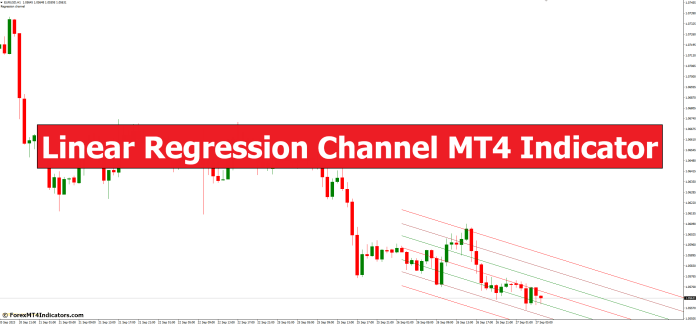

Linear Regression Channel MT4 Indicator

In the ever-evolving world of financial markets, traders and investors are constantly seeking tools and strategies to gain an edge in their decision-making processes. One such tool that has gained popularity among traders is the Linear Regression Channel MT4 Indicator. In this article, we will delve into the intricacies of this indicator, exploring its uses, advantages, and how it can be effectively incorporated into your trading strategy.

What Is the Linear Regression Channel MT4 Indicator?

To grasp the essence of this indicator, it’s essential to understand what linear regression is. Linear regression is a statistical method used to model the relationship between a dependent variable and one or more independent variables. In the context of trading, this method is applied to historical price data to identify trends and potential areas of support and resistance.

The Linear Regression Channel MT4 Indicator takes this concept and presents it graphically on a price chart. It consists of three lines:

Linear Regression Line (LR)

This is the middle line of the channel and represents the linear regression of the price data over a specified period. It serves as the central reference point for the channel.

Upper Channel Line (UCL)

The UCL is the upper boundary of the channel, typically positioned above the LR line. It is calculated by adding a certain number of standard deviations to the LR line.

Lower Channel Line (LCL)

Conversely, the LCL is the lower boundary of the channel, positioned below the LR line. It is calculated by subtracting a specific number of standard deviations from the LR line.

How Does It Work?

The Linear Regression Channel MT4 Indicator serves several purposes:

Trend Identification

By observing the LR line, traders can discern the prevailing trend in the market. An upward-sloping LR line indicates an uptrend, while a downward-sloping line suggests a downtrend.

Support and Resistance Levels

The UCL and LCL act as dynamic support and resistance levels. When the price approaches these boundaries, it often encounters resistance or support, providing potential entry or exit points for trades.

Volatility Measurement

The width of the channel, determined by the standard deviations used in its calculation, reflects market volatility. A wider channel indicates higher volatility, while a narrower channel suggests lower volatility.

Reversal Signals

When the price extends too far beyond the UCL or LCL, it may signal an overextension and a potential reversal in the opposite direction.

Incorporating the Linear Regression Channel into Your Strategy

Now that we understand the basics, let’s explore how you can integrate the Linear Regression Channel MT4 Indicator into your trading strategy:

Trend Confirmation

Use the LR line to confirm the direction of the trend identified through other technical analysis tools. Aligning your trades with the prevailing trend can enhance your success rate.

Support and Resistance Zones

Identify key price levels near the UCL and LCL as potential areas for setting stop-loss and take-profit orders. These zones can also serve as entry points for trades when price reversals occur.

Combining with Other Indicators

Consider using the Linear Regression Channel in conjunction with other technical indicators, such as moving averages or oscillators, to validate signals and reduce false alarms.

Risk Management

Given the volatility aspect of the indicator, implement robust risk management strategies, including proper position sizing and stop-loss orders, to protect your capital.

How to Trade with Linear Regression Channel MT4 Indicator

Buy Entry

- Look for a bullish trend when the LRC is sloping upward.

- Consider buying when the price touches or bounces off the lower channel line (support).

- Use additional confirmation indicators, like RSI or MACD, to confirm the bullish momentum.

- Set a stop-loss order below the recent swing low for risk management.

- Set a profit target, either at the upper channel line (resistance) or based on your risk-reward ratio.

Sell Entry

- Look for a bearish trend when the LRC is sloping downward.

- Consider selling when the price touches or bounces off the upper channel line (resistance).

- Use additional confirmation indicators to confirm the bearish momentum.

- Set a stop-loss order above the recent swing high for risk management.

- Set a profit target, either at the lower channel line (support) or based on your risk-reward ratio.

Linear Regression Channel MT4 Indicator Settings

Conclusion

In summary, the Linear Regression Channel MT4 Indicator is a valuable tool for traders seeking to analyze market trends, identify support and resistance levels, and manage risk effectively. By incorporating this indicator into your trading arsenal and understanding its nuances, you can make more informed trading decisions and improve your overall trading performance.

FAQs

- What timeframes are ideal for using this indicator?

The choice of timeframe depends on your trading style. Short-term traders may prefer lower timeframes, while long-term investors may use higher ones. - Can the Linear Regression Channel predict market crashes?

While it can identify potential overextensions and reversals, it should not be solely relied upon for predicting major market crashes. - How do I adjust the indicator settings for different market conditions?

Experiment with different settings and timeframes to find the configuration that aligns with the specific market you are trading.

MT4 Indicators – Download Instructions

This is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to transform the accumulated history data.

This MT4 Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust their strategy accordingly. Click here for MT4 Strategies

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

How to install MT4 Indicator?

- Download the mq4 file.

- Copy mq4 file to your Metatrader Directory / experts / indicators /

- Start or restart your Metatrader 4 Client

- Select Chart and Timeframe where you want to test your MT4 indicators

- Search “Custom Indicators” in your Navigator mostly left in your Metatrader 4 Client

- Right click on the mq4 file

- Attach to a chart

- Modify settings or press ok

- And Indicator will be available on your Chart

How to remove MT4 Indicator from your Metatrader Chart?

- Select the Chart where is the Indicator running in your Metatrader 4 Client

- Right click into the Chart

- “Indicators list”

- Select the Indicator and delete

(Free Download)

Click here below to download:

Download Now

Comments are closed.