Key Levels to Watch for Bullish Continuation

EUR/USD Analysis

Recommended by Richard Snow

How to Trade EUR/USD

Persistent Powell Sends the Dollar Lower, Euro Rises

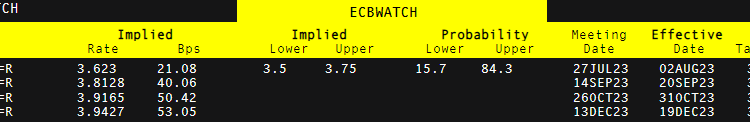

Jerome Powell’s testimony in front of the U.S. House Financial Affairs Committee stressed that the Fed anticipates a more gradual pace of rate rises in the future. Markets now factor in just one more 25-bps hike before seeing the Fed pause, while the ECB is on track for another two 25-bps hikes – which are largely priced into market expectations.

Market Implied Probabilities for Future Rate Hikes

Source: Refinitiv

EUR/USD Key Technical Levels to Watch

A bullish continuation appears in play in EUR/USD which began the initial ascent after reversing off the zone of support around 1.0700. The initial rise was bolstered by the June 15 ECB rate decision which saw an even steeper bull run appear. Thereafter, prices eased lower as some of the steam of the move was released – resulting in the formation of a bullish flag.

The minor pullback tested and even traded below 1.0910 intra-day but failed to close below the level of support, suggesting bullish momentum could soon return. Yesterday’s price action highlights a return to bullish potential even with EUR/USD struggling to build on yesterday’s gains.

Further upside remains constructive upon a daily hold above the 1.0965, with upside levels of resistance at 1.1033 and the 2023 high of 1.1100. The MACD, while admittedly a lagging indicator, hints towards extended upside momentum. The bullish continuation would need to be reassessed in the event the pair trades and closes below 1.0910.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

The lower intra-day move in EUR/USD gained pace immediately after the surprise 50 basis point hike form the Bank of England (BoE). EUR/USD headed lower in the moments that followed the announcement.

EUR/USD 5-Min Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.