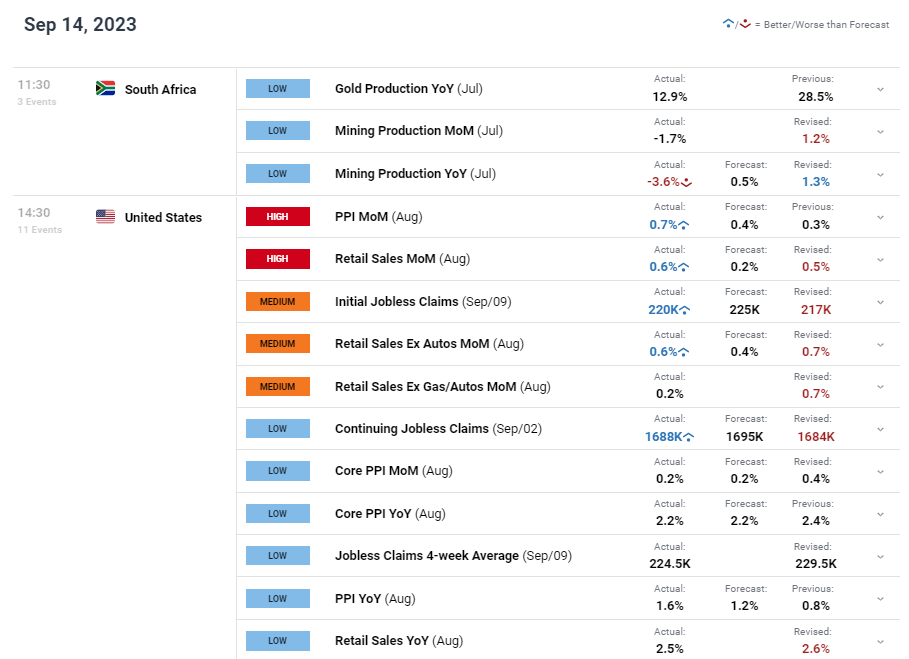

The rand has been steadily depreciating against the USD throughout the European session stemming from South African mining data (see economic calendar below). Key mining metrics disappointed and being an integral component to economic growth, frailty in this sector does not bode well for the ZAR.

US economic data then reinforced the “higher for longer” narrative from the Federal Reserve with better than expected actual data relative to forecasts on PPI, retail sales and initial jobless claims. PPI is of particular concern from a Fed point of view in that the leading indicator could point to sustained CPI pressure that could see the central bank potentially increasing interest rates one more time.

“The August advance is the largest increase in final demand prices since moving up 0.9 percent in June 2022.” – Source: Bureau of Labor Statistics

In addition, initial jobless claims came in slightly under the 225K estimate thus outlining a strong US labor market that is yet to show significant signs of weakness (another supplier to inflationary pressures). The healthy US economy and likelihood of sustained elevated rates is now contrasting economic data out of South Africa that point to rate cuts far sooner than is expected in the US. Should this trend endure, the rand is in for further weakness.

With no further economic data points scheduled for today, markets are likely to digest recent information heading into comparatively quiet Friday that includes Michigan consumer sentiment as the only noteworthy release.

ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

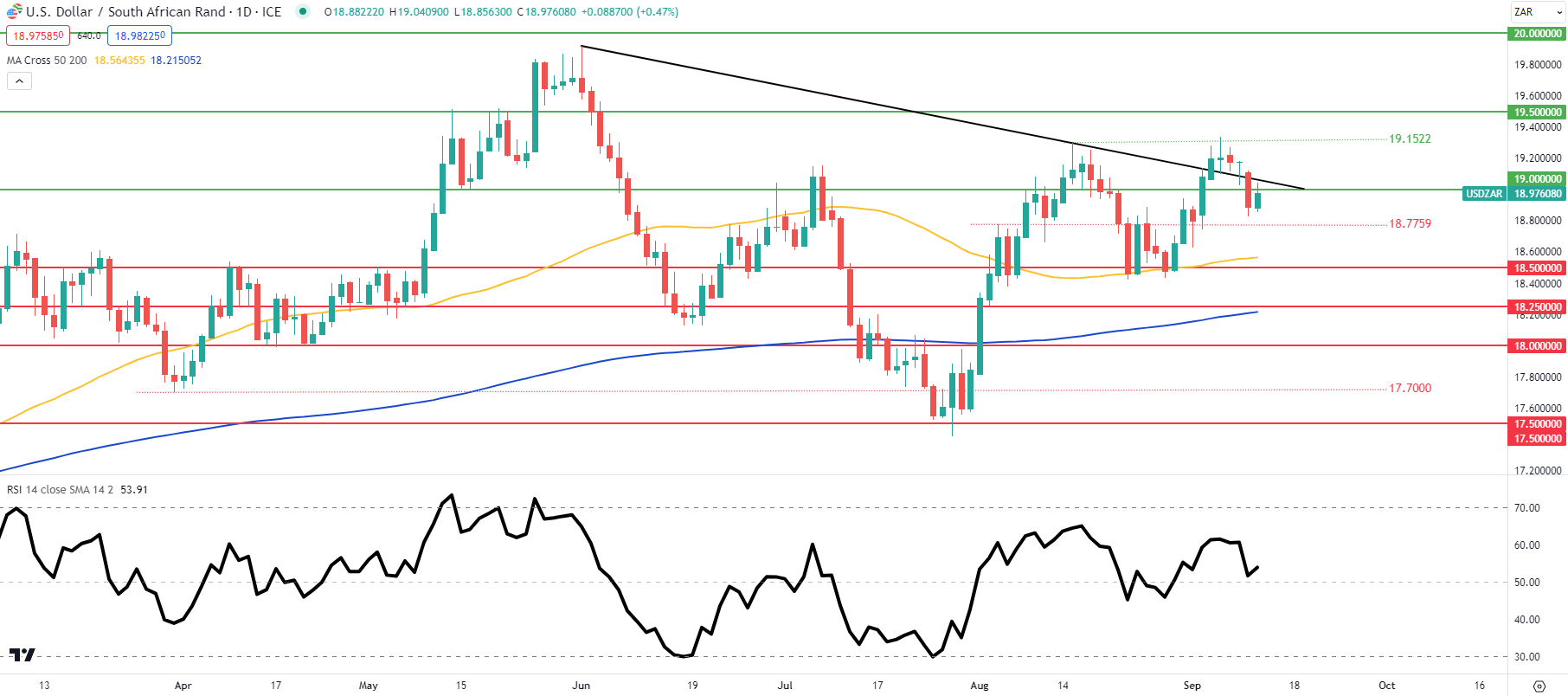

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily USD/ZAR price action above has now pushed up towards the 19.0000 psychological handle coinciding with trendline resistance. Next week’s Fed rate decision and South African inflation could be the catalyst that gives traders some directional bias moving forward. Currently, as reflective via the Relative Strength Index (RSI), markets favor neither bullish nor bearish momentum, underlying their indecision.

Resistance levels:

- 19.5000

- 19.1522

- Trendline resistance

- 19.0000

Support levels:

- 18.7759

- 50-day MA (yellow)

- 18.5000

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.