Markets Cautiously Side with Doves

NFP TALKING POINTS AND ANALYSIS

- Will NFPs defy prior jobs data once again?

- NFP’s to set the tone for September.

- Risk for upside surprise could tank SPX & establish USD.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

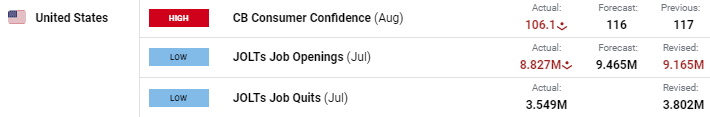

US FUNDAMENTAL BACKDROP

Non-Farm Payrolls (NFP) yet again will carry a lot of weigh around financial markets as Friday’s print has the potential to alter the Fed’s policy decision. Before heading into the actual NFP report, the build up has shaped markets towards a more dovish outlook post-NFP. This week kicked off (see economic calendar below) with US job openings (JOLTs) missing expectations estimates while ADP figures supported a weaker labor market. Further pessimism surrounded the US economy via CB consumer confidence and a worse than expected GDP print.

The core PCE price index (Fed’s preferred measure of inflation) then shifted momentum away from a more accommodative monetary policy after inflationary pressures remained elevated (although expected) with initial jobless claims surpassing projections.

USD ECONOMIC CALENDAR

![]()

Reflecting back to the Jackson Hole Economic Symposium, Fed Chair Jerome Powell did not provide much change in the current narrative of higher for longer and even eluded to the possibility for another rate hike if necessary. Chair Powell’s speech has consequently placed more emphasis on economic data such as the NFP report and with the US labor market being stubborn in its response to higher rates, Friday’s release could shake things up.

Currently, money markets (refer to table below) are expecting the first rate cut to occur in May 2024, a far cry from September 2023 just a few months ago. This fickle nature of markets reiterates the significance an unexpected NFP could bring and with markets skewed towards (majority of major investment banks) a lower print, anything notably stronger could catapult the US dollar and quell recent upside on SPX.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

The Fed’s Bostic aligned himself with a more patient approach supportive of higher interest rates to ensure inflation softens to the appropriate levels, while leaving the door open for additional rate hikes – similar sentiments to Fed Chair Powell. Looking at the NFP calendar below, estimates are at 170k but many economists and market analyst are looking slightly lower. Unemployment projections remain subdued and anything in line with estimates will not show any weakening in the US jobs market. Another key metric will be average earnings that has played a meaningful role in keeping inflation ‘sticky’.

NFP CALENDAR BREAKDOWN (GMT +02:00)

Source: DailyFX economic calendar

PROSPECTIVE MARKET REACTION

| <160K | 160K – 190K | >190K |

|---|---|---|

| Bearish USD | Neutral USD | Bullish USD |

| Bullish S&P 500 | Neutral S&P 500 | Bearish S&P 500 |

TECHNICAL ANALYSIS

Recommended by Warren Venketas

Get Your Free USD Forecast

U.S. DOLLAR INDEX DAILY CHART

Chart prepared by Warren Venketas, IG

The daily DXY chart above shows price action above the 200-day moving average (blue) but below the 104.00 psychological handle. The index has recently stepped below the overbought zone of the Relative Strength Index (RSI) but remains in bullish territory. Anything under expectations could open up the 102.50 level while a robust NFP release may pierce 104.00 and beyond.

Resistance levels:

Support levels:

S&P 500 DAILY CHART

Chart prepared by Warren Venketas, IG

The SPX chart has been trending higher after breaking above the bear flag chart formation (black). Bears will be looking for a strong NFP read while bulls may expose the 4607.07 level once more if NFP’s disappoint.

Resistance levels:

- 4637.30 (March 2022 swing high)

- 4607.07

Support levels:

- 4512.14

- 50-day MA (yellow)

- 4400.00

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently distinctly LONG on SPX, with 67% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect S&P 500 sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.