Lower US CPI Tames USD/JPY, GBP/JPY Rises

Japanese Yen Analysis (USD/JPY, GBP/JPY)

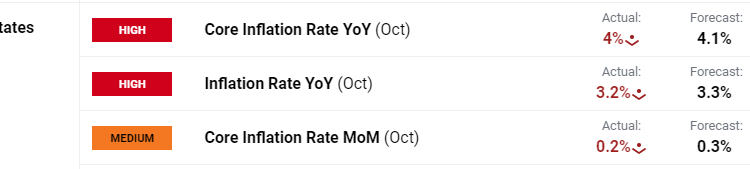

US CPI Has Knock on Effects for the Wider FX Market

With inflation heading in the right direction, forward-looking markets are already anticipating interest rate cuts sooner than before, potentially accelerating the dollar decline. The greenback has been propped up throughout the rate hiking cycle, buoyed mainly by rising rate expectations and more recently rising bond yields. If US data continues to soften, major currency pairs are likely to see a more prolonged period of relief against the most traded currency in the world.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Introduction to Forex News Trading

USD/JPY Dips after US CPI miss but the Yen struggles to appreciate

The Japanese yen has depreciated against the US dollar for a number of weeks now as markets braced for the possibility of FX intervention from Japanese officials which has not yet materialized. Earlier this morning the Japanese Finance Minister Suzuki was not going to be drawn into comments around current FX levels but reaffirmed he is aware of the pros and cons of a weak yen.

One thing to note now is that oil prices have eased considerably in the last three weeks, meaning a weaker yen is more tolerable. Oil reliant companies will see their fuel costs easing and the continued yen depreciation supports attractively priced Japanese exports.

The USD/JPY pair printed a new yearly high yesterday, without much push back from Japanese officials. Markets have become more emboldened to trade above the 150 market for extended periods of time as the immediate threat of FX intervention has faded. The pair is down only 0.7% at the time of writing while GBP/USD is up more the 1.7% – revealing the inability of the yen to take advantage of the move.

The pair heads towards 150 but the uptrend has been relentless, keeping well above the dynamic level of support shown by the blue 50-day simple moving average. In the absence of intervention, it would appear that a significant decline in USD/JPY will be a massive challenge even as US data eases.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade USD/JPY

In recent weeks, US futures have not only brought interest rate cuts forward but they have also increased the number of hikes anticipated in 2024. Markets price in the possibility of a 25 basis point cut as early as May next year and factor in just under 100 basis points in total, or four cuts of 25 bps each). As such the dollar and US yields have sold off and trade a fair distance from their respective peaks.

Implied Probabilities of US Rate Cuts

Source: Refinitiv, prepared by Richard Snow

GBP/JPY soars close on 2% ahead of UK CPI tomorrow

GBP/JPY rose at an impressive rate after US CPI showed signs of improvement but tomorrow is the turn of the UK. UK inflation data is released at 7am UK time tomorrow with expectations of a massive drop in headline inflation and a lesser – but still encouraging – decline in the core measure.

Should inflation print inline or lower than anticipated, the current advance may encounter some resistance, halting momentum around the 188.80 level – last seen in 2015. In addition, the market may soon become due for a pullback as the RSI nears overbought territory, meaning an extended move may be difficult in the absence of inflation surprising to the upside tomorrow. The next level of note to the upside would complete a full retracement of the major 2015 to 2016 decline around 195.30. Support lies back at 184.00 followed by 180.00.

GBP/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.